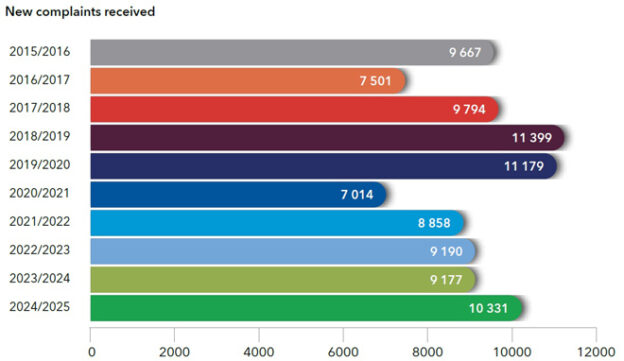

The Office of the Pension Funds Adjudicator (OPFA) saw a 13% increase in the number of new complaints during the 2024/5 financial year, with the implementation of the two-pot retirement system the primary reason for the increase.

The 2024/25 report was the last one signed off by Muvhango Lukhaimane (pictured), whose 12-year tenure as Adjudicator will end in December this year.

Lukhaimane said she is leaving with immense gratitude and pride in what the Office has been able to achieve, from good governance to efficient, timeous service delivery.

“It has been an extraordinary privilege to serve in this role – championing fairness, promoting accountability, and striving to protect the rights and dignity of retirement fund members. Over the years, I have witnessed the retirement fund system evolve, and I have had the honour of being in the midst of implementing key legislative reforms. I am encouraged by the collective progress we have made and appreciate that there is still more to be done.

“I wish to take this opportunity to thank the dedicated teams I have had the privilege of working with, the various stakeholders who supported our mandate, and the public who entrusted us with their queries,” Lukhaimane wrote in the report.

“As I step off at my station, I remain confident in the capacity, integrity, and the continued role of the Office in protecting consumers.”

Main reasons for complaints

The Office received 10 331 new complaints in 2024/25, which was an average of 861 complaints a month.

The report states that the introduction of the two-pot system on 1 September 2024 led to a surge in complaints. From October to December 2024, the OPFA received 3 105 new complaints, which was a 34% increase compared with the same period in 2023. It received 2 246 enquiries related to the system from September 2024 to March 2025.

A significant number of complaints stemmed from employers failing to remit deducted contributions to funds, leaving members unable to access their benefits from the savings component. Other complaints related to delays in the administration and processing of withdrawals from the savings component.

“While the implementation of the two-pot system has been successful, a further rise in complaints related to two-pot withdrawals is anticipated in the 2025/26 financial year, prompting the OPFA to prioritise resource allocations and proactive stakeholder engagement,” Lukhaimane said.

She said the two-pot system has highlighted the extent of the non-compliance with section 13A of the Pension Funds Act – an issue the OPFA has been raising for the past decade.

At 44.34%, complaints pertaining to section 13A (non-payment of contributions by participating employers) continued to be the highest category of complaints investigated and closed, followed by withdrawal benefits at 38.79%. Jointly, these two categories constituted 83% of the total closed complaints categories.

The Office said the two categories often overlap with one another because complainants discover that their employer failed to pay contributions only when they attempt to withdraw their benefit.

In his foreword to the annual report, Minister of Finance Enoch Godongwana said the recurrence of these issues and the high number of complaints remain of great concern. He urged stakeholders to remediate this undesirable result of poor fund governance, management, and administration.

“This, in effect, undermines the government’s efforts as outlined in the three priorities of the Government of National Unity to reduce poverty, tackle the high cost of living, and build a capable, ethical, and developmental state,” he said.

The report noted that prescription and the time-barring of complaints often mean that even where the Office orders employers to pay outstanding contributions, only a partial recovery is realised because funds have not held employers to account timeously.

Lukhaimane said another reason for the rise in the number of complaints was the increase in participating employer liquidations within umbrella funds.

“Commercial umbrella funds have no appetite to insist on compliance with the payment of defaulting employers. They simply terminate the participation of the employer within the fund; in most instances, without notifying members. This results in the employer’s continuing deducting contributions from unsuspecting members well after the participation date,” she wrote.

The Adjudicator also attributed the increase in complaints to efforts to make more fund members aware of the OPFA’s services. “There has been successful outreach, education campaigns, and media coverage that improved public awareness of how and where to lodge complaints.”

PSSPF – again

The Private Security Sector Provident Fund (PSSPF) remained the single-largest cause of complaints lodged with the OPFA, as has been for several years, and the two-pot system has amplified the issues related to its administration.

Lukhaimane said the PSSPF does not appear to have a proper monitoring system in place to detect the non-payment of contributions by employers and has consistently failed to act against defaulting employers.

