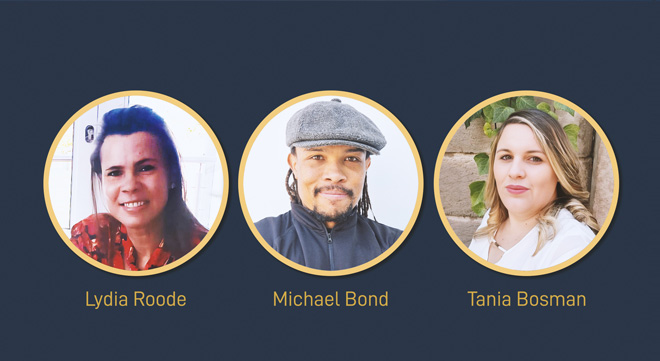

Top achievers in the Higher Certificate in Short-term Insurance (NQF 5) believe the qualification provides practical, workplace-ready skills that make a meaningful difference in their careers.

The qualification, offered by Moonstone Business School of Excellence (MBSE), covers core short-term insurance topics such as underwriting, risk management, claims handling, and insurance law.

Valedictorian Lydia Roode, a claims consultant at Phoenix Risk Solutions (Pty) Ltd, said she was able to apply her knowledge immediately to a complex claim involving a collapsed ceiling.

“Thanks to the HCert qualification, I had a solid understanding of proximate cause, policy exclusions, and the structure of cover. This allowed me to participate confidently in the investigation and explain to the relevant stakeholders why the business interruption section would not respond,” she said.

Roode added that the experience underscored the importance of understanding causation, policy wording, and how technical evidence affects claims outcomes.

“The qualification gave me the confidence and insight to analyse the situation thoroughly and communicate the findings in a clear, professional, and policy-aligned way.”

Michael Bond, an insurance broker at McDonogh & Co. (Pty) Ltd, also credited the qualification with helping him to serve a client more effectively. He recalled how a client, impressed by his earlier assistance with a commercial policy, asked him during a follow-up meeting to assess her personal insurance needs and quote on the spot.

“Thanks to the material covered in the Claims and Underwriting module, I was able to confidently calculate an estimated premium using my company’s rating guide. I demonstrated that we could offer more competitive rates than her current insurer (at the time). It felt rewarding to apply the knowledge in a real scenario and operate with the same confidence and accuracy as our underwriting team,” he said.

Tania Bosman, who is exploring opportunities in the insurance sector, said that although she has not yet had an opportunity to apply the course content in practice, she feels equipped to hit the ground running.

“I am confident that the knowledge and skills I’ve gained through the HCert will allow me to add value from day one when the opportunity comes.”

Moonstone interviewed the three top achievers to understand how the qualification is shaping their career journeys and to share their advice with those considering enrolling.

Lydia Roode

For Lydia, the qualification was a catalyst for personal and professional growth.

The decision to enrol in the HCert was partly inspired by encouragement from Phoenix Risk’s learning and development department and her manager, who urged the team to deepen their industry knowledge. Having already completed her RE5 through Moonstone, Lydia said she trusted the provider’s training approach and saw the HCert as a natural next step. She also saw it as an opportunity to formalise years of industry experience and challenge herself academically.

Lydia said the Risk Management module, although the most challenging, had the greatest impact on her thinking. She credited the course material and insights from senior colleagues with helping her to understand risk from a broader, client-centred perspective.

“This process deepened my appreciation for the importance of viewing financial planning holistically and considering risk management from multiple angles,” she said.

To manage the demands of full-time work and study, Roode adopted a disciplined routine, studying in the early morning, breaking modules into manageable chunks, and reviewing mock assessments weekly. She treated study sessions like fixed appointments and found that explaining concepts aloud helped to reinforce her understanding.

“For me, putting in the extra effort was not about overachieving; it was about proving to myself that I could still grow and succeed academically,” she said.

