The Council for Medical Schemes (CMS) has advised schemes to limit their contribution increases for 2024 to 5% plus “reasonable” utilisation estimates, to protect members from further financial distress and the risk of losing their health insurance.

Once estimates of members’ utilisation of healthcare services are factored in, it can be assumed that contribution increases will be above 8% (see below for an explanation).

The CMS on Friday released a circular that discusses the factors the regulator will consider when assessing schemes’ contribution increases and benefit changes for 2024.

The circular describes the outlook for the key macroeconomic indicators that will affect the medical schemes industry in 2024: global economic growth, the South African economy, interest rates, exchange rates, and employment. These factors directly and indirectly affect the affordability of contribution rates, the financial performance of schemes, the membership growth, and the industry’s long-term sustainability.

The CMS says the current macroeconomic environment is characterised by multi-year high interest rates because of stubbornly higher inflation and a volatile rand, surging energy prices, and lacklustre economic growth. As a result, most household budgets will remain constrained for the foreseeable future, leaving most consumers in a precarious financial position.

The circular then discusses the key industry-specific factors the CMS will consider when assessing the appropriateness of benefit changes, contribution rate increases, and overall cost increase assumptions for 2024 year. These are:

- the expectations for inflation;

- the rate of medical scheme contribution increases relative to consumer inflation;

- headline inflation relative to medical and health insurance inflation; and

- healthcare utilisation assumptions.

Schemes must justify increases above the guideline limit

Headline inflation, as measured by the Consumer Price Index (CPI), is expected to average 5% in 2024, before moderating to 4.5% in 2025, according to the statement issued in July by the Monetary Policy Committee of the South African Reserve Bank (Sarb).

The CMS uses CPI as a proxy measure for the affordability of annual contribution increases.

The CMS says its recommended contribution increase of 5% plus a reasonably assumed utilisation factor is in line with the Sarb’s CPI forecast.

“It is CMS’s position that the annual industry price inflation assumptions must be anchored firmly in line with the CPI forecast of the Sarb. Persistently and stubbornly above-inflationary annual contribution increases are simply above the budget line for most members of medical schemes. High medical schemes contribution rates create a barrier to entry for potential new entrants to the private healthcare industry,” the circular says.

“While recognising the importance of pricing models that prioritise the interests of members, the CMS acknowledges that some medical schemes may find it necessary to implement contribution increases that exceed the CMS’s recommended increments linked to the CPI. The aforementioned circumstances can be attributed to industry-specific cost-push factors encompassing various elements, such as the burden of diseases, unfavourable demographic profile, and the repercussions of a depreciated rand exchange rate.”

In such cases, the circular says, boards of trustees must provide the registrar with a comprehensive business plan justifying the proposed above-inflation contribution increases. The business plan must comply with the requirements of Advisory Practice Note (APN 303) on the adequacy of contribution increases, as prescribed by the Actuarial Society of South Africa.

Similarly, “to avoid isolated incidents of deliberate under-pricing by some medical schemes, to gain an unfair competitive edge in the market, which may pose an insolvency risk to a medical scheme”, boards that intend to implement contribution increases below CPI must also submit an independent actuarial evaluation in line with APN 303 to justify their pricing assumptions.

Pandemic-induced anomaly

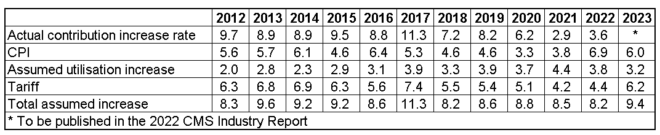

Over the past decade, medical schemes’ contribution increases have consistently surpassed CPI, except in 2021 and 2022, the CMS says.

The below-inflation contribution increases implemented in the past two years were mainly because of a collaborative effort by the CMS and the industry aimed at insulating members from the adverse economic climate in the aftermath of the Covid-19 pandemic.

In 2020, medical and health insurance inflation outpaced headline inflation, before falling sharply below CPI during the peak of the pandemic. The two rates remained below CPI for the rest of 2022, before starting to normalise and accelerate again in the first six months of 2023, the circular says.

Factor in utilisation costs

The circular says there was a significant decrease in the utilisation of healthcare services in the aftermath of the pandemic. Emerging trends point to a return to pre-pandemic behaviour, but there is still a high degree of uncertainty about post-Covid utilisation. Therefore, medical schemes must assume reasonable utilisation estimates for 2024 based on historical pre-pandemic utilisation data, a scheme’s current demographic profile, and more recent actual claims data.

The CMS’s analysis of cost increase assumptions for 2023 shows that the combination of demographic and utilisation factors are projected to add about 3.2 percentage points to the total cost increases for medical schemes. This projection is lower than the 3.8 percentage points estimated for 2022.

The CMS says it remains concerned that the utilisation estimates submitted by schemes do not always correlate with the changes in their demographic and risk profiles.

Fewer, not more benefit options

The CMS says it will consider applications for the registration of new benefit options only in exceptional circumstances.

According to the circular, the Health Market Inquiry found that the high number of benefit options and complex benefit design have an adverse effect on consumers and competition in the market. Consequently, the industry must continue to review its benefit options and consolidate or terminate options that are not sustainable in terms of both membership and financial performance.

“At the core of the medical scheme’s business plan must be the need to improve risk pooling, cross-subsidisation, and affordability, while simultaneously offering members quality healthcare services, including investing in preventative care initiatives, provider networks, and virtual care benefits. The delivery model must be premised on the principles of strategic purchasing of healthcare through value-based contracting with cost-efficient providers,” the CMS says.

The CMS says schemes with sufficient economies of scale should continue using their strategic purchasing to ensure value-based contracting with providers and pass on some of the efficiency gains to their members.

It recommends that increases in non-healthcare expenditure for 2024 must also be adjusted in line with CPI.

Medical schemes have until 1 September to submit their applications for the new benefit options and efficiency discounted options they propose to implement from 1 January 2024. The deadline to submit applications for contribution and benefit changes is 1 October.

Good Day,

Please can i get more info and rates on all the Comprehensive plans. I see that the Classic Smart Comprehensive is excluded in the 11.9% increase.

Will there still be 5 Comprehensive plans to chose from?

Thanks

Natasha

Good day,

According to information provided to Moonstone by Discovery Health Medical Scheme, the Classic Smart Comprehensive has been redesigned for 2024.

The Classic Delta Comprehensive, Essential Comprehensive and Essential Delta Comprehensive benefit options will be consolidated into the Classic Comprehensive and Classic Smart Comprehensive benefit options in 2024.

So no, it seems going forward there are only two Comprehensive plans to choose from.

As to the increase, for the “redesigned” Classic Smart Comprehensive, that too is 11.9% (from R5 441 to R6 088 for the main member only). I hope this helps! See the following article for further explanation, specifically on the increases to the Saver plans.

https://www.moonstone.co.za/discovery-healths-2024-contribution-increases-await-green-light-from-cms/

Good afternoon,

I struggeling to get information regarding increase limits. Is a pensioner is on Myfed, which works on income scale, can the medical aid change the fees with almost 80%?

Pensioner paid R2200pm.

January medical aid increased her contribution to R3400 without notification, and deducted a further R750. The total being R4150?

Is there some sort of law that thwy must inform you in order to make an informed decision?