“Shaping our future with confidence” reads the header of Sanlam’s 2023 annual results. If the “superior” operating performance figures captured in this document are anything to go by, it is confidence well deserved.

Following a tumultuous period marred by events such as the Covid-19 pandemic, the group’s annual results, released last week, showed a significant upswing in Sanlam’s performance in 2023. And this upturn, it seems, can be largely attributed to the group’s operations in India.

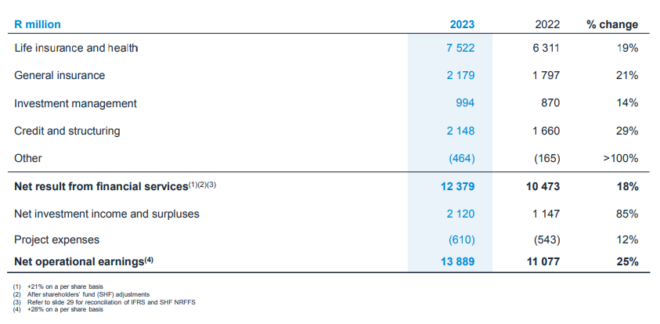

According to the results, Sanlam achieved record-breaking financials, with net profit from financial services reaching R12.4 billion. Lines of business within the group experienced notable growth, including a 19% increase in the life insurance portfolio, a 21% rise in general insurance, a 14% uptick in investment management, and 29% growth in credit and structuring.

The company also saw record-high new business volumes, nearing R400bn, with strong sales growth across all sectors.

Sanlam declared a dividend of 400 cents per share, up from 360 cents per share in 2022.

In addition, the company maintained a robust solvency position, boasting a group solvency cover ratio of 170% at the end of December 2023.

Sanlam group chief executive, Paul Hanratty, said the results reflected the group’s focus over the past three years on improving the performance of its existing operations, while investing in long-term growth.

Three strategic pillars

Sanlam Limited is the holding company of the Sanlam group of companies, which operates through subsidiaries, associated companies, and joint ventures. Sanlam Life Insurance Limited (Sanlam Life) is the largest operating subsidiary and holding company for all Sanlam’s operations in emerging markets.

The report, for the period 1 January 2023 to 31 December 2023, covers the activities of Sanlam in Africa, Asia, and selected emerging and developed markets.

Activities focused on three strategic pillars: building a fortress position in South Africa, accelerating growth across Africa, and strengthening the group’s position in Asia.

Labelled the largest insurer on the African continent, Sanlam’s footprint extends across South Africa, Namibia, Botswana, Zimbabwe, Mozambique, Zambia, Angola, Tanzania, Kenya, Uganda, Gabon, Cameroon, Nigeria, Niger, Benin, Burkina Faso, Togo, Ghana, Mali, Côte d’Ivoire, Senegal, and Morocco.

The group’s presence in Asia includes India and Malaysia. In India, this is through the group’s shareholding in the Shriram entities. The relationship with Shriram dates to 2013 when Sanlam acquired a 3.7% direct stake in the company for close to R1bn. Today, Sanlam’s effective shareholding in Shriram is 10.2%.

The group’s operations in Malaysia consist of MCIS Life and Pacific and Orient.

Life insurance

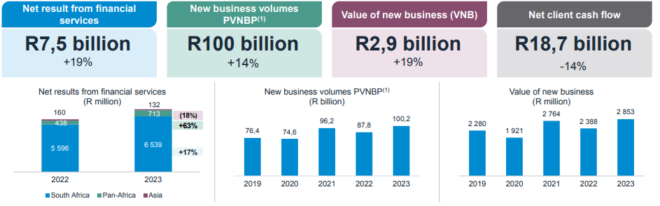

The net result from financial services for life insurance increased by 19%, with South Africa up 17% and Pan-Africa 63% higher.

The group said the South Africa and pan-Africa operations recorded favourable risk experience and higher asset-based income from improved investment market performance and strong recent new business inflows.

The South African operations also benefited from higher earnings from the credit portfolio backing life insurance liabilities.

Growth in Asia was dampened by a weaker performance in Malaysia.

