Much has been said about the confusion surrounding this year’s Budget, but it boils down to a simple truth: you can’t spend what you don’t have.

South Africa faces a long list of urgent funding needs – from crumbling infrastructure and under-resourced schools to an overstretched healthcare system, social support demands, and efforts to revive a struggling economy.

In the Budget Review released on 19 February, the government tried to close part of the fiscal gap by scrapping inflation adjustments to the personal income tax brackets and proposing a two-percentage-point VAT hike to 17%. That proposal was quickly rejected.

By March, Treasury returned with a one-percentage-point increase, phased in over two years – but that too was dropped amid political and legal resistance.

Read: Coalition politics hampered Budget consensus, says Godongwana

The February tax proposals were expected to raise R58 billion in additional revenue for 2025/26. But by 12 March, the expected figure had halved to R28bn. The latest Budget Overview, released on 21 May, puts the number even lower: just R18bn in extra tax revenue.

Tracking the numbers

To put the shifts in perspective:

- Initial January draft: Revenue for 2025/26 was projected at R2.067 trillion from taxes, R353.1bn from borrowing, and R180.1bn from non-tax revenue – totalling R2.6 trillion.

- March revision: Tax revenue was lowered to R2.041 trillion, borrowing raised to R370.4bn, and non-tax revenue revised slightly up to R180.2bn – totalling R2.592 trillion.

- May update: Tax revenue fell further to R2.021 trillion, borrowing rose to R377.9bn, and non-tax revenue adjusted to R179.7bn – totalling R2.579 trillion.

From February to May, tax revenue projections dropped by R46.5bn. To help fill the gap, Treasury increased borrowing by R24.8bn – still leaving the Budget R8.6bn short of earlier estimates.

Debt burden grows

Meanwhile, debt repayments remain a major drain. Gross government debt is set to rise from R5.69 trillion in 2024/25 to R6.09 trillion in 2025/26, and R6.82 trillion by 2027/28.

Even with a projected R30.2bn reduction in the gross borrowing requirement (compared to the March Budget), debt-service costs will consume 22 cents of every rand collected in revenue next year. Over the next three years, R1.35 trillion is earmarked for servicing debt.

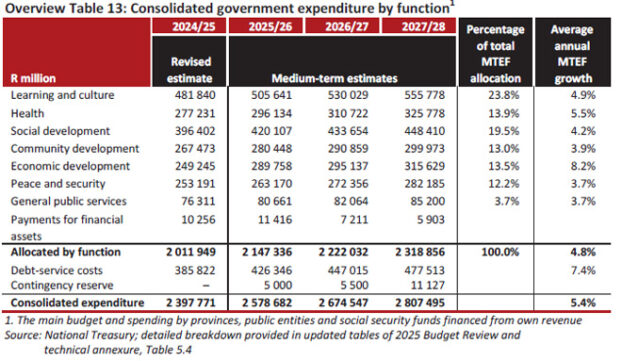

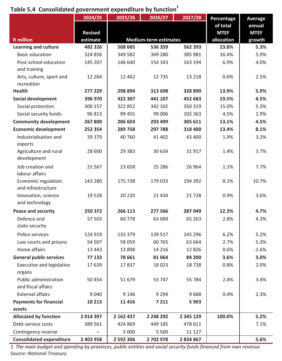

Still, overall government spending is not shrinking. In fact, the latest Budget Review outlines an additional R180.1bn in spending over the medium-term expenditure framework (MTEF) compared with last year’s Budget. But it’s clear that the government has had to rethink some of its priorities – and the areas facing cuts reveal which ones are being protected.

Healthcare, education and other frontline services hit

The Budget Overview trims consolidated government spending by R69.4bn over the next three years – largely through cuts to provisional allocations. These are funds set aside for specific projects and are released only once departments or municipalities demonstrate readiness to implement them.

But with the Budget still not approved, these funds remain frozen. In the interim, government operations continue under section 29 of the Public Finance Management Act, which allows limited spending based on the previous year’s Budget.

Before provisional allocations can be unlocked, the Division of Revenue Bill must be tabled before the Appropriations Committee and assessed. The committee has 35 days to complete its review. Once that process is concluded, the bill can be considered by the full House.

