Funeral benefits remained the product most complained about to the Life Division of the National Financial Ombud Scheme (NFO) last year.

The NFO last week released its first annual report, which covers the 10 months from its recognition as an industry ombud scheme on 1 March last year.

The Life Division was known as the Ombudsman for Long-term Insurance (OLTI) before it and three other industry ombud schemes amalgamated as the NFO.

Complaints about funeral insurance accounted for 45% of complaints in 2024, marginally up from 44% in 2023. Complaints about life benefits rose again last year, to 36% from 34% in 2023. Disability benefits constituted 7% of complaints, down from 9% in 2023 and 8% in 2022 and 2021.

Health-benefit complaints held steady at 5%, while credit life complaints fell slightly from 8% to 7%.

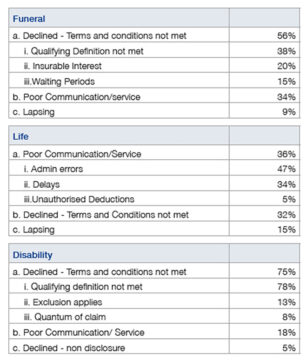

This year’s annual report does not provide data on the reasons for complaints that is comparable with the information in the OLTI’s 2023 report. It states only that declined claims was the most common reason for complaints, followed by complaints about poor service or administration.

The table below provides a breakdown of the reasons for complaints for funeral, life, and disability products.

Of the formal complaints finalised by the Life Division in 2024, 25% were resolved either wholly or partially in favour of complainants, down by 1% from 2023.

The Division recovered a total of R202 854 491.24 for complainants over the 10 months from March to December.

This link will open the complaints data pertaining to the 25 insurers (participants) about which the Life Division received the most complaints in 2024.

Of the five life insurance companies that received the most complaints, 628 formal cases were opened against Old Mutual, representing 18% of all complaints opened. Liberty Group had 399 formal cases opened, representing 11%, Hollard had 259 cases (7%), Metropolitan Life had 216 cases (6%), and Sanlam had 188 cases (5%).

One must be careful about drawing conclusions from the data about which life insurers are providing good or bad customer service. Large insurers with many in-force policies invariably attract more complaints than insurers with fewer clients.

Fewer new cases registered

The Life Division registered 5 638 new cases in 2024, 16% fewer than the 6 714 cases registered in 2023. It finalised 5 977 cases in 2024, of which 3 943 were formal cases and 2 034 were premature cases.

Premature cases are complaints that were submitted directly to the NFO before the complainant exhausted the life insurer’s internal complaint processes. The NFO sends these complaints to the insurer and provides it with an opportunity to resolve the complaint directly with the consumer. If the insurer does not resolve the complaint within the allotted time to the consumer’s satisfaction, the complaint becomes a formal complaint.

Although the total number of complaints finalised declined from the previous year, the number of formal complaints increased by 26%. Denise Gabriels, the Lead Ombud: Life Division, said this may be partly attributable to the fact that in the NFO, premature complaints (previously referred to as “transfers” by OLTI) automatically convert to formal complaints if not resolved within the required timeframe.

Ten final rulings were issued against life insurers.

Applications to appeal

In the 2023 annual report, the OLTI was reported that four applications for leave to appeal were granted, and the appeals were pending. These appeals have been finalised, two of which were upheld and two were dismissed.

During the first two months of 2024, the OLTI received five applications for leave to appeal, all of which were dismissed.

From 1 March to 31 December 2024, the NFO received 27 applications for leave to appeal final rulings in respect of complaints in the Life Insurance Division, of which one was granted but later dismissed on appeal and one was settled by the insurer. Seven were still pending by the end of the year, and the rest were dismissed. All the applications for leave to appeal were brought by complainants.