The once-off cost of implementing the two-pot retirement system is estimated at R1.629 billion – and retirement fund members may be footing the bill for years to come.

A report released this week by the Financial Sector Conduct Authority sheds light on how administrators are recouping the costs of rolling out the system, which came into effect on 1 September last year. These mechanisms include once-off fees, higher ongoing administration charges, and transaction fees when members access savings.

The FSCA’s Report on Two-Component Related Costs and Fees warns that although many administrators appear to be subsidising the initial cost in the short term, they plan to recover more than the system’s year-on-year operational costs over time.

“This implies that there will be a cross-subsidisation between generations of members,” the report states. “Further engagement with individual administrators is required to understand the rationale for the expected fees.”

The two-pot system requires fund administrators to split member contributions into a savings component – from which limited annual withdrawals can be made – and a retirement component.

This restructuring has come with significant expenses. Administrators have had to update IT systems, improve record-keeping capabilities, roll out member education campaigns, and gear up for the administrative demands of processing withdrawals.

On average, the once-off implementation cost works out to R252 per member – but the report notes substantial variation, ranging from R0 to R3 072 per member.

“This variation likely accounts for the different approaches adopted by administrators to recover costs,” the FSCA says.

To assess the cost implications, the FSCA surveyed 111 registered section 13B administrators and six self-administered funds. After excluding incomplete or irrelevant responses, the FSCA analysed the responses of 76 entities.

Most administrators reported they are passing on the costs through increases in monthly administration fees, withdrawal transaction charges, or a combination of the two. In some cases, administrators absorbed the initial cost, which may lead to higher fees in the future, the FSCA warns.

The Authority says it is still too early to draw firm conclusions about the long-term cost impact. “There is uncertainty about the support and additional administration that will be required in future,” the report says.

Long-term costs of two-pot system

Many retirement fund administrators are still uncertain about the long-term costs of maintaining the two-pot system, with several indicating they have yet to quantify the expected additional expenses over the next three years.

According to the FSCA’s report, some administrators said they do not foresee ongoing costs, because the necessary system development work has been completed. Others view future maintenance as part of their standard administration processes.

However, the report cautioned that many of these responses came from self-administered funds.

“It should, however, be noted that a number of these relate to self-administered funds, which ultimately means that the fund expenses increase, and the source of general expense funding will need to increase to cover the higher expenses,” the report stated.

Some administrators said they plan to absorb part of the cost and recover the rest through various fee mechanisms. Thirteen plan to introduce a savings withdrawal fee, 10 will raise administration fees, and nine intend to apply a combination of both.

Of the 35 administrators that intend to recoup once-off development costs, recovery timelines vary widely – from as short as three years to as long as a decade.

Retirement fund fees may surge after year one

When comparing projected costs and fees over the next three years, many retirement fund members won’t see an immediate increase in fees. In the first year, 46 administrators reported no additional charges. However, by the second year, most plan to introduce new fees to cover the ongoing costs of running the two-pot system.

In year one, where fees are charged, they range dramatically – from as little as R3 to as much as R312 per member.

In year two, the fee picture becomes more complex:

- 49 administrators still won’t charge an additional fee.

- Three administrators who charged in year one will stop doing so.

- 12 will reduce their fees, although in several cases, the new fee is still far higher than the actual costs – “in some cases very significantly”, the reports notes.

- Nine will keep fees the same, “some below the expected costs in the year and some very significantly above the expected costs”.

- Five administrators will increase their fees by 4% to 10%.

- One administrator plans to more than double its fee.

By the third year, although some administrators (10) expect the costs to have reduced from those in year two, the majority expect an increase between 0% and 10%. When it comes to fees in year three:

- Only two administrators expect fees to be reduced.

- 17 expect fees to remain unchanged, although “it is noted that a number of the fees for the year are above the expected costs for that year, as much as 1 550% of the expected cost”.

- Six administrators expect fees to be raised between 1% and 10%.

- One administrator expects fees to be hiked by over 50%, “though still recovering only a small proportion of the expected costs”.

Interestingly, the report noted that for some of the respondents, the expected year one costs are much higher than the once-off two component costs to prepare for the implementation of the two-pot system.

