When South Africa’s retirement industry was handed a 1 September 2024 deadline to implement the two-pot retirement system, many doubted the sector’s ability to modernise at speed. Less than a year later, the reform has already reshaped member behaviour, tested operational resilience, and revealed structural weaknesses.

At last month’s Institute of Retirement Funds Africa annual conference, Michelle Acton, chief customer officer: Corporate at Old Mutual South Africa, and Guy Chennells, chief commercial officer at Discovery Corporate & Employee Benefits, shared what the data is revealing. Their reflections serve as both a progress report and a reality check: the system has created momentum, but on its own it will not secure adequate retirement outcomes for most South Africans.

Discovery tracks withdrawal trends

Chennells said withdrawals spiked when the system launched in September 2024 before stabilising, with only a modest downward trend month to month. A second surge came in March 2025 as the new tax year opened, this time driven largely by repeat claimants.

Discovery’s data shows that first-time withdrawals averaged R13 000, while repeat withdrawals dropped sharply to R4 600 – a 60% fall as savings balances were depleted. Chennells noted that this “second-time hit” may dampen demand in future, because the payoff is less compelling.

Currently, about 90% of members qualify to withdraw, provided they have at least R2 000 in their savings pot and, if over 55, opted in under the T-Day rules. Despite this, 61% of eligible members have left their money untouched, while 39% have withdrawn – and 93% of those took their full balance.

Read: Two-pot system could quadruple South Africans’ savings, Discovery says

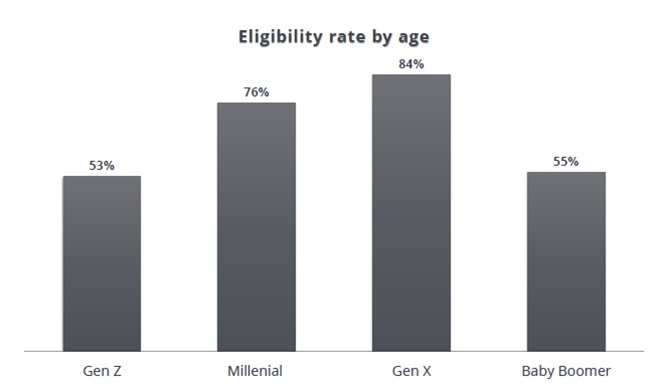

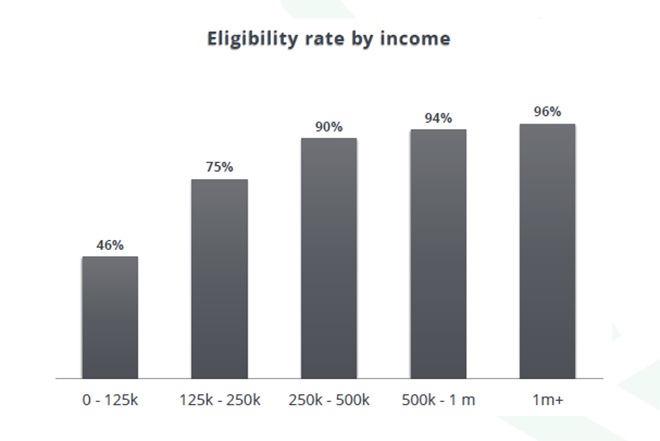

Eligibility differs widely across groups. Baby boomers are under-represented because many over-55s have not opted in, while younger members often lack the minimum R2 000 savings balance.

By income, the gap is most pronounced among low earners: more than half of accounts below R125 000 annual income had not accumulated enough to qualify after nine months.

“After all of the talk about being able to get your money, there are a lot of disappointed people who are yet to see the benefit for themselves,” Chennells remarked.

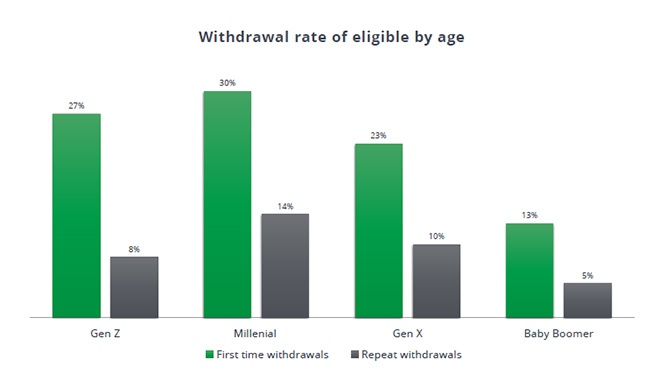

Withdrawal rates also tell a generational story. Millennials lead first-time and repeat withdrawals, which Chennells linked to “the heavy family commitments, trying to build up assets, trying to pay off the house, trying to pay off cars” phase of life. Gen Z members had low repeat withdrawal rates, while those nearing retirement were least likely to draw down.

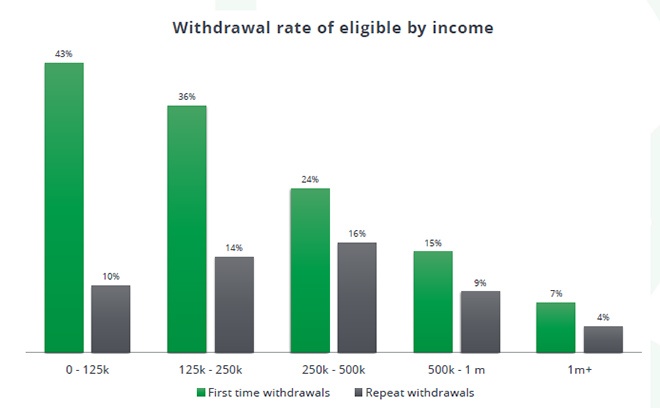

By income, withdrawals were highest among low earners and lowest among the wealthy. Among members earning more than R1 million, just 7% withdrew once and 4% twice.

