Santam’s bold strategy curbs underwriting challenges, drives growth

Santam will ramp up efforts to tackle increased weather- and fire-related risks by implementing measures such as adjusting premiums and setting stricter risk limits.

The SARB has forfeited to the state cash totalling R42m from Berdine Odendaal’s bank accounts, as well as her R18m property in Paarl’s Val de Vie estate.

Read more

Santam will ramp up efforts to tackle increased weather- and fire-related risks by implementing measures such as adjusting premiums and setting stricter risk limits.

The 2024 edition of the annual EY (Ernst & Young) Global Insurance Outlook details the risks, rewards, and a roadmap for the responsible deployment of GenAI in the industry.

As car insurance underwriting becomes increasingly intricate, brokers play a crucial role in informing clients of the distinctions between private and business usage.

Aon’s 2023 State of the Market Report unveils troubling trends as South Africa’s insurance landscape grapples with various challenges.

Old Mutual Insure’s chief commercial officer weighs in on the trends set to define the short-term industry over the next decade.

These include delays with funeral policy claims, advice to clients who buy living annuities, and insurance policy disclosures.

“Husband’s moles cost widow R2m,” screamed the headline. The article, which appeared in Rapport on 5 June, sketched the background to yet another claim refuted on grounds of non-disclosure. Background The client was […]

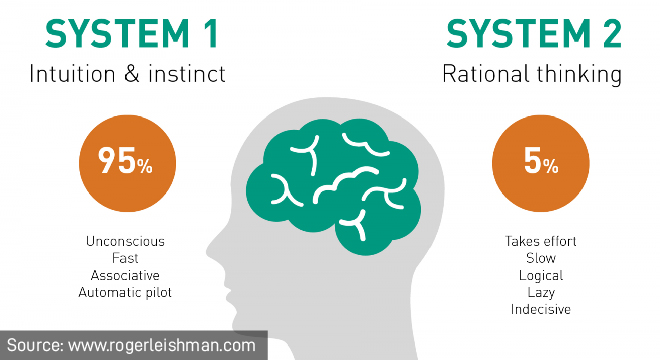

When it comes to finance, we assume people are rational, so we give people more information and longer documents and explain the actuarial principles in the hope that they will result in their […]

Clients often find insurance conversations challenging. They want to get through them quickly and enter them with a preconceived idea of what they want to talk about. But intermediaries can have more meaningful […]

When it comes to insurance, the payment of claims is top of mind for most clients. Ultimately risk cover is there to protect a policyholder when the unexpected happens. It is therefore concerning […]