Despite Momentum Group delivering record headline earnings of R6.26 billion for the year to the end of June, the value of new business (VNB) slipped 20% to R469 million – the only negative indicator in an otherwise strong set of results.

For chief executive Jeanette Marais, this dip underscores why the group is “investing aggressively in advice to drive growth”, with independent financial advisers (IFAs) at the centre of Momentum’s strategy to rebuild VNB and sustain long-term competitiveness.

“Our focus on advice remains a key component of our strategy and of our future growth … We remain the undisputed market leader when it comes to independent financial adviser distribution, and we will leverage this position to continue to drive growth in our business,” Marais told advisers at the group’s annual results presentation.

Building on MDS and specialisation

Momentum Distribution Services (MDS) has been central to the group’s advice-led approach since 2018, when the business began a deliberate process of specialisation. Marais credits those early decisions with today’s results:

“We couldn’t have been here if it weren’t for specialisation and how our product and our channel areas have reinvented themselves over the last seven years. We are now bearing the fruit of the tough decisions we made years ago.”

The MDS product dashboard for 2025 shows year-on-year growth across the board, with Investments up 10%, Myriad up 9%, Investo up 3%, Health up 13%, and FundsAtWork up 10%.

Defending and growing market share

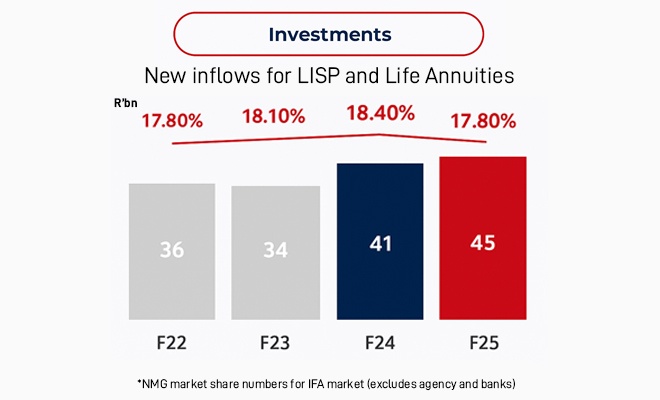

Momentum has maintained a solid foothold in key IFA-driven areas such as annuities and life risk. Over the past three years, new inflows from IFAs into its Linked Investment Service Provider (LISP) and life annuities business have grown from R36bn to R45bn.

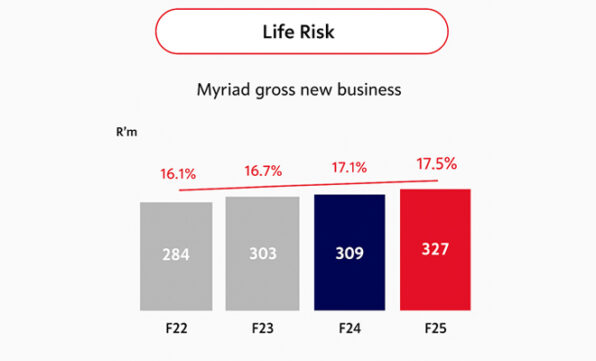

Meanwhile, Myriad – Momentum’s flexible risk product suite – has seen gross new business rise from R284m in 2022 to R327m in 2025.

Despite intensifying competition, Marais said Momentum has continued to expand its share of the risk market: “We’ve been growing our market share despite competition that is heating up with several new players entering this market all the time.”

Why IFAs choose Momentum

When asked why Momentum has become the go-to partner for many IFAs, Marais pointed to people, relationships, and consistency:

“Support for independent financial advisers is in our DNA. For many, many years, this was the main way in which we’ve been distributing our products. We champion IFAs. We understand what they need, and we have great relationships with our support of IFAs.”

Initiatives such as adviser partnerships have extended the benefits of networks to advisers who prefer to remain independent. Independent benchmarking also reinforces this positioning: NMG Consulting’s surveys consistently rank Momentum’s life risk business consultants higher than anyone else in the industry, with its investment consultants regularly in the top three.