Lydia praised MBSE’s mock assessments and lecturer support as key to her success. “The feedback and support from the lecturers were always encouraging and clear, which made the learning process far less intimidating,” she said. She also found the structured layout of the online portal – particularly the recommended readings and module tools – valuable in building confidence and staying on track.

She encouraged learners to make consistent time, engage with the portal’s resources, and not hesitate to ask for help.

“Most importantly, believe in yourself. You are capable of more than you realise, and with the right mindset, structure, and support, success is absolutely within reach.”

Michael Bond

The HCert was Michael’s first course with MBSE – but it likely won’t be his last.

“I’m definitely considering enrolling for further qualifications in the future, potentially progressing towards a related designation to deepen my expertise”

His decision to start with the HCert was influenced by his company’s longstanding use of Moonstone for compliance, regulatory exams, and professional development.

“They’ve consistently delivered excellent support and resources,” he said. “MBSE’s flexible learning model and industry-relevant curriculum really stood out and made it the ideal choice for my professional development.”

The qualification has influenced how he thinks about the role of a short-term adviser.

“The course provided a solid foundation for the work I deal with daily and equipped me with the tools to put theory into practice,” Michael said. “It helped me realise that short-term insurance is not just about selling products but about offering sound advice and building lasting client relationships. With the right knowledge base, I’m now better able to recommend solutions that are genuinely in the client’s best interest and ensure their most valuable assets are properly protected.”

Sticking to a consistent study routine helped him to manage the workload.

“I set aside dedicated study time each week, breaking the work into manageable sections. I also made use of study notes, and the self-assessments provided to reinforce key concepts. The study plan provided for each module helped me break down the workload into more manageable pieces and absorb material more effectively. Moonstone provides you with everything you need to perform well.”

He too commended MBSE’s resources.

“The mock assessments helped me gauge my understanding and prepare for summative assessments with confidence. The lecturer support was responsive and timeous whenever I had any issues, which made life easy. I never felt like I was isolated during the course.”

Tania Bosman

Tania has set her sights on a career in insurance and financial planning.

She has already completed the National Credit Act course and is preparing to write her RE5 exam as the next step in her professional development.

Driven by a desire to grow both personally and professionally, Tania said she enrolled in the HCert to “improve my skills, gain credibility in the industry, and create better opportunities for my future”. She viewed the qualification as “an investment in myself and my personal growth”.

The qualification has given her a clear career direction and strengthened her commitment to the field.

“It’s motivated me to keep learning and growing, and I’m now more focused and confident about the steps I need to take to reach my long-term goals.”

Tania credited her success to disciplined study habits and MBSE’s resources. She followed the study plan closely, made regular use of self-assessments and mock exams, and created flash cards to reinforce key concepts.

“Combining these tools with a consistent weekly study routine and clear goals kept me focused, motivated, and confident throughout the course,” she said.

She also praised MBSE’s learning support.

“The mock and self-assessments provided a realistic sense of the exam format and helped me identify gaps in my knowledge early on. Lecturer support was also very accessible and responsive, which made a big difference when I needed clarification or guidance on complex topics.”

For prospective students, Tania advises commitment and consistency.

“The course content is manageable, but it requires discipline and focus. Make full use of the study plans, mock assessments, and lecturer support – these resources are there to help you succeed. Don’t hesitate to ask questions and engage actively with the material. Lastly, set clear weekly goals and stick to them. This approach will make the workload feel much more manageable and keep you motivated throughout the qualification.”

Enrolments

The Higher Certificate in Short-term Insurance (NQF 5) is one of five accredited qualifications offered by MBSE. The others are:

- Postgraduate Diploma in Financial Planning (NQF 8)

- Advanced Certificate in Financial Planning (NQF 6)

- Occupational Certificate: Compliance Officer (NQF 6)

- Higher Certificate in Wealth Management (NQF 5)

Apply today at www.mbse.ac.za.

For more information, contact us at help@mbse.ac.za.

Great kudos to Lydia for all the extra hours and effort put in !!

I’m sure the extra knowledge will paoff in the long run

Brilliant effort Lydia. Learning should never stop.