Debarments by financial services providers increased by 43% between 2023/24 and 2024/25, whereas FSCA-initiated debarments decreased by 16% over the same period. This is according to the Financial Sector Conduct Authority’s latest Regulatory Actions Report.

The Authority released its third annual Regulatory Actions Report yesterday.

FSPs debarred 1 679 representatives during the reporting period, which was from 1 April 2024 to 31 March 2025. The FSCA said the upward trend “underscores the growing vigilance among FSPs in maintaining ethical standards and regulatory compliance within the financial services industry”.

Yet, the Authority said it is concerned about an emerging trend where FSPs initiate debarment proceedings only once the six-month window stipulated in section 14(1)(b) of the Financial Advisory and Intermediary Services Act has lapsed. This undermines the effectiveness of the debarment process.

The FSCA urged FSPs “to act promptly and decisively when grounds for debarment arise, to maintain the integrity of the financial services industry”.

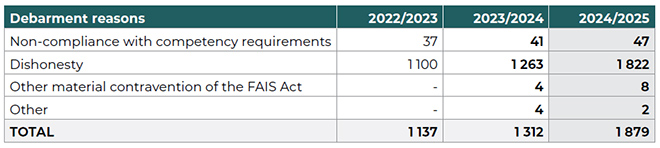

The table below provides a breakdown of the reasons for FSP-initiated debarments:

The FSCA debarred 131 individuals in 2024/25, compared with 156 in 2023/24.

The Authority said the reduction was likely the consequence of its “targeted interventions”, including longer debarment periods and the increased public visibility of debarment actions.

Most of the debarments arose from dishonest conduct, with a significant portion involving the submission of false policies by representatives – a form of misconduct highlighted in the 2023 Regulatory Actions Report and which continues to be a major concern.

The number of representatives debarred by the FSCA and FSPs in 2024/25 constituted about 1% of the total number of appointed representatives.

Decrease in total fines issued

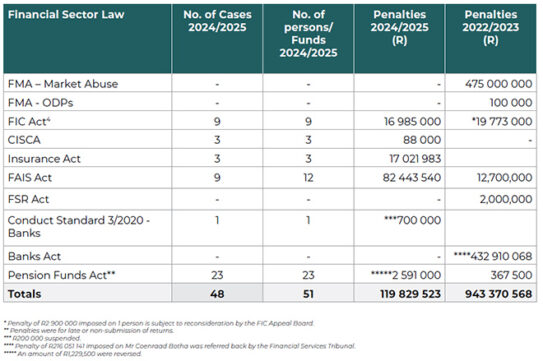

The FSCA imposed administrative penalties totalling R119 829 523 on 51 persons and funds in 2024/25. This was a decrease of 87% from the total quantum of R943 370 568 imposed on 31 people in the previous year. This significant difference was mainly because the FSCA imposed hefty penalties related to the Steinhoff scandal in 2023/24.

Last year, the FSCA imposed penalties of R495m on the late Markus Jooste, the former chief executive of Steinhoff International. Other substantial fines were R216m on CBI director Coenraad Botha and R143m on Classic Financial Services’ Jacobus Geldenhuis.

The table below shows the administrative penalties imposed by the FSCA categorised by the relevant financial sector law.

One of the significant penalties during the reporting period was the R68m fine imposed on the key individuals of the N-e-FG group of companies: Phahamisa Administrators (Pty) Ltd (formerly N-e-FG Administrators), N-e-FG Fund Management (Pty) Ltd, and The Wealth Strategist (Pty) Ltd.

Read: FSCA fines and debars retirement fund administrator’s directors

N-e-FG Administrators collapsed in 2021, leaving at least R470m in members’ retirement savings unaccounted for.

The FSCA fined N-e-FG founder Corné Jansen van Rensburg and managing director Frederick du Preez R30m each, and they were debarred for 30 years each. Steyn Jansen van Rensburg was fined R8m and debarred for 20 years, and Christiaan Janse van Rensburg was debarred for 10 years.

All four individuals have lodged reconsideration applications with the Financial Services Tribunal (FST).