Health

Sanlam’s health line of business consists mostly of the group’s 59.8% shareholding in AfroCentric Investment Corporation Limited.

The net result from financial services for health increased by 18%. Sanlam said the increase in Afrocentric ownership from 28.7% to 59.8% in May 2023 supported this growth.

The group announced the successful conclusion of its transaction to acquire a controlling shareholding in AfroCentric in May 2023.

AfroCentric is a black-owned investment holding company with significant interests in the healthcare market, including the Medscheme medical scheme administration business and a pharmaceutical business.

“Afrocentric experienced challenging operating conditions in the first half of 2023 but recorded an improved performance in the second half, benefiting from higher administration fee income as a result of increased membership, higher new business secured, and higher sales in the pharmacy business,” Sanlam said.

General insurance

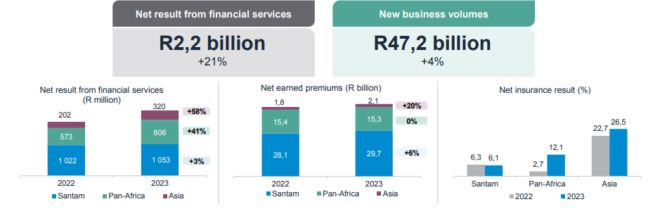

Under general insurance, the net result from financial services (R2.2bn) increased by 21%, with Santam up 3%, pan-Africa 41% higher and Asia showing an increase of 58%.

Santam increased by 3% thanks to solid growth in alternative risk transfer and an improved return on insurance funds which offset a weaker underwriting performance.

Read: Santam’s bold strategy curbs underwriting challenges, drives growth

Pan-Africa increased by 41% (25% in constant currency) driven by improvements in both underwriting margin and investment return on insurance funds margin.

Asia’s performance improved by 58% due to strong performance in India, albeit dampened by weaker growth in Malaysia.

Sanlam said a continued recovery in sales volumes and reserve releases due to a better-than-expected claims experience following good claims management, underpinned India’s strong performance.

Investment management

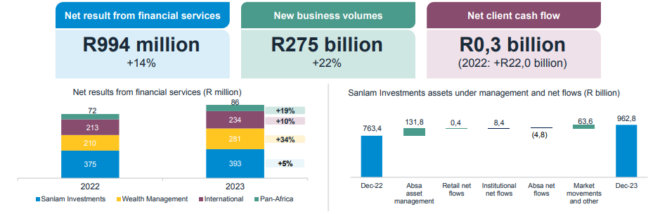

When it comes to investment management, the net result from financial services (R994 million) increased by 14% (19% excluding UK operations disposed of in 2022).

South Africa increased by 15%, despite lower performance and fund establishment fees. Improved investment market performance over the year and strong net inflows in recent periods supported earnings, with the wealth business also benefiting from increased trading activity.

Sanlam said synergies realised from the Absa asset management integration supported asset management.

Sanlam and Absa implemented a transaction that combined their investment management businesses in South Africa on 1 December 2022.

The transaction saw Absa exchanging its investment management business, Absa Investments, for a stake in Sanlam Investment Holdings Proprietary Limited (SIH).

On the international side, business increased by 10%, “benefiting from performance fees earned in the second half of 2023”.

Pan-Africa increased 19% because of higher fee income from increased assets under management.

Credit and structuring

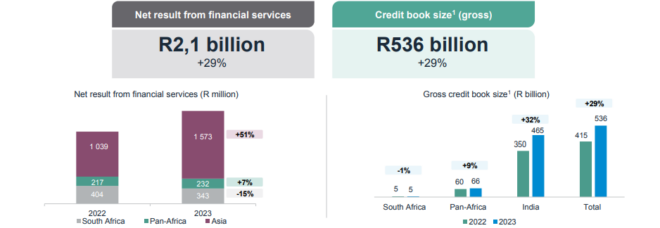

Credit and structuring showed a 29% increase in the net result from financial services (R2.1bn) because of the strong performance from the India operations – “the largest contributor to the group’s earnings from credit and structuring”.

India achieved growth of 51% from Shriram Finance Limited. Sanlam said the business benefited from a larger advances book, improved cost efficiencies, and better collections.

