Every year, the Budget Speech commands wall-to-wall media coverage. Most of this coverage asks something along the lines of, “What does the Budget mean for the taxpayers, the economy, and markets?” Increasingly, this question should also be asked in reverse. How does the state of the economy and the bond market influence the Budget?

That is not to suggest that the Budget has no impact on the bond market. It clearly does because it determines the size of government borrowing, which is to say the supply of bonds.

The Budget also has an impact on the economy. After all, the government will spend R2.3 trillion in the coming fiscal year. Spending levels have grown strongly over the past 12 years. Although this spending should in theory support economic activity, real GDP growth has averaged only 0.8% since 2012, as the Budget pointed out.

Not multiplying

National Treasury’s internal estimates show that the so-called fiscal multiplier is below one, meaning that each rand of government spending results in less than one rand’s worth of additional national income (GDP). There are two broad reasons for this.

First, although spending has increased in quantity, it has decreased in quality. It has often been wasteful or misallocated. For example, education receives the biggest allocation in the Budget, but the country is not producing the skills it needs. Another example is the hundreds of billions that have been poured into Kusile and Medupi, neither of which functions properly despite being brand-new power stations.

Second, much of the increase in spending has been funded through borrowing. As the bond market’s assessment of the government’s creditworthiness has deteriorated, borrowing costs have risen, not only for the government, but also for the private sector, acting as a drag on economic activity. In turn, the higher borrowing costs mean the government’s debt service burden has risen sharply, crowding out spending on other areas, such as infrastructure. Already, interest payments exceed social grants. The latter boosts consumption in the economy, the former does by much less because 25% of bondholders are foreigners, while the rest are mostly domestic financial institutions.

It is the rising interest burden – brought about by higher yields on government bonds – that is forcing the government into fiscal consolidation in an election year.

James Carville, President Bill Clinton’s adviser, famously said: “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would want to come back as the bond market. You can intimidate everybody.”

The poor state of the economy and the sceptical bond market are now in the driving seats.

When are debt levels sustainable?

Let’s put this in a global context. Government debt levels rose sharply after the global financial crisis as the public sector stepped in when the private sector stepped back. But in many cases, the fiscal response was insufficient, and austerity was imposed too quickly.

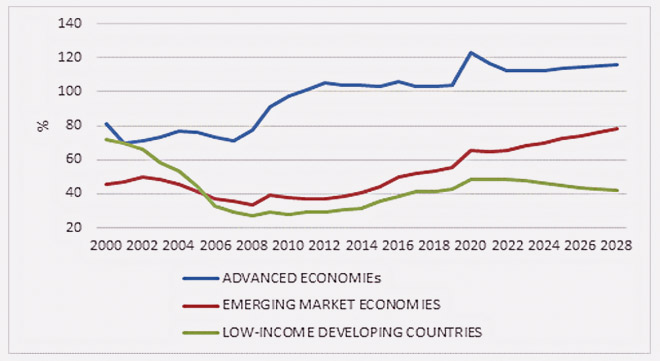

When Covid hit, governments again stepped in. The combination of the collapse in tax revenues and massive stimulus packages, notably in the US, saw government debt-to-GDP ratios rise further. The 2022 inflation surge reduced these ratios somewhat (if there is one thing inflation is good for, it is reducing debt burdens), but debt levels are still higher today than in 2019, as chart 1 shows.

