Towards the end of last year, asset manager Ninety One shared the following insights into the financial adviser market in South Africa.

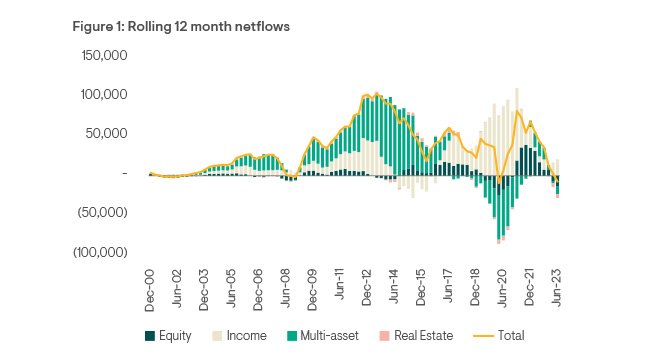

The retail investment industry experienced a tough 2023, as the following graph of rolling 12-month net flows for the South African collective investment schemes (CIS) industry:

Jaco van Tonder, the head of Advisor Services in South Africa at Ninety One, says the local CIS industry has experienced aggregate net outflows on three occasions since 2000. The first two were in response to external crises: the global financial crisis of 2008 and Covid-19 in 2020. The third time was in the first half of 2023.

“For all players in the local investments industry, from platforms to CIS Mancos to financial advisers, 2023 has been a year where consolidation was either enacted or vigorously considered and business growth was only achievable if you grew your market share,” he says.

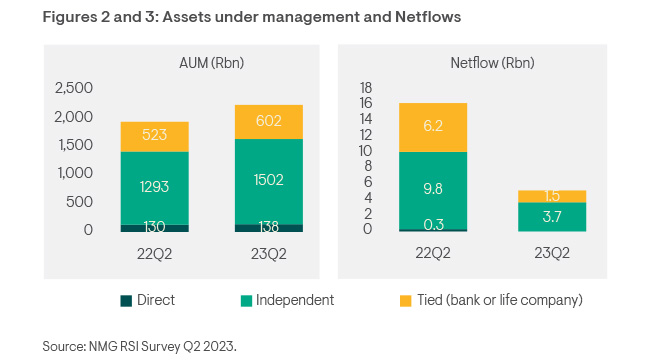

NMG Consulting’s second-quarter 2023 Retail Savings and Investment (RSI) Survey highlighted the drop-off in flows for the financial adviser market. The following graph from the survey provides the year-on-year asset and flow experience for independent advisers, tied advisers, and direct (unadvised):

Van Tonder says the above graphs reinforce several key conclusions about the market conditions over the past year:

- Markets helped to grow assets by more than 15% between the second quarter of 2022 and the second quarter of 2023.

- Net-flow momentum stalled significantly over the past 12 months.

- Whereas all channels experienced a dramatic reduction in net flows, tied channels experienced a more pronounced reduction.

- Direct (unadvised) investments remain a small part of the South African savings industry and do not seem able to threaten the advised investment channels.

The RSI survey also polls advisers on the key areas of concern in their practices. In previous years, adviser concerns focused on ever-increasing regulations or fee pressure. This time around, although not unexpected, political risk, the state of the economy, and client emigration were cited by more than 60% of advisers.

The challenge facing advisers is that one can do nothing about the state of politics or the economy. They are distractions, and well-established advice firms know that the key in difficult markets is to focus on what you can control: high-quality engagements with clients who are also concerned and looking for guidance on their financial affairs, Van Tonder says.

Financial performance of independent financial advisers

Every year, Ninety One tracks the financial affairs of about 35 independent investment-focused wealth advisory firms, ranging from single-adviser lifestyle firms to large national corporates. Ninety One obtains basic financial ratios from the participants, reflecting the revenue and cost growth in their firms. This information helps Ninety One to keep track of how these firms perform over time.

The results for 2023 (covering the 2022 financial year) provide a glimpse into how well adviser firms have weathered the impact of Covid lockdowns, as well as the difficult market conditions of the past 12 months.