South Africa’s contribution declined because of reduced net interest income.

“This was as a result of muted book growth and higher bad debt provisions given the difficult economic environment,” the annual results report read.

India – a ‘near-term’ growth engine

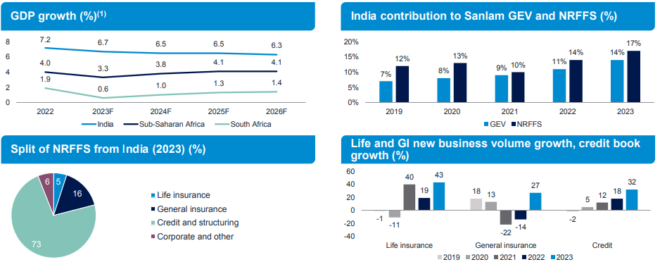

In its Integrated Report 2023, Sanlam said its presence in Asia, with the focus on India, significantly contributed to its overall scale and was a more near-term growth engine in its business portfolio.

The group added that although it was not a market leader in India, it had successfully carved a niche by catering to a large population of lower-income earners, particularly in underserved parts of the country.

Sanlam stated that the Indian economy has recovered well from the Covid-19 pandemic.

“We expect to widen financial inclusion and record sustainable solid growth in these markets over the medium to long term,” the group said.

The Shriram entities include Shriram Finance (8.2 million customers), Shriram Life Insurance (10.9 million customers), and Shriram General insurance (4.5 million customers).

Sanlam has a 10% shareholding in Shriram Finance, 40% in Shriram General Insurance, and 42% in Shriram Life Insurance.

With a focus on life and general insurance, as well as credit solutions, Shriram has built a track record in the lending and insurance businesses, offering products and services to the underbanked through its extensive branch network in semi-urban and rural areas.

In addition, Shriram’s ecosystem across its financing and insurance businesses encourages cross-selling. According to the integrated report, the group was also diversifying its distribution through partnerships and digital platforms.

“We are already impacting the lives of 24 million individuals in Asia and the potential to gain market share and attract currently unserved clients is virtually unrestricted,” Sanlam said.

All eyes on SanlamAllianz

In September last year, Sanlam concluded a transaction with German-based multinational financial services group Allianz to form an Africa-wide insurance joint venture (JV), SanlamAllianz.

SanlamAllianz houses Sanlam and Allianz’s pan-Africa financial services operations, excluding South Africa and Namibia. Namibia is planned to be included later this year.

The initial shareholding split of Sanlam and Allianz in the JV was 60% and 40%, respectively (excluding Namibia).

The group has said Sanlam’s operations in Namibia “will be contributed at a later stage, and at a time when Allianz will also have the option to increase their shareholding in SanlamAllianz to 49%”.

Heinie Werth, former executive director of Sanlam Limited and Sanlam Life Insurance Limited, was appointed the chief executive of SanlamAllianz on 31 December last year.

The JV provides a wide range of products covering life and general insurance, healthcare, reinsurance, asset management and retail credit products to retail, commercial, corporate, and institutional clients across 27 countries in Africa.

According to the group, the transaction strengthened its top three pan-African market positions from 11 countries in life and 14 for general insurance, to 16 countries in both life and general insurance. It also gives Sanlam access to a large new market in Egypt.

In the annual results, Sanlam said that despite negative take-on impacts of currency movements (due to the appreciation of the Moroccan dirham and US dollar against the rand, and the depreciation of the Egyptian pound against the rand in the latter part of last year), it had high expectations for the JV’s growth and profitability.

It added that SanlamAllianz’s businesses were progressing well, the immediate focus being on stabilising the JV.

“We are progressing well in aligning cultures, hub integration, new management structures, and other related activities,” read the integrated report.

Sanlam said the long-term growth prospects for the portfolio were very attractive.

“We remain positive about the medium-to-long-term prospects for the African countries in which we operate. Short-term economic challenges are set to reverse over time, and the continent is likely to achieve good income growth, which will support our operations.”

To read the complete 2023 Sanlam annual results, click here. For the full Sanlam Integrated Report 2023, click here.