The Pension Funds Act (PFA) grants a retirement fund significant discretion to determine an equitable distribution of a death benefit, and the Financial Services Tribunal (FST) will not interfere with the fund’s decision if it is rational and based on relevant factors.

In a decision delivered this month, the FST also clarified that receiving an allocation to address financial dependency does not preclude a nominee from also receiving a share of the benefit based on the deceased’s beneficiary nominations.

The Tribunal dismissed a reconsideration application grounded on the assertion that two Allan Gray retirement funds acted irrationality when they allocated a death benefit.

Hayley Marie Ward (the applicant) sought a reconsideration of the decision by the Pension Funds Adjudicator (second respondent) to dismiss her complaint against the Allan Gray Retirement Fund (AGRF) and the Allan Gray Pension Preservation Fund (AGPE), collectively the first respondent.

Ward’s mother, Gail Pamela Millard, died in August 2023, aged 58. Mrs Millard was a member of both Allan Gray funds.

The total death benefit available for distribution was R7 943 571.31, comprising R7 919 190.83 in the AGPE and R24 380.38 in the AGRF.

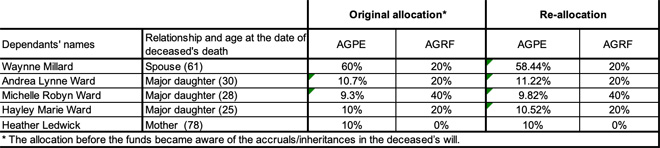

Mrs Millard’s nominated beneficiaries in respect of the AGPE were as follows:

- 10% to her second husband, Waynne Millard, to whom she had been married for 18 years at the time of her death;

- 30% to the applicant; and

- 28% and 32%, respectively, to the applicant’s siblings, Michelle and Andrea.

The applicant and her siblings were the major daughters of the deceased from her first marriage.

In respect of the AGRF, the deceased’s nominations were 20% each in respect of Mr Millard, the applicant, and Andrea, and 40% in respect of Michelle.

The funds’ allocation

The funds determined that Mr Millard and the deceased’s mother, Heather Ledwick, were factually dependent on the deceased.

In respect of Mr Millard, the funds considered that he was retired and shared a common household with the deceased. His monthly expenses of R33 223 exceeded his income of R11 584 (a shortfall of R21 639 a month, or R259 668 a year).

Mr Millard received a third-party capital payment of R1 015 105, inherited 50% of the communal home valued at R2.5 million, and received an accrual claim of R249 534.74.

The funds were not initially aware of the accrual claim of R249 534.74, so it was not factored into their original calculations to determine the extent of the spouse’s lost support. But it was ultimately considered and factored in as part of the funds’ decision.

The amount re-allocated to Mr Millard, after the deduction of the life policy (R1 015 105) and the accrual claim (R249 534.74) was R4 350 456.26.

The funds determined that the deceased’s mother, a retired widow, was financially dependent on the deceased for rent-free accommodation. The deceased gave her cash and a credit card to use as needed. She received a gross monthly income of R2 100 and inherited R100 000 from the deceased’s estate.

The funds determined that the applicant and her siblings were the deceased’s legal dependants but were not factually dependent on the deceased for support at the time of her death. They were of a sufficiently young age to make provision for the future.

Exercising their discretion in terms of section 37C(1)(bA) of the PFA, the funds re-allocated the death benefit as follows:

Complaint: funds used the incorrect figures

Hayley Ward, who is a Chartered Accountant, complained to the Adjudicator in April 2024. The crux of her complaint was that the funds used the incorrect life expectancy for Mr Millard, which resulted in the re-allocation of an excessive portion of the death benefit to him, thereby unjustly enriching Mr Millard to the prejudice of the applicant and her siblings.

Ward submitted that if the funds had used the correct facts and figures, at most 19% of the total death benefit would have been allocated to Mr Millard and not 58%.

She determined that the funds likely used a life expectancy of 29 years for Mr Millard. This, Ward said, was out of kilter with the sources she considered, which reflected life expectancies of 14.01 years (per the South African Revenue Service’s life expectancy tables) and 13.3 years (per Census 2011: Estimation of Mortality in South Africa).

In a subsequent letter to the Adjudicator, Ward added a further grievance: the funds allocated the surplus (above what was needed for the factual dependants) according to the deceased’s nominations. The funds’ re-allocation decision already exceeded the deceased’s original nominations in a way that favoured Mr Millard. Therefore, Ward said, the funds should have distributed the surplus of the death benefit in the AGPE between her and her siblings only.

Rationale for the funds’ decision

The funds said the PFA does not prescribe a calculation methodology, and the methodology they used was in keeping with what is used by the courts to calculate a claim for loss of support.

The methodology included an assumed real discount rate of 3%, a shortfall of R259 668 in Mr Millard’s annual income, and that his life expectancy was 16.81 years. The funds also assumed that the deceased’s likely retirement age would have been 63, at which point her income would have dropped by a third.

The funds said the PFA does not specify what factors a board may or should consider in effecting an equitable distribution. However, at common law, the board needs to consider a wide range of factors, such as the extent of dependency, the financial status of each beneficiary, each beneficiary’s future earnings potential, the beneficiaries’ ages and relationship with the deceased, the amount available for distribution, and the wishes of the deceased.

In her reconsideration application, Ward did not dispute the funds’ factual findings or materially with the assumptions used. Nevertheless, even allowing for different calculation methodologies, she could arrive at the figure calculated by the funds, and the discrepancy between her calculation and that of the funds meant they acted irrationally.

She maintained that Mr Millward should have been re-allocated R2 226 366.29, not R4.35m, in the dependency calculation.

Nominations as a guide for surplus distribution

The Tribunal said it was noteworthy that Ward did not dispute the allocation made to Mrs Ledwick. This indicated that the amount re-allocated to Mr Millard, rather than the funds’ allocation methodology, lay at the heart of the applicant’s complaint.

The fact that the calculation methodology used by Ward yielded a different outcome in respect of Mr Millard did not mean that the funds’ calculation was incorrect, or that their preferred calculation methodology was unreasonable.

The re-allocated amount in respect of the AGPE awarded to Mr Millard exceeded what the deceased indicated in her nomination. However, the PFA envisaged such an outcome. The main purpose of the Act is to ensure that dependants are adequately provided for, even if this requires deviating from the deceased’s nominations.

Ward submitted that the funds should have disregarded the deceased’s nomination in regard to the surplus because the funds had already re-allocated an amount in excess of the nomination to Mr Millard.

The Tribunal said this argument was without foundation because the funds took the appropriate and relevant facts into account in calculating the amount to be re-allocated to Mr Millard.

Although the needs of dependants take precedence, the deceased’s nominations retain relevance as a guiding factor for distributing any surplus death benefit remaining after the dependants’ needs are met.

The decision clarifies that receiving an allocation to address dependency needs does not preclude a nominee from also receiving a share of the surplus based on the deceased’s nominations.

The FST said the Adjudicator correctly explained to the applicant that it is not the function of the Adjudicator’s Office to decide what is the fairest or most generous distribution, but to determine whether a board acted rationally and arrived at a proper and lawful decision based on the relevant facts.