The PSSPF lodged 395 complaints against non-compliant employers, and in most of those cases, large amounts of contributions (dating back to 2002 in some cases) became prescribed, to the detriment of members.

“As a further result of the PSSPF’s failure to act, members are forced to fend for themselves and approach the OPFA on an individual basis, each lodging an individual complaint against their employer/former employer, resulting in an escalation of the number of complaints lodged,” she said.

“Furthermore, the PSSPF continues to experience communication breakdowns with its administrator, Salt Employee Benefits, whereby the PSSPF provides letters of compliance in respect of employers that the administrator says are in default. Several matters of this nature have been referred to the FSCA.”

Slight increase in finalised complaints

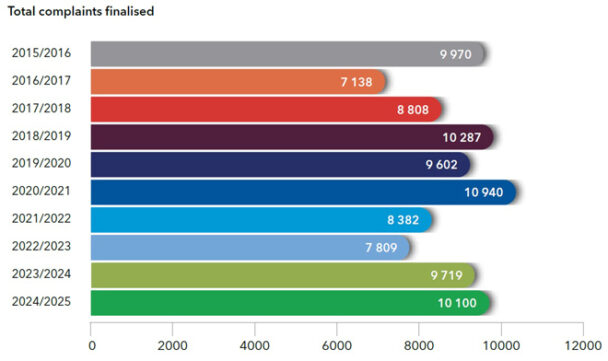

A total of 10 100 complaints were finalised during the year (including complaints carried over from the previous year), reflecting a 4% increase compared with the previous year.

A total of 5 434 complaints were finalised in terms of a fully investigated and reasoned determinations. This constituted 54% of all complaints closed during the year, with 55 more formal determinations issued compared to the previous year.

A total of 1 175 complaints were closed as settlements (12%), 1 890 as out of jurisdiction (19%), and 1 601 as abandoned, withdrawn, or duplicates (15%).

The report said 93% of complaints finalised as determinations, out of jurisdiction, or settlements were closed within six months – 8% higher than the Office’s target of 85%, and an improvement of 16% compared with the previous year.

Need to improve customer service

When complaints were analysed in respect of the Treating Customer Fairly (TCF) outcomes, the top three categories were service delivery, claims/disbursements, and the provision of information – these three areas constituted 94.38% of complaints.

The report said the complaints about poor service (48.94%) were mostly about poor or inadequate communication by funds in relation to the payment of contributions and benefits.

The Office urged more funds to use the refer-to-fund (RTF) process to achieve better outcomes. During the RTF process, the OPFA facilitates the lodging of a complaint with the fund for internal dispute resolution.

“A notable number of disputes have been resolved in this manner without the need for a formal complaint being investigated,” it said.

In 2024/25, 724 disputes were resolved via the RTF process, which was about 3% higher than in 2023/24.

“For those funds that failed to take advantage of this process, it is hoped that with time, constant encouragement, and an increase in compliance-related regulations, this will change.”

The report said there is an urgent need for a regulatory instrument applicable to retirement funds that incorporates the TCF principles, “and the passing of the Conduct of Financial Institutions Bill will be a welcome intervention in this regard”.

Most decisions upheld by the Tribunal

In 2024/25, 87 for reconsideration were lodged with the Financial Services Tribunal (FST) by people dissatisfied with the OPFA’s decisions. Four applications were withdrawn. The FST issued 83 decisions, of which 54 upheld the decisions of the OPFA, while 27 were remitted for reconsideration.

Nondumiso Ntshangase, senior legal adviser at the OPFA, drew attention to two significant decisions by the FST during the year under review.

In P Force Security Services (Pty) Ltd v TS Mofokeng and Others, the Tribunal held that reconsideration in terms of section 230(1)(b) of the Financial Sector Regulation Act constitutes an internal remedy as contemplated in section 7(2) of the Promotion of Administrative Justice Act. Highlighting the importance of immediate, more readily available, and cost-effective internal remedies, the Tribunal deemed the employer’s premature seeking of High Court relief to be an abuse of process aimed at frustrating the fund member.

In the case of ME Semenya and Others v Old Mutual Superfund Pension Fund and Others, the OPFA was not provided with a death benefit investigation report. The FST recommended that the PFA should insist on such reports to assess the fund’s reasoning in benefit allocations.

Ntshangase said the decision is significant because the OPFA has encountered challenges with funds withholding investigation reports, citing the Protection of Personal Information Act.

“The OPFA, as a public body, is empowered to gather such information when exercising its duties. The OPFA can also collect the personal information directly from funds during Tribunal proceedings,” she said.

thnks

The Amount deducted for Tax ranged from 18% to 39%

Eg R12774 .00 was the tax on a withdrawal of R30k

Government neglected to fully inform of this Tax issue.

Sars exploited millions of Tax Payers

and earned billions in Tax