It’s that time of year again when medical schemes gear up to announce their contribution increases. And, as always, the Council for Medical Schemes (CMS) has fired the opening shot with its annual guidance circular. Cash-strapped consumers can only hope schemes won’t brush it aside yet again.

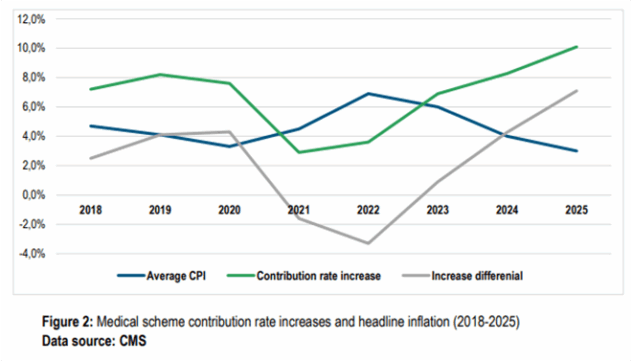

In Circular 24 of 2025, the CMS advised that contribution increases for 2026 should be capped at 3.3% “plus reasonable utilisation estimates”. That’s tighter than last year, when the CMS suggested 4.4%, and the year before, when it recommended 5% plus utilisation estimates in line with headline inflation.

Schemes, however, have rarely heeded the call. For 2025, Discovery Health Medical Scheme announced a weighted average increase of 9.3%, Momentum 9.4%, Bonitas 10.2%, Medihelp 10.8%, and Bestmed 12.75%. A year earlier, Discovery set its hike at 7.5%, Bonitas at 6.9%, Momentum at 9.6%, Bestmed at 9.6%, and Medihelp at 15.96%.

The CMS has acknowledged the pattern.

“The annual medical scheme contribution rates have consistently increased at a higher rate than consumer inflation. The CMS remains concerned by this trend, as it places a significant financial burden on members of medical schemes. Coupled with steep increases in the price of electricity and high food inflation, it is evident that most household budgets are significantly constrained,” the Circular states.

Yet, the regulator has signed off on these hikes year after year – perhaps justified, at least in part, by the phrase: “plus reasonable utilisation estimates”.

Between a rock and a hard place

Globally, the International Monetary Fund expects economic growth to slow from 3.3% in 2024 to 2.8% in 2025 as trade wars and geopolitical shocks weigh on the outlook. For South Africa, the prospects are worse. Growth is projected at just 1% in 2025 and 1.3% in 2026, far too low to ease unemployment, which has already climbed to 33.2%. Although the rand has firmed recently, it remains volatile; interest rate cuts offer some relief but little lasting respite.

In this environment, the CMS is urging medical schemes to tighten the reins.

The Circular sets out five factors it will consider when judging contribution increases:

- Headline inflationary expectations.

- Contribution increases relative to the Consumer Price Index (CPI).

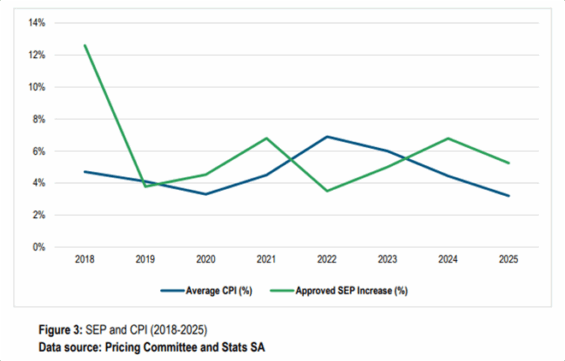

- The Single Exit Price (SEP) relative to CPI.

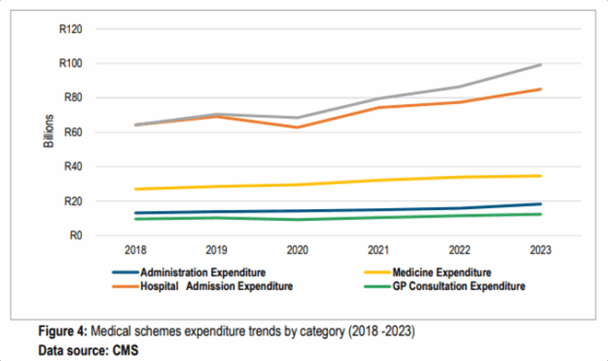

- Expenditure trends.

- Reserves and investment income.

Inflation and affordability

South Africa has no official medical price index, so the CMS uses CPI as a proxy. Inflation has hovered at the bottom of the South African Reserve Bank’s target range of 3 to 6%, averaging 2.8% in April and May before edging up to 3% in June. The SARB projects an average of 3.3% in both 2025 and 2026. That’s where the CMS’s 3.3% recommendation comes from.

The regulator pre-empted the usual counter-argument that private medical inflation exceeds CPI: “Although private medical inflation generally exceeds CPI by 2 to 3 percent, CMS believes that the annual industry price increase assumptions should be linked to inflation. With cash-strapped consumers grappling with the current cost-of-living crisis, raising contributions above CPI is simply unaffordable for most households.”

To protect members from steep contribution hikes, the CMS recommends capping non-healthcare expenditure (NHE) for 2026 at just 3.3%, in line with inflation. It warns that in the current tough economic climate, there is no justification for increases above CPI – those costs land squarely on members’ premiums.

“Medical schemes with sufficient economies of scale are expected to use strategic purchasing when contracting with all providers to ensure value-based contracting. Trustees must also strive to incorporate efficiency and performance metrics into managed-care contracts to improve operational efficiencies and the overall quality and efficiency of patient care delivery.”