“It is unclear whether this might be due to the costs of the savings withdrawal payments being included in the ongoing costs, rather than being separated.”

The Authority goes on to state that although administrators are likely absorbing some of the early costs, many appear to be recovering these over the long term – and in some cases, charging more than the system actually costs to run the system each year.

In short, this means future members could end up paying for expenses that mostly benefited current or past members.

In response to whether the introduction of the two-pot system has led – or will lead – to an increase in administration fees (beyond standard inflation-linked increases at contract anniversaries), 17 administrators said “yes”, 57 said “no”, and two did not respond.

However, of those who said “no”, 19 still showed projected additional fees in their year-on-year estimates. Three also noted that questions relating to admin fees did in fact reflect extra charges (such as a percentage of salary deducted from contributions, a rand amount deducted from contributions, or a rand amount deducted from the member’s share of fund).

Many administrators that indicated no increase in the administration fee said they would instead apply a separate savings withdrawal fee.

Two-pot withdrawal fees vary wildly across funds

There’s a striking inconsistency in what fund members are being charged to access their own savings under the two-pot system.

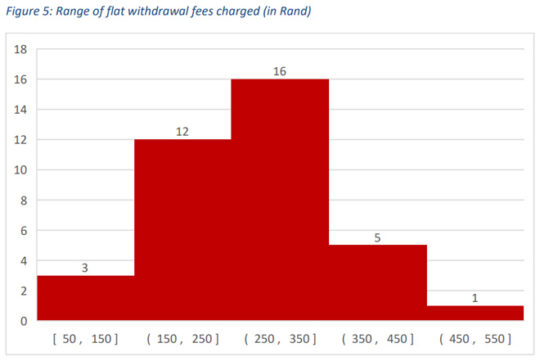

According to the survey (see Annexure A), 28 administrators said they do not charge any transaction fee when members withdraw from the savings component. But the majority – 37 administrators – do charge a flat fee, ranging anywhere from R50 (Sanlam Developing Markets) to R500 (Automated Outsourcing Services), with the average at R278. Most fees fall between R250 and R350.

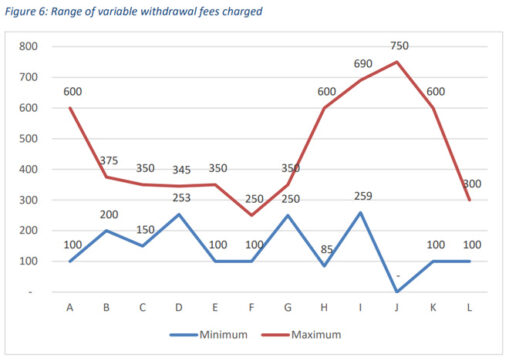

Twelve administrators use a variable fee structure, often based on the withdrawal amount. These charges range from as low as R10 to a maximum of R750 (Transparent Financial Services), although most seem to start at R100 and cap at about R350.

The transaction fee is deducted from the savings component in 46 cases that charge a transaction fee.

But the FSCA flagged an issue with three administrators that deduct the fee from somewhere else: “Of concern was that three do not deduct this fee from the savings withdrawal component, which raises a concern given that this fee specifically relates to the saving withdrawal component,” the report noted.

There also seems to be limited support for low-income members withdrawing small amounts. Only six administrators said they make fee dispensations for small withdrawals.

In response to the question, “Is there a specific fee dispensation for the withdrawal of small amounts?”, 27 administrators said it wasn’t applicable (because no fee is charged), 36 said “no”, one didn’t respond, six said “no” but charge a variable fee, and only six confirmed they offer a reduced fee.

Still, there may be some relief on the horizon. Just over half – 51% – of administrators currently charging a withdrawal fee said they would consider lowering it in the future, depending on how frequently members access their savings.

In conclusion, the Authority stated that the longer-term implications and eventual impact on overall administration fees are still not known and may settle as time progresses and as the practical implications of the system are experienced.

“The FSCA will continue to apply its mind to the question whether the fees are justified by the costs incurred and will initiate engagements with the administrators that are the outliers – both those that appear to be charging disproportionate fees, as well as those that appear not to have made any investment in preparing for the two-component system,” the report noted.