The Banking Division of South Africa’s National Financial Ombud Scheme (NFO) has cut its complaint resolution time by a third in its first year under the new structure, improving efficiency despite a major organisational change.

According to the NFO’s inaugural annual report, the division reduced its average turnaround time from 78 days in 2023 to 52 days in 2024. It also recovered more than R29 million on behalf of banking customers.

A year ago, the Ombudsman for Banking Services (OBS) became part of the newly established NFO, which brought together the Credit Ombud, the Ombudsman for Short-term Insurance, and the Ombudsman for Long-term Insurance under one umbrella.

Nerosha Maseti, Lead Ombud for the Banking Division, said the integration of four separate offices was a major milestone that improved how complaints are managed.

“Despite major internal changes, including the appointment of a new Lead Ombud and new management, the team adapted seamlessly, handling and resolving complaints at a faster rate than the previous year, all while maintaining a strong commitment to fair outcomes,” Maseti said.

Cases reported

In 2024, the Banking Division opened a record 15 412 cases, up from 8 521 in 2023.

Of these, 9 485 were classified as premature cases and 5 930 as formal cases.

Formal cases involve a full investigation by the ombud, including evidence-gathering, issue analysis, and engagement with both the complainant and the bank, leading to a formal resolution or finding.

Referrals – typically the first step in the process – are sent back to the bank, giving its internal complaints team 20 days to resolve the issue directly with the complainant. If unresolved or if the bank fails to respond, the matter is escalated to a formal case.

By year-end, the division had closed 11 535 cases, made up of 5 439 premature cases and 6 096 formal cases.

Of the formal cases concluded, 79% of findings were in favour of the bank, while 21% favoured the complainant.

Of the five banks with the highest number of formal cases opened, Capitec led with 1 203. This represented 20% of all cases opened, as can be expected for the bank with highest number of customers by far. Findings in favour of complainants totalled 22%.

FNB came in at a close second, with 1017 cases opened, representing 17% of all cases opened, with findings in favour of complainants totalling 16%.

Standard Bank had 998 cases opened, representing 17% of all cases and 19% of findings in favour of complainants.

Nedbank had 881 cases opened, representing 15% of all cases and 22% of findings in favour of complainants.

ABSA had 812 cases opened, representing 14% of all cases and 13% of findings in favour of complainants.

The ombud’s office cautioned that complaint volumes should be interpreted with context. Various factors, such as the size of the bank’s customer base, play a significant role. Larger banks naturally handle more transactions and interact with a broader spectrum of clients, which can result in a higher volume of complaints, simply due to their scale.

The categories of complaints

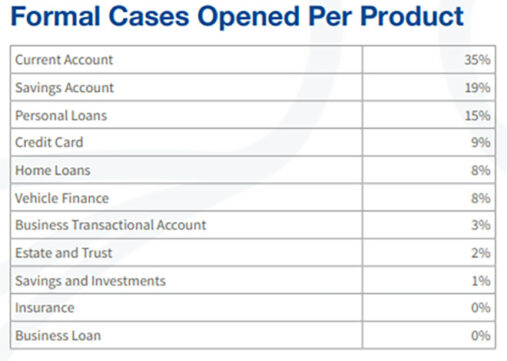

The Banking Division’s busiest complaint categories in 2024 were current accounts (35%), savings accounts (19%), personal loans (15%), credit cards (9%), and home loans (8%), according to the NFO’s annual report.

Current account complaints were dominated by issues related to digital banking (61%), followed by alleged misconduct (17%) and card-related issues (8%). Within digital banking, mobile banking fraud made up 49% of cases, phishing 27%, and vishing 10%.

Under savings accounts, 64% of complaints related to digital banking, 22% to misconduct, and 9% to card issues. The digital banking complaints involved 56% mobile banking fraud, 19% phishing, and 9% transfers to the wrong account.

For personal loans, the main complaint types were collections (31%), misconduct (30%), and credit information listings (23%). Within collections-related complaints, 28% involved prescribed debt, 10% disputed balances, and 10% involved the bank’s refusal to make payment arrangements.

Fraud continued to be the most common issue across all banking complaints, accounting for 30% of the total. Maladministration and complaints from debt-stressed consumers were the second and third most reported categories.

“These trends align with patterns observed in previous years, where fraud-related disputes consistently accounted for a significant portion of complaints,” the report stated.

“Additionally, past reports highlighted the growing impact of financial hardship on consumers, with debt-related complaints becoming more pronounced. In response, our division has strengthened its focus on financial education and proactive engagement with industry stakeholders to drive improvements in consumer protection.”

Vulnerable consumers

The report highlighted a strong focus on supporting vulnerable consumers, with 255 individuals identified and assisted during their complaints process.

The top subcategories included consumers aged 65 to 75 (52%), those aged 75 to 85 (18%), and individuals who had experienced major life events such as retrenchment (13%) or the death of a spouse or life partner (7%). Other categories included those aged 85 and older (6%), individuals with a mental disability (1%), those who were not financially literate (2%), and consumers who used a wheelchair (1%).

“We achieved numerous successes in advocating for their specific vulnerabilities and needs,” the Banking Division stated.