The traditional approach to investment focuses on outperforming a benchmark or maximising returns for a given level of risk, or minimising risk for a given level of return. Under this paradigm, investors are assumed to have no emotional biases and only care about optimising their returns. Clients however have specific real-life goals which are not solely tied to financial markets.

According to social comparison theory, humans have an instinctive need to compare their social and personal worth against others. Even when there is no way of objectively making such comparisons, we simply look at people similar to us to make comparisons and evaluate ourselves relative to them. We try to keep up with the Joneses. Social media sparked this phenomenon even further.

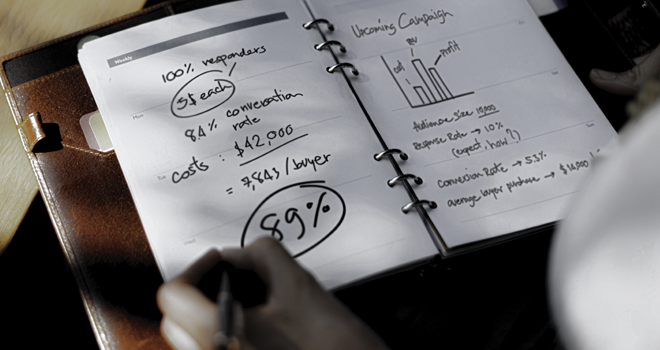

Although emotions are often viewed as anathema to sound financial decisions, there is a huge emotional element to holistically defining financial goals. A goals-based financial planning approach takes into consideration the fact that investors have differing goals which vary in terms of how critical they are to them. Goals-based investing is the future of wealth management because it provides a holistic solution to the investor’s main challenge of optimising total assets to efficiently fund lifetime goals.

Moonstone Business School of Excellence (MBSE) has developed the Introduction to Goals-Based Financial Planning approved for 4.5 FSCA CPD hours. This course presents an overview of goals-based investing and aims at providing practitioners with the necessary introductory background to adopt a goals-based approach to financial planning.

Financial planners, financial advisors, para-planners and business owners will benefit from enrolling for this course.

Once you have completed the course you will be able to demonstrate knowledge of social comparison theory and how it affects the financial and emotional well-being of people. You will also understand the financial planning paradigm and familiarise yourself with approaches a practitioner can use in guiding clients towards setting financial goals that truly reflect their financial and emotional needs. Finally, you will learn how to implement goals-based asset allocation and develop a goals-based financial planning strategy.

Click here to for more information and to register.