SEP and medicine costs

The Circular also highlights the SEP, the regulated selling price of medicines. SEP adjustments are linked to inflation but are often higher. The CMS’s data shows that although both CPI and SEP have been trending down since 2024, the SEP has consistently run about 2% above CPI. This matters for schemes because medicines – particularly for the Prescribed Minimum Benefits and chronic conditions – remain one of their biggest cost drivers.

The SEP adjustment for 2026 is still to come, but schemes are told to make “reasonable estimates” when modelling increases.

Expenditure pressures

Healthcare utilisation is the industry’s pressure valve – and it’s running hot. The CMS links rising utilisation, driven by ageing members and chronic conditions, directly to escalating claims and higher contribution increases. When expenditure outpaces inflation, the CMS warns, “it puts upward pressure on annual increases in contributions”.

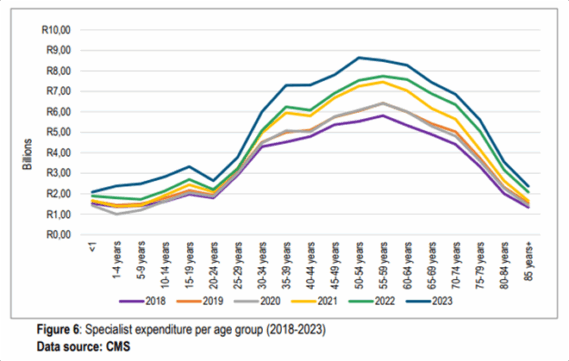

Since 2018, spending has climbed across all categories, with post-Covid surges in specialist consultations and hospital admissions leaving GP visits far behind.

“Despite the policy emphasis on strengthening primary healthcare, spending on GP consultations was the lowest during the period under review,” the CMS notes.

The numbers, it argues, highlight an unsustainable cost path dominated by specialists and hospitals.

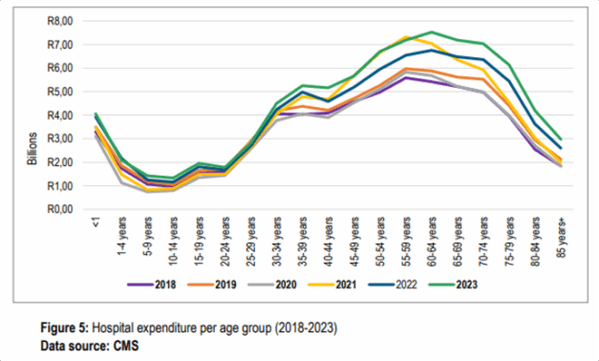

Hospital costs rise predictably with age, peaking among 60-to-64-year-olds before slowing. The CMS attributes this to the heavy burden of chronic disease and multimorbidity.

“These trends highlight the need for innovative strategies such as the use of exclusive provider contracting to curb spiralling high-cost in-hospital claims.”

Specialist spend follows a similar arc: climbing from young adulthood, peaking in the 50s, then tapering off. The CMS says this underlines the case for “risk-based care co-ordination and more robust referral pathways” to manage costly specialist claims.

The bigger picture: healthcare expenditure is rising faster than inflation. The CMS says the drivers are structural – technology, ageing, and chronic disease – and the response must be structural too.

“Managing spiralling healthcare costs remains a key priority… Trustees must, therefore, continue to seek efficient strategies to curb costs without compromising quality health outcomes.”

Reserves – too much or too little?

Reserves remain the industry’s ultimate catch-22. By law, schemes must hold at least 25% of gross contributions in reserve – a safety net to protect members and keep schemes solvent when claims or costs spike. By the end of 2023, the industry was sitting on a healthy average solvency ratio of 43.45%, well above the statutory floor.

But with that cushion comes mixed messages. Trustees are urged to stick to “the current prudent financial risk management approach to ensure the industry’s long-term sustainability”.

At the same time, the CMS pushes them to tap into their strong balance sheets to shield members from relentless medical inflation “without immediately passing all costs to members through unreasonable contribution increases”.

And in instances where trustees may be tempted to lean too hard on aggressive under-pricing, they are advised to note the regulator’s “grave concern”. According to the Circular, some actuaries may be bowing to trustee pressure and setting contributions too low, eroding reserves in the process.

“Not only do such pricing models violate the requirements of APN 303, but such pricing also leads to erosion of reserves, predisposing such medical schemes to the risk of insolvency. The Registrar warns that in the future, there will be severe consequences for such conduct, including barring such individuals from rendering services to medical schemes and reporting such individuals to the Actuarial Society.”

Open to negotiation

The CMS also signals some flexibility.

“The CMS is also cognisant that some medical schemes may require contribution increases higher than the CMS’s recommended CPI-linked increments.”

In such cases, trustees must submit a comprehensive business plan to the Registrar, complete with clear financial and actuarial justification. The plan must fully comply with the Advisory Practice Note (APN 303) on the adequacy of contribution increases, as prescribed by the Actuarial Society of South Africa (ASSA). The Circular notes that the Registrar may even require a second, independent actuarial analysis to justify above-inflation increases.

“The Registrar’s decisions to approve or decline any proposed contribution increases will continue to be dependent and sensitive to each medical scheme’s financial and demographic risk profile.”

Based on past patterns, it’s likely the CMS will see plenty of these “comprehensive business plans”.

Let’s hope, though, that this is where the cycle stops, giving cash-strapped South Africans some much-needed relief from steep contribution hikes.