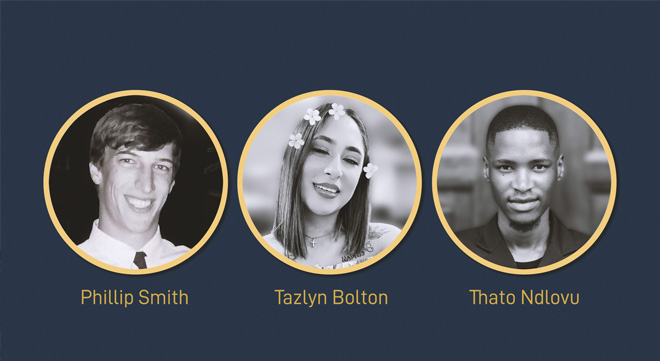

No matter their age, background, or career stage, Phillip Smith, Thato Ndlovu, and Tazlyn Bolton discovered the same truth: the Higher Certificate in Short-Term Insurance (HCSTI) is more than a certificate. It’s a launchpad for confidence, practical know-how, and long-term career growth.

Covering insurance fundamentals, risk management, underwriting, claims, and the legal framework, the HCSTI – provided by Moonstone Business School of Excellence (MBSE) – equips students to assess risk, advise clients, and take on bigger responsibilities, all while reinforcing lifelong learning.

Stepping up when it matters

Phillip Smith, 35, already had hands-on experience at his father’s brokerage, Terry Smith & Associates Insurance Brokers, handling commercial and personal lines alongside specialist coverages. But in June 2023, a personal moment made formal qualification urgent.

“The reality set in that I needed to be properly qualified in order to take over the business so my father could retire,” he explains. “It was about getting my ducks in a row.”

Phillip’s path into insurance was unconventional. After pursuing a professional golf career, he returned to the family business, later realising formal qualifications were essential to lead with confidence. Exams had always been a fear.

“Writing exams has always been my biggest fear in life,” he admits. Choosing the right environment was critical. Phillip credits MBSE for academic structure and personalised support. Lecturers Alec Basson and Debbie Costopoulos, with administrator Tarnay Hass, guided him throughout the programme.

One early insight set the tone: mastering the glossary.

“Debbie advised us right at the start to learn the glossary properly so that we could understand the study material from the outset,” Phillip says. “That made a massive difference.”

Real-world case studies turned theory into practice, and exam anxiety began to fade.

“With the support of the lecturers and staff, my anxiety around exams became a lot less,” he says. “They understand students, they understand the industry, and they were always willing to take my calls and talk things through.”

Commercial insurance, especially business interruption claims, became a standout module. Under Basson’s guidance, Phillip explored how Covid-19 reshaped policy wordings in the hospitality sector, and how brokers now advise clients differently. The HCSTI’s impact extended beyond theory – he applied his learning to claims, policy terms, and Treating Customers Fairly, sharpening his client-focused approach.

“I wanted to stay in the insurance industry, be compliant, and be of real service to my clients,” he says. “I needed to know that I’m capable of giving the correct advice and taking over the business responsibly.”

Building credibility early

Thato Ndlovu, 24, approached the HCSTI as more than a regulatory requirement – it was a step toward credibility, confidence, and long-term relevance in a demanding, evolving industry.

Working at Aon Re as a Facultative Broker Support Intern, Thato entered the field fresh out of university without a traditional insurance background. With a Bachelor of Science in Economic Sciences, Mathematics, and Computational and Applied Mathematics, he had strong analytical skills but needed formal training.

“Much of what I know about insurance I’ve built through on-the-job learning, short courses, and now formalised it with the HCSTI,” he explains.

Though mandatory at work, Thato treated it as an opportunity.

“I realised that I didn’t want to be left behind,” he says. “The HCSTI felt like the right next step to future-proof my knowledge.”

Expecting a textbook-heavy programme, he was surprised by its practical focus. Case studies mirrored real situations, making the learning immediately relevant. The workload was demanding but manageable, supported by structured modules, accessible lecturers, and regular touchpoints.

Two areas reshaped his perspective. First, the Fundamentals of Insurance module reinforced mastering the basics – principles, terminology, and mechanics. Second, the focus on regulation, ethics, and Treating Customers Fairly (TCF) became a turning point.

“That was a turning point,” he reflects. “It helped me see compliance not as a box-ticking exercise, but as a core part of building long-term trust.”

Thato began seeing himself not just as support staff, but as a professional partner helping brokers and clients make informed decisions.

The HCSTI’s practical value was immediate: reviewing underwriting information daily, Thato improved at assessing risk, interpreting contracts, and supporting brokers effectively.

“Completing the HCSTI reminded me that I’m capable of managing serious commitments and learning at a high level, even with a busy life,” he says.

The qualification also encouraged him to aim higher. Thato is considering further studies while targeting increased responsibility – technical support, compliance, training, or leadership.

“You don’t need to be the perfect student,” he says. “You need discipline, a willingness to ask for help, and a clear reason why you’re doing it.”

Learning with purpose

At 22, Tazlyn Bolton was ready to move from participation to professional understanding. A central administration broker intern at Aon, her career began through structured work-based learning: a one-year YES programme and a one-year learnership.

“I genuinely wanted to learn and contribute,” she says. “I never see myself as ‘done’ learning. I’m constantly asking questions, researching, and looking for ways to grow, both professionally and personally.”

That drive led her to the HCSTI.

“I didn’t want to just do my job,” she explains. “I wanted to truly understand why things are done the way they are.”

With hands-on experience already under her belt, Bolton recognised gaps in her theoretical knowledge. The programme reshaped her approach to learning.

“The HCSTI pushed me to connect concepts instead of learning them in isolation,” she says. “It made the learning feel real and relevant, especially because I could immediately relate it to what I see and do at work every day.”

The commercial insurance module confirmed her career direction.

“The commercial insurance module really confirmed that this is the area I want to grow in,” she says. “It made me realise how important it is to fully understand risk, structure, and decision-making.”

She applied lessons directly to client work and internal discussions.

“It made me more confident in my role,” she says. “I could follow conversations more clearly and understand how different pieces fit together.”

Balancing work and online study was challenging. Bolton stayed disciplined, planning ahead, and tackling tasks step by step.

“There were times when it felt overwhelming,” she reflects. “But I learned to stay disciplined, plan ahead, and take it one step at a time.”

Support structures made the difference. Lecturers, resources, and mock assessments helped her test understanding and build confidence.

“Knowing support was available made a big difference, especially when things felt challenging,” she says.

Her advice to others balancing work and study is practical:

“Believe in yourself and stay committed. It takes discipline and effort, but it’s absolutely worth it. The confidence and clarity you gain will open doors and help you see your potential more clearly.”

If you also want to have this transformative experience and unlock your career in short-term insurance, you can apply for the Higher Certificate in Short-term Insurance here.

Expanding qualifications for a changing world

MBSE offers six accredited qualifications, ranging from entry-level certificates to advanced postgraduate studies:

Postgraduate Diploma in Financial Planning (NQF 8)

BCom Financial Management (NQF 7)

Advanced Certificate in Financial Planning (NQF 6)

Occupational Certificate: Compliance Officer (NQF 6)

Higher Certificate in Wealth Management (NQF 5)

Higher Certificate in Short-term Insurance (NQF 5)

If you also want to have this transformative experience and unlock your career in short-term insurance, you can apply for the Higher Certificate in Short-term Insurance here.

Registrations for 2026 are open

Registrations for semester 1 close on 26 January.

Visit www.mbse.ac.za to learn more and secure your place for the 2026 academic year.

For more information, contact MBSE at help@mbse.ac.za.