The sanctions stemmed from findings that clients’ funds were invested without mandates, placed in unregulated entities in which the key persons had an interest, and other serious contraventions of the FAIS Act.

The FSCA has shared its evidence and findings with the South African Police Service and the National Prosecuting Authority.

Licence withdrawals and non-submission of returns

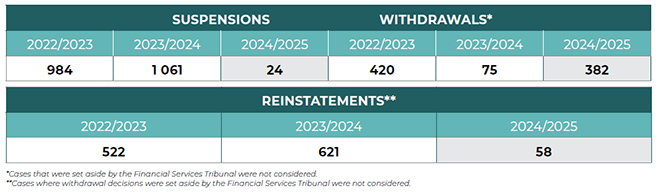

The number of FSP licence suspensions decreased by 98%, from 1 061 in 2023/24 to only 24 in 2024/25. Conversely, licence withdrawals increased by 409%, from 75 in 2023/24 to 382 in 2024/25.

The Authority attributed the shift primarily to the cycle for processing suspensions and withdrawals related to the non-submission of statutory returns. The cycle spans two reporting periods. Where licences were suspended in the previous period and entities failed to submit the returns, the suspensions resulted in withdrawals during 2024/25.

More than 90% of the licence withdrawals in 2024/25 were because of the non-submission of statutory returns. The remaining withdrawals were linked to serious misconduct, such as the submission of false claims and policies and engaging in financial services activities with unauthorised entities.

Regarding suspensions, 46% were because of the non-submission of statutory returns. The remainder were attributed to FSPs’ failing to act with due care, maintain financial soundness, or appoint key individuals and compliance officers.

Most directives issued to remedy FICA non-compliance

The Financial Sector Regulation Act and the Financial Intelligence Centre Act (FICA) empower the FSCA to issue directives to financial institutions. “These directives serve as a valuable regulatory tool, particularly in cases where non-compliance can be remedied or the resulting harm can be reversed,” the Authority said.

The FSCA issued 13 directives to regulated entities in 2024/25.

Nine directives, each accompanied by a substantial fine, were issued in response to FICA non-compliance. The respondents were directed to remediate the non-compliance identified during on-site inspections. The directives related to addressing deficiencies in their Risk Management and Compliance Programmes, and screening clients against the Targeted Financial Sanctions lists.

Three directives were issued to funeral parlours, instructing them to regularise their operations.

One directive was issued to Wenru (Pty) Ltd, requiring the FSP to enhance its internal systems and controls to mitigate the risk of client losses due to fraud, negligence, or misconduct. Wenru, an insurance brokerage, was also fined R100 000.

The sanctions stemmed from Wenru’s processing payments without a client’s consent. These unauthorised transactions were instructed by Adell van Wyk, who served as a director and representative of Wenru until her resignation in 2020.

Wenru challenged the sanctions by applying for reconsideration to the Tribunal. However, after reviewing the case, the Tribunal upheld the sanctions.

Van Wyk was fined R1m and debarred for 15 years.

Read: Tribunal upholds FSCA’s sanctions for unauthorised advice

Marked decline in enforceable undertakings

Enforceable undertakings, which are an alternative to formal regulatory or enforcement proceedings, decreased from 41 in 2023/24 to 14 in 2024/25, of which 12 related to the insurance sector – namely, funeral parlours.

The FSCA attributed the marked decline to two factors. First, the period during which the enforceable undertakings were signed. An additional nine enforceable undertakings were signed after 31 March 2025, relating to investigations completed in the previous year.

Second, the FSCA’s investigation team opted to conduct full investigations rather than entering into enforceable undertakings with authorised entities. “The change was prompted by concerns that entities were exploiting the previously more lenient stance,” the Authority said.

Of the two non-insurance enforceable undertakings in 2024/25, one was entered into with stock exchange A2X.

In 2023, the FSCA received a complaint from the JSE about A2X’s admission process, which involved A2X admitting the securities of certain issuers onto its trading platform without requiring the issuers to undergo the application process prescribed by the Financial Markets Act (FMA) and A2X’s listing requirements.

