The establishment of the Financial Services Tribunal has brought much-needed legal certainty to the industry – in particular, those who are disgruntled by the views of decision-makers, as well as rulings by the FAIS Ombud and the Pension Funds Adjudicator.

The latter two bodies are empowered to make decisions in an informal manner to expedite the resolution of complaints. Regrettably, particularly in the case of the FAIS Ombud, this has not happened. Certain rulings by the Tribunal and its predecessor, the FSB Appeal Board, included scathing comments about its application of the rules directing the conduct of the Ombud.

In most instances, though, both appeal mechanisms, chaired by retired judges, applied a formal law application to contentious matters, intended to guide future actions by the two complaint-resolution bodies. Regrettably, as became evident, particularly again in the case of the Ombud, it appeared as if a copy-and-paste approach was more prevalent than an actual application of the legal mind.

Another huge improvement was that it provided the underdogs of this industry with a platform that really listened to them. Earlier, they were obliged to seek legal redress when dissatisfied with decisions against them. This is particularly true as far as dismissals and debarments are concerned. I contend that most of the earlier terminations stemmed from lack of production or personal differences, rather than fit and proper shortcomings. In many instances, proper process was not followed, but nobody checked to ensure that it did.

This does not mean that all such decisions were unfair. We have seen cases where complainants had actually admitted to committing fraud but appealed against their debarments on grounds of the effect their transgressions would have on their dependants.

A case that I found particularly amusing was published last week. A request for reconsideration was made against the FSCA and FNB/NBS. I suspect most people in the industry these days are of the opinion that NBS is the Afrikaans acronym for “naaste bottelstoor”. If it was, in the fact, the Natal Building Society, which merged with Boland Bank in 1998, then I suppose the request may have been out of time, considering that such requests need to be made within six months of the decision.

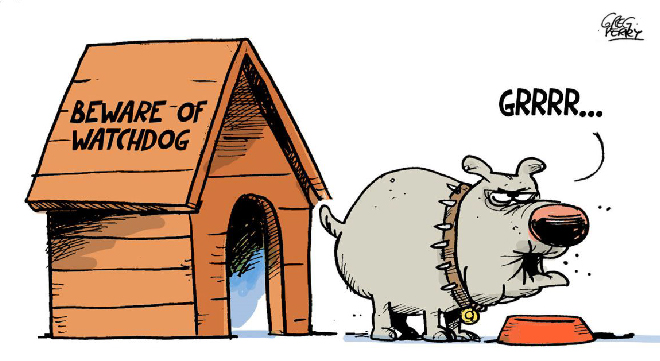

The Tribunal treats such requests, rightfully, in a less-than-diplomatic manner.

“The application for reconsideration is summarily dismissed because it is frivolous because it contains no grounds of any merit and is based on suppositions.”

On religious grounds

Rapport carried an article on Sunday about an investment scheme that offered returns of 200%, the possibility of living to the ripe old age of 120, and, as an added benefit, the abolishment of unemployment. According to the article, the purpose of this group is the establishment of heaven on earth. It also notes that this is not an investment scheme, but an “international investment facilitator” based in Mauritius.

With reference to questions from the FSCA, Rapport said “investors” were called upon to refer such requests to them for their legal team to address. In a YouTube video, on which the newspaper based the story, it claims that the company says the FSCA is now part of its pre-introduction phase and will basically sign off everything prior to the formal launch of the plan.

The Regulator, in a media release, has indicated that it is investigating MyWealth Method. It warned that failure to comply with requests for information from the public “… may be viewed as a hinderance of the investigation process …”, which is a criminal offence.

From previous experience, I tend to regard some Rapport articles with great circumspection, but watch this space.

Promises, promises

Election time is really trying for those who love to read. The way in which the various parties can interpret the same statistics is mind-boggling.

The one aspect no one can deny is voter apathy, and possibly a protest against poor service delivery. From an 89% turnout in 1994, down to a projected 47%, is a very clear indication that South Africans are gatvol, to say the least.

In reviewing my own experience in the run-up to the elections, I was reminded of the guy who said that he read an article on the dangers of alcohol. He was so upset that he decided there and then to stop reading.