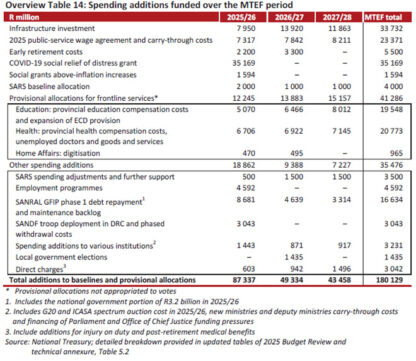

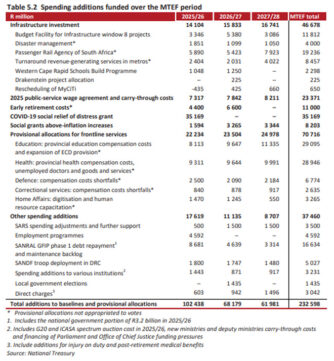

These allocations were meant to support major initiatives: infrastructure, social protection, public-sector wage agreements, and frontline services. But the latest numbers show significant revisions.

A comparison of March and May Budget Reviews reveals:

- Infrastructure investment for 2025/26 was halved, from R14.1bn to R7.95bn.

- Allocations for disaster management and the Passenger Rail Agency of South Africa disappeared altogether.

- The early retirement incentive, first announced in the 2024 Medium-Term Budget Policy Statement (MTBPS), was cut from R11bn to R5.5bn, halving the targeted exits from 30 000 to 15 000.

Some spending was redirected:

- The South African National Defence Force’s three-year allocation for operations in the Democratic Republic of Congo was replaced with a once-off R3.04bn payment for 2025/26.

Funding for frontline services saw one of the sharpest declines: provisional allocations dropped from R22.2bn to R12.2bn.

Breakdown of key cuts to frontline services:

- Education: From R8.1bn to R5.07bn – affecting provincial salaries and early childhood development.

- Health: From R9.3bn to R6.7bn – reducing support for unemployed doctors and operational needs.

- Home Affairs: From R1.47bn to R470 million – affecting digitisation and staffing.

- Defence and Correctional Services: Allocations to cover compensation shortfalls have been removed.

21 May 2025

12 March 2025

Some departments spared – or boosted

Despite the broad belt-tightening, National Treasury confirms that most departmental baselines remain unchanged. In the foreword to the Budget Overview, director-general Dr Duncan Pieterse emphasised that critical services remain protected:

“Revisions to the March 2025 Budget Review projections reduce anticipated revenue and spending, but departments largely retain their baselines and critical service delivery areas are protected.”

The standout winner? The South African Revenue Service, which receives a R4bn boost – on top of the R3.5bn announced in the 2024 MTBPS. The total increase of R7.5bn will strengthen its use of data, AI, and tech to improve tax administration. It also supports hiring 1 700 debt collectors, with 500 already on board, and 250 more starting in June.

In 2024/25, SARS recovered R95bn in outstanding tax. Commissioner Edward Kieswetter expects that increased capacity could bring in at least R20bn more next year – although this hasn’t yet been factored into revenue projections.

By contrast, the Department of Social Development faces medium-term reductions across multiple categories, including learning and culture, health, public services, and community development – the latter set to receive R6.1m less in 2025/26.

Only economic development has escaped untouched, maintaining its full R289.76bn allocation for 2025/26.

21 May 2025

12 March 2025

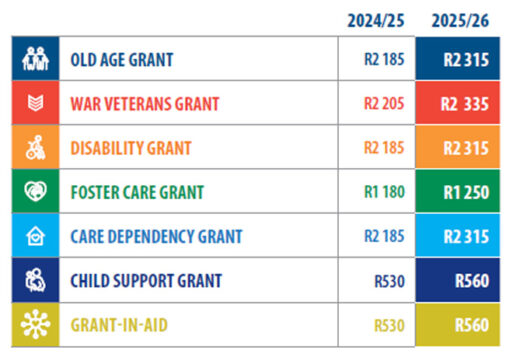

Social grants largely preserved

Social grants, which faced major cuts between February and March, have seen no further reductions in the May update.

Originally, the government planned to allocate R23.3bn over the MTEF to raise grant values. This was scaled back to R8.2bn in March – a R15.1bn cut.

Read: VAT hike scaled back, but social grants take the biggest hit

Still, the 2025/26 social grants budget is R1.6bn higher than in 2024/25. And the “temporary” Covid-19 Social Relief of Distress grant has been extended to 31 March 2026. A total of R35.2bn has been allocated to maintain the R370 monthly payment per beneficiary.

But, with the VAT increase gone, so is the proposed expansion on the basket of VAT zero-rated foodstuffs.

Ultimately, this year’s Budget reflects more than shifting numbers – it’s a balancing act between politics, fiscal limits, and competing priorities. With borrowing space shrinking, Treasury faces tough trade-offs. The road ahead demands better efficiency, stronger tax collection, and a frank conversation about national priorities. Because in the end, you can’t spend what you don’t have.