Marais also highlighted technological advances designed to make IFAs’ lives easier:

“In Myriad, we did world-first work over the last two years to simplify the underwriting process through technology, making the lives of IFAs so much easier. And in fact, Myriad in terms of technology, ease of doing business, and underwriting are rated consistently highly by advisers in the NMG survey.”

Growth path ahead

Momentum plans to increase the number of IFAs it supports through MDS from about 2 500 today to 3 000 by 2027, underscoring the group’s confidence in the advice channel.

Other pillars of the strategy include:

- Consult by Momentum: now one of the largest networks in the industry, offering an attractive home for tied advisers moving into independence.

- Flexibility and open architecture: enabling IFAs to custom-build solutions across Momentum’s product ranges to deliver the best client outcomes.

- Strong product partnerships: ensuring that sales growth is supported by competitive, highly rated offerings across investments, health, retirement, and risk.

Summing up, Marais reiterated that success in the IFA market takes patience, focus, and long-term commitment:

“Market dominance in the IFA market doesn’t happen overnight; it is the outcome of years of hard work and of focus.”

Leaner, cleaner, more productive

Momentum has been focused on creating a more efficient, productive, and sustainable sales force – a strategy that has been under way for several years.

The National Franchise Partners (NFP), Momentum’s former franchise-based agency model, was phased out as part of a strategic overhaul to enhance operational efficiency and align with the group’s long-term objectives.

The NFP model was a significant component of Momentum’s distribution strategy, relying on a network of independent franchisees to sell insurance products. However, over time, the company recognised that this model was not sustainable because of various challenges, including escalating costs and complexities in management.

In response, Momentum initiated a comprehensive restructuring plan.

Chief financial officer Risto Ketola reported that the agency sales force at Metropolitan Life was reduced by about 15% over the past 12 months, yet new business volumes fell only 6%, signalling a sharp increase in productivity per agent. In late June, some agents were writing more than four policies a week, “nearly double the rate from a few years ago”, highlighting that remaining agents are focused on quality, as well as quantity. Recurring-premium business remained almost flat year-on-year, despite fewer agents, further illustrating the effectiveness of the approach.

Marais explained that reductions in sales headcount at Metropolitan Life and Momentum Life were “completely by design”.

“This was a two-year project for us because we knew that for the last 10 or so years, the foundation on which we were running NFP was simply not sustainable, not in terms of our franchise model. As you know, we closed that down completely. I mean, that had a massive impact on our business. And at the same time, the bonuses … that we were paying our agents … actually just were not sustainable, so that caused a very big reduction in numbers.”

She noted that the majority of affected NFP agents transitioned to Consult by Momentum, with more than 90% staying within the business:

“We haven’t actually lost the headcount, but what we managed to do is keep them in the business, and move them on to Consult. And that has helped Consult quite a bit.”

Further refinements came with the introduction of validation requirements. Agents now need to bring in a minimum level of new business to remain active, preventing the system from sustaining agents who rely solely on commissions from existing books. Marais described this as creating a more profitable and sustainable model, which positions Momentum to attract and recruit the right advisors going forward:

“We are perfectly positioned with an affordable, very profitable model that we can now apply to actually go out into the markets and to start to recruit advisers for that model.”

The overhaul also included a clean-up to address fraud:

“Just as we started with our five-point plan, we had very large percentages of fraud that came out of that business. We needed to clean it out. And what we couldn’t do was to simply get rid of the people who were part of the fraudulent transactions, but not completely revise how we recruit, who we recruit, and more than anything, how we manage our sales force. That has completely changed.”

She added that even with an overall 35 to 40% reduction in sales numbers, the resultant drop in new business was only around 15%, showing that Momentum retained its highest-performing, most tenured agents while removing underperformers and inactive accounts:

“We held on to the quality people, and the clean-up literally was more of a numbers one, but possibly the right one to now set us up for future success.”