A while ago, news headlines carried stories regarding the unfortunate CLICKS Tresemme advertisement. This whole incident caused reputational and financial damage for both CLICKS and Tresemme and financial damage for many other stores who carried the Tresemme brand.

You may ask what this has to do with behavioural finance? At the time, a very influential social commentator said this whole unfortunate chain of events were caused by an unconscious bias held by the person/s responsible for the advertisement. Many unintended consequences followed because of an action/decision caused by an unconscious bias.

The purpose of this analogy is to highlight just how much financial damage may be caused by this. Therefore, it is now more important than ever for both financial planners and their clients to gain some insight into their own unconscious biases that might influence decisions and cause damage to their long-term financial security.

Most of us know by now that there are two systems of thinking and deciding – intuitive (the short route) and reasoning (the long route) – and that for most decisions the two systems are closely aligned. But they tend to become un-aligned when it comes to financial decisions. Some experts explain that financial decisions should be taken with a long-term view although we live perpetually in the short term. This world where we live is called “the zone of anxiety”. It is in this “zone of anxiety” that we are confronted financially and emotionally by uncertainty (Gregg B Davis). In behavioural finance we know that decisions are mostly made in the zone of anxiety whilst we need to achieve the long-term end goal.

The purpose of this article is not to turn all of you into diagnostic experts who know all the behavioural biases by heart and are able to diagnose and categorise your clients accordingly. What I want to achieve is to list typical behaviour by investors in times of uncertainty and provide guidelines on how to work around them.

INVESTOR PARALYSIS is a typical fear-induced investor behaviour in uncertain times. When investors experience the results of volatility in markets and investment returns, they fear losing their money. The role of the financial planner is to coach the investor to make the right decision in these circumstances.

The most important way to deal with investor paralysis is to get the investor to commit to a suitable investment plan, a plan of action with small steps (milestones) towards reaching their long-term goal. It can almost take the form of a schedule of pre-commitments of when to do what.

It changes the decision from when to invest to how much and how often. An example is to commit to move investments offshore when the exchange rate is at a certain level, then to phase the move of investments in over a specific period, into investments that suits the investors risk profile.

This strategy will most likely make the investor feel in control and limit the influence of emotional biases such as loss and regret aversion and retain the status quo. It is about replacing old behaviours with small new behaviours.

LACK OF DISCCIPLINE is another typical investor behaviour in uncertain times. It is about avoiding the Siren Song of Emotions. The story goes that the Greek hero Odysseus on his way home after the fall of Troy had to sail past the island of the sirens. The sirens were dangerous seductresses, creatures who lured sailors with their voices to shipwreck and die. Odysseus had his sailors tie him to the mast and fill their own ears with beeswax in order not to hear the luring songs. In doing so he was taking steps to constrain their future behaviour.

It is important to understand that we are all human and that sometimes it is almost impossible to overcome the force of short- term desires. You as financial planners can assist investors to overcome the impulses of the intuitive mind such as:

| ● | herd mentality, |

| ● | too good to be true investment return promises, |

| ● | overconfidence caused by short term successes, and |

| ● | not to be influenced by the most recent prominent information available in the form of news headlines. |

The best chance for and investor to avoid Siren Song of Emotions is to engage with a qualified financial planner that can assist with a sound investment plan with rules and deadlines. This is about the best way for an investor to avoid temptations and be continuously reminded of the sound reasons behind their financial plan and to stay on track to reach their goals.

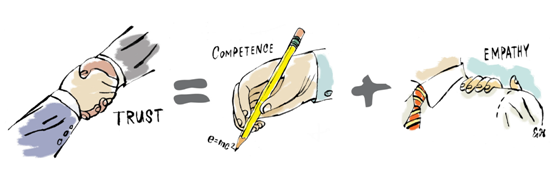

A CRISIS IN TRUST remain one of the biggest reasons why investors, even sometimes those with a sound investment plans, fail to stay on course in uncertain times. Trust according to Noah Goldstein (UCLA Anderson School of Management) consist of two main components:

“Active demonstrations of professional competence and personal empathy have been identified as key to building and maintaining trust”.

The regulator and professional bodies have done a lot of work to try and educate the public to seek advice from licenced and qualified financial planners. Financial planners as a group have not always done themselves a favour by creating mistrust in their own profession. It is also true that there have been and always will be unscrupulous financial planners, but they are mostly in the minority. By focussing as a collective on sound principals we can assist the public to trust most professional planners and do themselves a favour. The experience of honest empathy (of his/her advisor) by an investor will always be the defining factor whether advice will stick.

If you care to make a difference it is vital to assist the investor in experiencing connection between the real meaning and purpose of their dreams and goals and their unique financial plans. This should always be the goal and not investment returns. Then to focus continuously on the advancement towards reaching their goals.

The above list of typical investment mistakes is not the only mistakes made. We can add lack of self-control, inability to choose long-term gain over short-term pleasure and many others.

The best financial advisors can do in these times is to do more of the right things. Constantly reminding our clients of the meaning and purpose of their investment plan – the why; remind them that good investment periods always outperformed bad periods as long as you stick to your plan – the what (principals);then to back up your advice with what experts and other winners believe – the who; and lastly keep reminding them of the process to gain success – the how.

Focus on creating positive meaningful conversations as you grow the relationship; now more than ever.

PS: For a good casual read buy the new book by Theo Vorster: Jou geldsake – hou kop in onseker tye. This book is aimed to benefit all investors, young and old, unexperienced, and experienced.