Under this process, A2X would initiate the listing and notify the issuer, which was given a specified period either to accept or decline the inclusion of its securities. If the issuer failed to respond, A2X proceeded to list the securities on the date indicated in the opt-out letter. The FSCA found that the FMA does not permit the admission of securities to an exchange without a formal application by the issuer.

The enforceable undertaking required A2X to regularise the listings of issuers admitted through the incorrect admission process. Specifically, A2X must obtain consent from each issuer to remain listed. If an issuer opted to delist, A2X was obliged to facilitate the delisting and bear the associated costs.

The enforceable undertaking became effective in March 2025. In addition, the FSCA imposed an administrative penalty of R700 000 on A2X.

Surge in new investigations

There was an increase of 59% in the number of new investigations initiated by the FSCA compared to 2023/24, with new cases rising from 483 to 767. More than 70% of these cases pertained to unregistered financial services and unregistered insurance business.

The number of new cases involving unregistered insurance business rose by 136% to 184, compared to the previous year, and FAIS-related cases increased by 65% to 481.

New investigations related to insider trading decreased from 22 to 16, but finalised cases increased from 14 to 41.

The FSCA finalised 633 cases in 2024/25, compared with 430 in 2023/24. There were 494 ongoing cases in 2024/25, compared with 430 in the previous year.

The finalised cases in 2024/25 included 57 where the Authority conducted a desktop investigation and concluded it did not have the jurisdiction to investigate the matter.

The FSCA highlighted a decision by the Constitutional Court to dismiss an application by Michael Deighton, the former managing director of Tongaat Hulett Developments (Pty) Ltd.

The Authority is investigating alleged contraventions of section 81 of the Financial Markets Act, relating to false and misleading statements published by Tongaat Hulett Limited during the 2017 and 2018 financial years. Deighton was identified as one of several senior executives implicated in questionable accounting practices.

During the investigation, Deighton refused to be interviewed unless granted prior access to all documents and evidence in the FSCA’s possession. The Authority declined this request, citing procedural norms. Deighton subsequently approached the High Court, which in 2022 ruled in his favour, declaring the investigation procedurally unfair.

The FSCA appealed the decision. In February 2024, the Full Bench of the High Court in Pretoria overturned the earlier ruling, finding that:

- There was no legal basis for demanding prior access to investigative documents.

- Deighton suffered no prejudice from the lack of such access.

- Disclosure at that stage could have compromised the integrity of the investigation.

- The FSCA’s approach was consistent with its statutory investigative mandate.

- Midstream judicial review is justified only in cases of grave injustice, which was not demonstrated.

Read: FSCA’s investigation into Tongaat Hulett accused not unlawful

Deighton sought special leave to appeal to the Supreme Court of Appeal, which was denied. He approached the Constitutional Court, which in June this year dismissed the application, citing its premature nature and lack of prospects for success.

The Authority said the judgment reinforces the FSCA’s authority to conduct investigations without undue interference and affirms the legitimacy of its investigative procedures. “The ability to carry out investigations under statutory powers – without premature judicial intervention – is critical to the FSCA’s mandate to uphold integrity in the financial sector.”

Reconsideration applications lodged with the Tribunal

The FSCA took 1 323 administrative decisions in 2024/25, of which only 47 were challenged via reconsideration applications to the FST. The Tribunal finalised 34 cases in 2024/25.

In the previous reporting period, 33 applications were filed with the Tribunal, and 43 cases were finalised.

Of the 34 cases finalised in 2024/25, the FSCA’s decisions were upheld in 11 cases. In the three cases where the applications were withdrawn, the FSCA’s decisions remained in force. In the remaining 20 cases, the Authority agreed, by way of consent order, to have its decisions set aside and referred back for further consideration.

In several instances, the FSCA agreed to set aside its decisions when the reasons for its decisions involved the non-payment of levies or failure to submit statutory returns, provided the respondents subsequently paid the levies, submitted the returns, or made satisfactory arrangements in this regard.

What’s happen with the NTC matter. After the FSCA cautionary everything goes dead. HOW?

If I enquire about an investment scheme, will my query be kept secret from the party concerned? Meaning my name, email,cellphone number?

Please clarify: is this if you enquire from the FSCA?