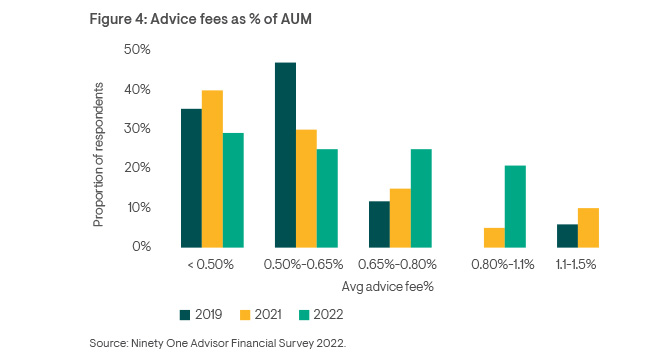

The results for fees as a percentage of assets and revenue growth are indicators of how well investment advice firms are performing financially.

The chart below compares the total practice fee revenue as a percentage of assets (fee rate as a percentage) for the participating practices between 2019 and 2022 (2020 review was not run because of the lockdowns).

Instead of just showing average fee rates over the three years, the graph shows the distribution of fees charged by the participants in the survey.

Van Tonder says several interesting conclusions can be drawn from the graph:

- 2022 was the first time no advice firms in the same group charged an average fee of more than 1.1% a year.

- There was a reduction in the proportion of firms charging fees of less than 0.65% a year.

- 46% of respondents indicated that their average fee is now above 0.65% a year – the highest proportion since the survey launched in 2016.

- The combined impact has been for average fees across all respondents to remain flat at 0.64%.

He says there appear to be at least two fee and value propositions in the survey group:

- The more conventional advice firms focusing on classic investment planning have a revenue margin that generally falls below 0.60% – some of the lower-margin operators are experiencing fee pressure.

- Advice firms offering a wider array of services, including a family office proposition, capture a larger slice of the investment management margin. They earn a revenue margin of between 0.65% and 1% a year or higher and appear more able to defend their revenue margin.

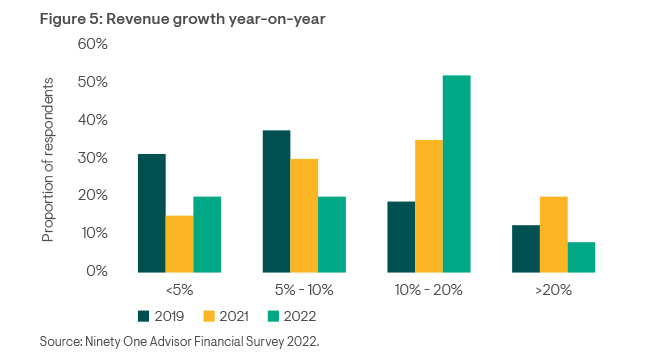

Revenue growth

In line with the NMG analysis of assets under management, which showed an increase in assets from market growth (despite low net flows), the respondent group also showed solid revenue growth in 2022, with 60% of respondents reporting double-digit revenue growth, Van Tonder says.

The average revenue growth across the entire group was reported at 12%, somewhat down from the 17% achieved in 2021, but still remarkable given the investment environment. These statistics emphasise again the healthy financials that underpin high-quality independently owned advice firms – despite low net flows for many top firms, these firms grow their revenue under most market conditions, Van Tonder says.

He says the data continues to support the thesis that independently owned financial adviser firms fare well under almost any market conditions.

“In difficult market conditions, advisers should focus on what they can control – the quality of client engagements. When the environment gets tougher, clients require more handholding and more coaching. Advice firms that have mastered these skills have a competitive edge and will grow their market share in tough markets,” Van Tonder says.

As South African investors remain wary and continue to hoard cash (with about R1.7 trillion of excess retail bank deposits in the local market waiting for investment opportunities), well-positioned independent financial advice firms stand to benefit as conditions improve next year, he says.

Dear Moonstone, I need assistance with registering for RE5. Can you please guide me on how to do it? Thank you.

Thank you for your interest in Moonstone’s RE service.

Information about how to register to write the RE exams can be found here: https://www.moonstone.co.za/services/regulatory-exam-body/

You can register online here https://www.faisexam.co.za/nav/public

Or you can phone our registration call centre weekdays during business hours(08h00 – 16h00). Call (021) 883 8000 or (021) 888 9796.