Chart 1: Global government debt-to-GDP ratios with projections

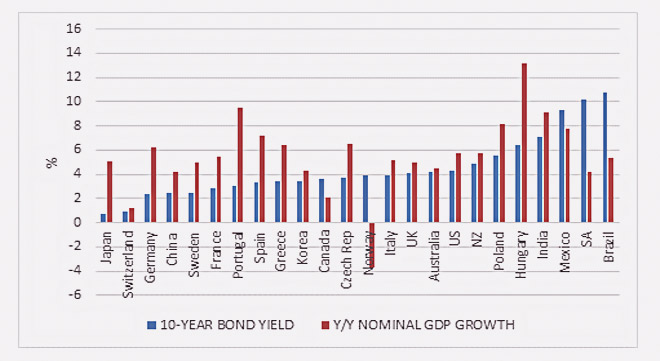

Are these debt levels sustainable, particularly with the increase in interest rates over the past two years? Very simplistically, if nominal national income growth is higher than the government’s cost of borrowing (the yield on its bonds), it should be broadly sustainable. There are other factors at play, but fundamentally it is this simple relationship between the growth of income (nominal GDP) and bond yields that determines whether a given level of debt will be stable or continue rising.

Chart 2 summarises the difference between year-on-year nominal growth rates (for the last available quarter) and the latest 10-year government bond yield for a selection of large economies. We focus on nominal growth because most debt is a nominal number, as is tax revenues.

This does not mean that countries can “inflate away debt” as is often suggested. The experience of the post-2008 period shows that inflation is not something policymakers can conjure out of thin air, nor is it something they can easily control once it arrives. What they can do is keep interest rates artificially low, also known as financial repression. But remember that while central banks set short-term interest rates, they have little direct control over long bond yields.

Chart 2: Growth-interest rate differentials for selected countries

In this sample of large economies, most have positive growth-interest rate differentials, despite bond yields being higher than they were two years ago. Nominal growth rates in most countries will probably slow in the quarters ahead. But Brazil, South Africa, and, to an extent, Mexico already have concerning fiscal dynamics. (We need not worry about oil-rich Norway.)

South Africa’s core fiscal challenge is therefore to get the growth-interest rate gap back into positive territory. As long as growth is low and borrowing costs are high, the only way to stabilise debt is to cut spending. This brings us to the 2024 Budget.

Why the Budget is market-positive

It can be summarised as a market-positive Budget given the tough circumstances, remembering that a good Budget for the market is not necessarily the same as a good Budget for other segments of society.

To start with, the deterioration in the 2023/24 budget deficit – the difference between spending and revenue – was not as bad as widely feared. Although the consolidated deficit for the current fiscal year is weaker than projected in February 2023, it looks set to end up in line with the November Medium-Term Budget Policy Statement (MTBPS) adjustment at 4.9% of GDP.

The deficit is then projected to decline steadily to 3.3% by 2026/27.

This is to be achieved by ongoing spending discipline. Non-interest expenditure will grow by less than inflation over the next three years, although upward adjustments were made to accommodate wage increases for front-line workers.

The additional annual R15 billion in tax revenues flagged in the MTBPS will be achieved by not adjusting the tax brackets for inflation. This is a stealthy form of tax increase, but it is an increase, nonetheless. Motorists get a bit of relief because the fuel levy is not adjusted for inflation.

If interest payments are excluded, the so-called primary balance is already in surplus. In other words, non-interest spending is already less than revenues, and this surplus is expected to continue growing in the years ahead. This will contribute to stabilising the debt ratio, but it should also be noted that a primary surplus of 1.8% projected for 2026/27 looks ambitious and is subject to several risks.

Fortunately, the pain of this consolidation is eased somewhat by an unwieldy acronym. Until recently, few people had heard of GFECRA, the Gold and Foreign Exchange Contingency Reserve Account at the South African Reserve Bank (SARB). But now it is the talk of the town.

GFECRA to the rescue

GFECRA is effectively the unrealised valuation gains or losses on South Africa’s foreign exchange reserves. Though held by the SARB, these gains or losses accrue to the government. Unlike in other countries, there has not been a regular transfer of gains from the central bank to the government.

