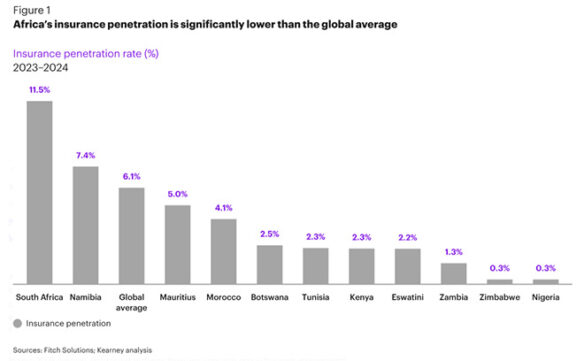

South Africa remains in a league of its own when it comes to insurance penetration. At 11.5%, the country far surpasses both the African average of below 3% and the global average of 6.8%, according to Kearney’s State of African Insurance in 2025 report.

This dominance reflects decades of regulatory maturity, diversified products, and advanced digital capability – positioning South Africa as the continent’s insurance hub. But the report cautions that past success will not guarantee future growth. The challenge for the local industry is to convert scale and sophistication into new forms of relevance: affordability, inclusion, and execution excellence.

The report notes that the continent’s insurance industry is entering “one of its most dynamic periods in decades”. With new technologies, evolving regulation, and cross-sector collaboration reshaping the market, focus has shifted from strategy to what the management consulting firm calls “industrialised execution” – turning ambition into tangible, inclusive growth.

“The next decade of African insurance will be defined by execution, not intention,” says Jo-Ann Pohl, associate director at Kearney Johannesburg. “The leaders will be those who operationalise affordability, embed cover at the point of need, and scale technology to reach those who have been historically excluded and underserved. This is Africa’s moment to redefine insurance as a driver of growth, trust, and resilience.”

Africa’s insurance gap: contrasting progress and persistent barriers

Although South Africa dominates the continent’s insurance landscape, much of Africa remains under-insured. Most countries have penetration below 3% of GDP, with only a handful – including Namibia and Morocco – approaching double digits.

In Kenya, penetration has hovered around 2.2%, despite a dynamic mobile-money ecosystem and strong domestic insurers. Nigeria, Africa’s largest economy, lags at roughly 0.4%, reflecting affordability challenges, low awareness, and limited product relevance. Even Tunisia and Ghana remain under 3%, well below levels needed to provide meaningful financial protection.

Several structural barriers underpin this gap:

- Affordability and income volatility, particularly in large informal sectors, make consistent cover and regular premiums difficult.

- Low awareness and limited trust, particularly where claims experiences have been inconsistent or insurance is viewed as a luxury.

- Regulatory fragmentation, with each jurisdiction applying its own licensing, capital, and compliance rules, hinders cross-border scalability.

- Distribution challenges, including limited agent networks, uneven digital adoption, and high transaction costs, make mass-market reach expensive.

Nonetheless, Kearney highlights emerging momentum. Digital-first micro-insurers in East Africa are experimenting with embedded and mobile-based products, while West African markets see increased activity around agricultural and SME insurance – suggesting a market gradually gaining traction, albeit from a very low base.

What South Africa is getting right

Strong regulation and solvency standards

Early adoption of risk-based solvency frameworks and alignment with international norms have underpinned market trust, safeguarded solvency, attracted investment, and enabled accurate capital modelling.

Digital leadership and AI integration

South Africa leads in digital transformation and enterprise-scale AI deployment. Insurers such as Discovery Insure and Naked illustrate how technology can improve underwriting, claims management, and customer experience while reducing costs. AI is increasingly used for fraud detection, document intelligence, and customer support.

Product and ecosystem innovation

Insurers are embedding protection into broader financial journeys – from mobile-driven microinsurance to health and wellness ecosystems. Integrating products across life stages and adjacent services has become a key differentiator in a competitive market.

Mounting pressures: affordability, lapse rates, and climate risk

Affordability remains the single biggest threat to sustained penetration. More than 8.2 million risk policies lapsed in South Africa in 2024 as consumers struggled with higher living costs.

The report stresses the need for flexible, affordable product design rather than simple price adjustments. Modular and bundled solutions aligned to household income levels can maintain continuity through economic turbulence.

Climate risk has also emerged as a capital threat. With floods, storms, and fires becoming more frequent, reinsurers are tightening terms and raising pricing. South African insurers will need forward-looking climate models, parametric solutions, and stronger catastrophe-risk partnerships to protect solvency and ensure sustainable pricing.

The next frontier: from trend response to execution advantage

Kearney emphasises that recognising trends is no longer enough. South Africa’s market leadership must now be matched by execution excellence across three imperatives already visible among top African performers.

Build multi-service insurance ecosystems

Standalone policies are giving way to ecosystem-based insurance that integrates products into broader life and business journeys.

For motor insurance, this might combine coverage with financing, telematics, roadside assistance, and repair networks. In health, coverage is extending to virtual consultations, chronic care, wellness, and diagnostics.

Executing this requires orchestration across owned and partner platforms, aligned data infrastructure, and open APIs to deliver seamless experiences.

“The outcome is not convenience – it is competitive defensibility,” notes Kearney.

Embed insurance at the point of need

High mobile and digital engagement in South Africa present an opportunity to provide cover at the exact moment of relevance. Examples are funeral cover bundled into airtime or digital wallets, motor insurance integrated into car dealership journeys, and device protection offered at e-commerce checkout.

This approach reduces acquisition costs, improves conversion, and enables micro-premiums. Success depends on robust APIs, flexible underwriting, and partner-management capabilities – areas where incumbents often lag.

Simplify and bundle for mass-market scale

Consumers face complexity in products, exclusions, and claims processes. Leading insurers are packaging multiple cover types – such as funeral, household, and motor – into tiered bundles aligned to life stages or income levels. For SMEs, industry-specific bundles (for example, goods-in-transit and liability for logistics operators) shorten sales cycles and improve retention.

Bundling creates transparency, reduces friction, and supports upselling, but requires deep customer insight, agile pricing, and streamlined claims handling.

Staying ahead in a shifting market

Kearney’s analysis suggests that South Africa’s insurers are better placed than most to lead this next evolution – they have the scale, technology, and regulatory base to do so. However, leadership will depend on moving faster than the competition in implementing these imperatives.

The firm maintains that execution – rather than vision – will determine which players succeed. Insurers that can effectively operationalise ecosystem thinking, embedded distribution, and simplified product design will be best placed to capture the next wave of growth. Those that lag in implementation risk stagnating in low-margin, commoditised segments.

Kearney argues that the differentiator among market leaders will not be the quality of their strategies, but their ability to convert intent into measurable capability. This includes embedding affordability into product design, aligning capital and risk frameworks to manage rising volatility, digitising distribution at scale, and using advanced analytics for real-time pricing and claims precision.

“Africa’s insurers are no longer just responding to change – they are shaping it,” adds Pohl. “By turning bold strategies into disciplined execution, the industry can support societal progress that is commercially sustainable.”