“This speaks to a behavioural selection effect – there are some people who are just going to need this money every year because that’s the way they’re managing their finances,” said Chennells.

The middle-income group stood out for repeat withdrawals, reflecting both quicker pot replenishment and persistent financial stress. “These are people who really are desperate, and they are pulling on any threads they can,” he added.

Education tops reasons for withdrawals

Discovery also tracks how members spend their payouts. Between September 2024 and May 2025, three-quarters of withdrawals went towards education, car and home expenses, short-term debt, or day-to-day living costs.

Education alone accounted for 25% of claims, peaking between December and February when school fees were due. Women were almost twice as likely as men to use withdrawals for education, with the trend most pronounced in lower- and middle-income groups.

“The biggest use of two-pot savings is helping people to keep their kids in school,” Chennells noted.

Short-term debt tied for second place, particularly among high-income members, while car and home expenses followed closely. Day-to-day household costs accounted for 12%. Only 2% of withdrawals were for emergencies, which Chennells described as “microscopic”, despite being a central justification for the reform.

Leisure spending made up 4%. Gen Z members were twice as likely as Millennials or Gen X to use their withdrawals for travel or lifestyle, with some admitting they simply wanted “to have a good time”. As Chennells put it, many younger members saw it as an opportunity: “Now I can use some of it to have some real fun, to really live life.”

Quick wins for Old Mutual: Engagement, education and data

While Discovery’s data highlights behavioural shifts, Acton argued that the system’s biggest short-term gains are structural. Members are checking their balances more often, administrators have accelerated digital upgrades, and data quality has improved as members updated contact details to access funds.

But the most significant win, Acton said, was industry collaboration. The system’s roll-out demanded unprecedented co-ordination among regulators, administrators, employers, and service providers.

“The sector demonstrated it can execute complex change at speed,” she noted – a capability it will need again as pressures mount.

Old Mutual’s behavioural lens: three member personas

Old Mutual’s research has identified three distinct member profiles:

- Preservers – disciplined members who leave savings untouched until retirement.

- Serial claimers – those who withdraw at the first opportunity, often regardless of necessity.

- Contingency withdrawers – members who treat the pot as an emergency fund.

Acton warned that serial claimers pose the greatest risk. More than 70% of those who had already withdrawn expect to do so again, signalling habitual reliance that could undermine retirement adequacy.

She also noted that many members remain unaware of the tax consequences of withdrawals. Engagement without education can backfire, she cautioned.

Stress cuts across income levels

Perhaps most sobering, Acton noted, is that financial strain is not confined to low earners. Even members earning more than R200 000 a month are tapping their pots. The problem, she argued, lies less in income than in discipline and planning. In short, good financial management is learned behaviour – not a function of how much you earn – underscoring the need for ongoing financial education.

Employers, meanwhile, remain critical to member education. Acton pointed out that workplace campaigns during the two-pot roll-out proved to be the most effective communication channel.

Strategic challenges ahead

Acton identified several structural challenges still looming:

- Exit complexity: Members face increasingly difficult decisions around the savings and vested pots, making counselling vital.

- Preservation by default: Positive for outcomes but raises questions about managing and consolidating preserved benefits.

- Portability risk: With South Africans holding multiple jobs, small, fragmented pots could proliferate unless consolidation is streamlined.

- Contribution adequacy: Many funds still allocate less than 8% of income to retirement, leaving balances dangerously low when split between the pots.

- Guardrails against serial claiming: Education alone will not be enough; policy and product design must work together to curb erosion.

Acton said members need more guidance than ever, particularly when it comes to exiting their funds.

“Members need help. And I think one of the big questions is whose role is it? And some people will say it’s the employer’s role with the exit benefit counselling role. But really, there is a lot more need for support on that.”

The bigger picture

Both speakers agreed that although the two-pot system represents a major step forward for retirement outcomes, it is far from a complete solution. It has sparked greater engagement, accelerated digital transformation, and revealed important behavioural patterns. Still, without higher contributions, stronger defaults, and greater fund consolidation, many South Africans will continue to retire with too little.

Acton reflected that the process showed the industry is capable of rapid change.

“I always used to joke that we have a very weak change muscle. But we proved that wrong – that muscle was well exercised last year in terms of coming together and getting it done.”

She added that the industry’s change muscle has now been tested and strengthened. The question, she said, is whether it will continue to be exercised – because if South Africa is to secure workable retirement outcomes, more reforms lie ahead.

I’m Jessie Shabangu my two pot claim doesn’t want me to withdraw, I don’t know why

Possible reasons:

You need a minimum of R2 000 in your savings pot to withdraw.

You can make only one withdrawal per tax year (from 1 March to the end of February).

If you are a member of a provident fund subject to the T-Day rules, you need to notify your fund/administrator that you want to opt into the two-pot system (otherwise you are automatically excluded).

SARS will not issue your fund/administrator with a tax directive required for a withdrawal if you are not registered as a taxpayer.