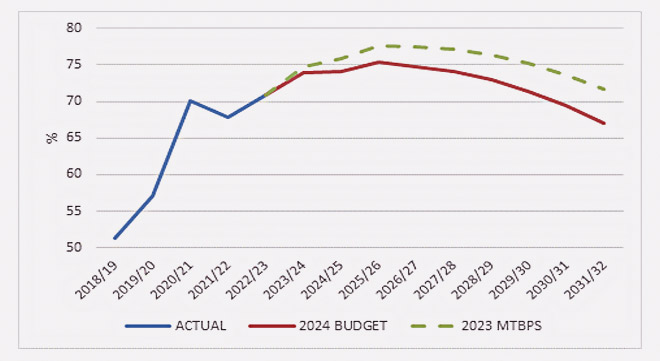

The sharp depreciation of the rand from R6 to the dollar in 2010 to almost R19 to the dollar today means that GFECRA has ballooned to about R500bn. National Treasury will tap R150bn of those gains to pay down debt and reduce the government’s annual gross borrowing requirement from R553bn in 2023/24 to R428bn in 2026/27. It also means the debt-to-GDP ratio is projected to stabilise at 75.3% in 2025/26, a lower and earlier peak than projected in last year’s MTBPS.

A clear framework for GFECRA transfers will be formalised through legislation, which is important, because the credibility and financial stability of the Reserve Bank is at stake.

Future transfers are highly unlikely to be anywhere near as big as R150bn, so this should be seen as a one-off boost, not an ongoing source of funding.

Chart 3: Gross government debt-to-GDP ratio projections

One can nit-pick the details of the Budget projections and the assumptions on which they are based. But Treasury cannot be faulted for sticking to its fiscal consolidation commitment despite it being an election year. Other developing countries often see populist budget policies leading up to elections, but there was no sign of it in South Africa’s 2024 Budget Speech.

All these projections, however, assume there will be policy continuity over the three-year period the Budget framework encompasses, and that the 29 May election will not throw a spanner in the works. This is another reason investors will not be in a great hurry to make firm conclusions about the fiscal trajectory.

It all comes down to faster economic growth

And then there is the question of economic growth, which is fundamental. The economic projections on which all the other Budget numbers are based point to a steady increase in growth, from an estimate of only 0.6% in real terms in 2023 to 1.3% this year and eventually 1.8% in 2026. This is an improvement, but it still shows an economy held back by several constraints. Nominal growth is forecast to average 6% over the next three years, below prevailing market yields.

A primary surplus implies the government is taking more out of the economy in tax revenues than it is putting back in the form of spending; therefore, fiscal policy will not support economic growth over the medium term.

Faster growth will have to come from reforms that address the crippling bottlenecks in energy, logistics, and elsewhere. The Budget placed great emphasis on these ongoing reforms but also noted that regulatory changes were being explored to encourage and facilitate greater use of public-private partnerships.

Although National Treasury is responsible for macroeconomic policy and generally does a good job of it, other, less efficient government departments are responsible for implementing the microeconomic policies that can enhance South Africa’s economic growth performance through, for example, the faster issuing of mining licences or work permits.

Strong anchor to bond market valuations

The initial market response was positive, given the surprisingly good (from the market’s point of view) outcome. But these moves were quickly offset by shifts in the pricing of the US interest rate cycle, a reminder that South African investments are and will always be subject to global developments.

The full Budget Review is a 277-page document, and one can easily get lost in the sea of numbers, ratios, projections, and assumptions. The bottom line is that South Africa needs faster economic growth to ensure long-term fiscal sustainability. Several reforms have been implemented to address the big constraints on economic growth, but these will take time to bear fruit.

In the meantime, though, South Africa cannot wait for faster growth to arrive, because the government’s interest bill would balloon to excessive levels. Hence the focus on fiscal consolidation, largely through spending discipline (helped along by the GFECRA windfall).

A rerating in the bond market (a decline in yields relative to our peer group) and an upgrade in sovereign credit ratings from the likes of Moody’s will probably have to wait until there is evidence that these fiscal targets are actually achieved and that the growth-enhancing reforms are bearing fruit. Nonetheless, the combination of prudent fiscal policy and monetary policy (a conservative central bank committed to its inflation target) continues to provide a strong anchor to bond market valuations.

Izak Odendaal is Old Mutual Wealth’s chief investment strategist.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.