The Financial Sector Conduct Authority has urged the public to treat with suspicion any approach by individuals or entities claiming to represent the FSCA or an authorised financial services provider – particularly when these approaches are made on social media platforms.

“Members of the public must be extremely cautious and verify the legitimacy of any financial services provider before parting with their money,” the FSCA says. “Authorisation status can be checked via the FSCA website or by contacting the Authority directly.”

In an alert issued this week, the FSCA highlighted growing concerns about impersonators who fraudulently use the Authority’s name, logo, and staff details, and present fake FSCA certificates to gain the public’s trust and solicit funds under false pretences. These impersonators pretend to “assist” with recovering funds lost through trading in financial products, including crypto assets, or reclaim money from failed investments.

“The impersonators are not authorised in terms of any financial sector law to provide financial services,” the FSCA said. “The FSCA has no association whatsoever with these individuals or entities.”

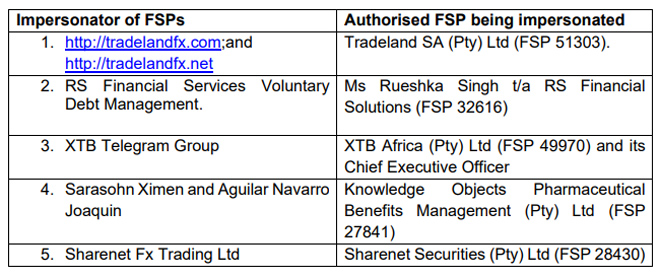

The FSCA also cautioned against scammers impersonating licensed FSPs by misusing legitimate FSP numbers and the personal information of registered staff or directors to appear credible. These tactics are commonly used to lure unsuspecting investors into depositing funds, often with “promises” of high or guaranteed returns.

Several individuals and entities have denied any association with the impersonators, whose details the FSCA has listed in its warning notice. Despite repeated attempts, the regulator has been unable to contact the named impersonators.

The FSCA urges the public to verify the legitimacy of any individual or company claiming to be linked with the FSCA or an authorised FSP, particularly when approached on social media platforms, including WhatsApp, Instagram, Telegram, and TikTok.

Any suspicious activity should be reported directly to the FSCA.

Impersonators of the FSCA include Geronimo, Audacity Capital, and Sarasohn Ximen and Aguilar Navarro Joaquin.

List of unauthorised persons/entities posing as FSPs

The FSCA has also warned against a range of other entities and individuals who are unlawfully offering financial services to the public. Some of these operate through platforms such as Telegram, TikTok, Facebook, and WhatsApp, “promising” high investment returns or offering trading signals – services which, by law, require FSP licences.

The following individuals and entities are not authorised to provide any financial services in South Africa:

- Austin Lee and Alpha Forex (Pty) Ltd

- TFE Elitment

- Lesego_dax

- Bestgradeoptions

- Umcebo the Legacy

- com

- net

- Mr Thokozane Nhlapo

- CMC Trading

- FX-Digital

- Binelite Pro

- Coinskillshub

- AGX Zen

- Binary Options Investment and Ms Caroline Mthethwa

- Alpha Wave Pro, Mr Andrew Carter and Mr Greg Lautman

- Immediate Edge / Edge Finance Ltd and Mr Isaac Cohen

- Titanstrades and Mr Craig O’Neil

- Zakes NAS100 and Forex Knights

- Start Capital

- Mr Trevor Cele

- Ms Puleng P Mariri

- Instaforex

Warnings about specific individuals and schemes

- Forex Venus SA and Ofentse Maluleke: Recruiting investors via Facebook, they promise unrealistic returns and offer trading services and signals without being licensed.

- Neo Forex Institute: Allegedly using Instagram and Telegram to sell forex signals, the entity has received multiple complaints. The FSCA confirms that providing such signals constitutes a financial service requiring authorisation under the FAIS Act.

- Fake BDSWISS representatives on Telegram: Fraudsters falsely claiming to be associated with BDSWISS Markets SA (FSP number 49479) are soliciting investments with promises of 100% guaranteed returns. BDSWISS has confirmed it does not conduct business through Telegram and is not linked to these individuals.

- Ghost Father of Forex and Zaahir Witbooi: Using TikTok to attract investors, these individuals promise unrealistic returns on investments. Neither is licensed to provide financial services.

- Jim Jackson and TradonaFXOnline: Allegedly operating through WhatsApp, Jackson is reported to be offering cryptocurrency investments with “guaranteed” returns of up to 3 150%. Investors are reportedly required to make additional payments before any funds are released.

Advisory to the public

The public should not accept financial advice, assistance, or investment offers from individuals or entities not authorised by the FSCA. Authorised financial services providers must clearly display their authorisation status in their documentation. If this is not present, it is advised to further investigate before making any payments.

To avoid financial fraud, individuals should always confirm whether an FSP is registered by checking the FSCA’s database.

Members of the public should always check the following:

- That an entity or individual is authorised by the FSCA to provide financial products and services, including for providing recommendations about how to invest.

- The category of advice the person is registered to provide, because there are instances where companies or people are registered to provide basic advice for a low-risk product but advice on far more complex and risky products.

- That the FSP number used by the entity or individual offering financial services matches the name of the FSP on the FSCA’s database.

You can check whether an entity or person is authorised to provide financial products and services by:

- Phoning 0800 110 443 (toll-free)

- Conducting an online search for an authorised financial institution by licence category: https://www.fsca.co.za/Regulated%20Entities/Pages/List-Regulated-Entities-Persons.aspx

- Conducting an online search for a financial institution that is an authorised FSP: https://www.fsca.co.za/Fais/Search_FSP.htm

I was scammed almost $6000 about R110,000 by people impersonating BDSWISS South Africa. Irene Kanyamaure is still in SOUTH AFRICA why can’t she be traced to account for our lost monies.