An insurer is not a supplier under the Consumer Protection Act

When seeking compensation from an insurer because of alleged third-party negligence, the best course of action is to pursue the matter in court, the National Consumer Tribunal says.

When seeking compensation from an insurer because of alleged third-party negligence, the best course of action is to pursue the matter in court, the National Consumer Tribunal says.

The aim of the newly established panel to ensure that the perspectives and concerns of retail financial customers are effectively considered in the Authority’s activities.

A provisional sequestration order for the estate of Classic Financial Services director Jacobus Geldenhuis has been granted.

Moonstone Business School of Excellence has three short courses that will improve your money management skills.

The governor of the Reserve Bank also says he is confident the country will get off the grey list in 2025.

The penalty is R8 215 a day, in terms of the Long-term Insurance Act or the Short-term Insurance Act.

The BHF raises 10 issues, including the ‘misuse’ of curatorships, whether NHI is informing policy prematurely, and the absence of low-cost benefit options.

The FSCA expects to receive a large number of amendments, so it would like to have prior sight of the proposed amendments beforehand.

Microinsurers are no longer restricted to imposing a waiting period of three months for a death, disability, or health event resulting from natural causes.

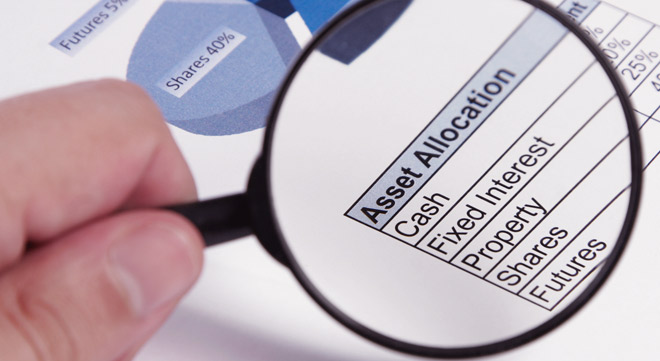

The exceptions to the exposure limits do not apply when the limits are breached because distributions are re-invested, the FSCA says.

The FSP conflated the requirements for debarment under section 14 of the FAIS Act with the requirements and procedure for a debarment by the FSCA.

The inherent risk of money laundering and terrorist financing for CASPs in South Africa is high, the report says.

The entities will co-operate to improve the level of submission of compliance reports.

The reasons for the sanction are virtually identical to those that saw the Authority fine an FSP earlier in February.

The 75% investment limit in Board Notice 52 inadvertently excluded the establishment of retail feeder hedge funds as a portfolio style.

Implementing – not merely creating – a Risk Management and Compliance Programme is crucial to ensure compliance with the Act.

The Authority’s findings in respect of an investigation have no legal consequences, the FST says.