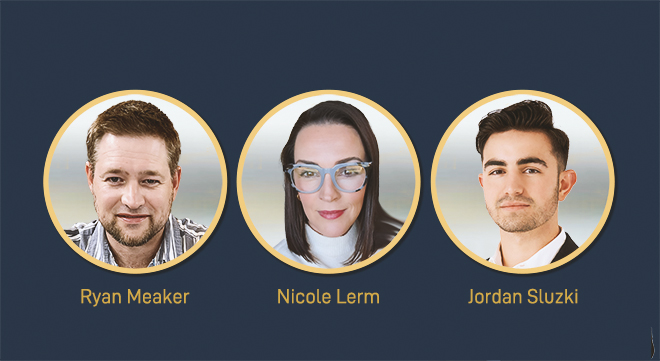

Diverse careers, different life stages, one common achievement: top marks in MBSE’s Advanced Certificate in Financial Planning (ACFP).

From a long-time director in shipbuilding and oil & gas, to a 40-year-old career-changer, to a junior adviser already applying financial concepts daily, these achievers show how the ACFP equips professionals with practical knowledge, confidence, and a roadmap toward the FINANCIAL SERVICES ADVISOR® (FSA®) and CFP® designations.

Laying a foundation for a new challenge

Ryan Meaker, 40, works at Mercy Ships International, having spent nearly two decades in shipbuilding and ship repair industries in roles ranging from director to consultant. After studying industrial engineering and moving from the automotive sector to oil & gas in Cape Town, he was ready for a new challenge.

“Because I have been either a CFO or an FD, many people will be surprised that I actually studied industrial engineering,” he says.

Ryan’s decision to pursue the ACFP was triggered by an opportunity to buy a family business, for which the qualification was required. Moonstone, acting as compliance officers for the business, made the institution a natural choice.

“My hope was also that I would gain knowledge that I could apply to my own financial planning,” he adds. “My initial expectations were that I would become equipped with the knowledge to confidently and professionally render personal financial services to high-net-worth individuals with complex income and wealth structures – and the qualification has provided a great foundation for this.”

Ryan cites the Capital Needs Analysis process as particularly eye-opening.

“It highlights how the buying power of money is eroded by inflation and how aggressive retirement contributions and planning need to be. It really brings into focus just how few people in South Africa will truly be able to retire within their expectations.”

Balancing study with life’s demands proved challenging, especially with a newborn during his first semester.

“My wife took many night shifts with the little one to let me study, which was hugely helpful.”

He adds that the Case Study exam was interesting “because it applied nearly the entire syllabus in one exam.”

He also found WhatsApp access to lecturers and mock exams invaluable.

For Ryan, the real impact is on future financial planning.

“The additional knowledge regarding retirement and estate planning has altered the way I consider future investments or expenditures personally. I will also ensure our future business offers even more retirement benefits and planning education to staff.”

He sees the ACFP as a steppingstone to pursuing CFP® accreditation should he enter financial services.

Reinventing a career later in life

Nicole Lerm, 42, works as a Partner Assistant at Adviceworx, supporting financial advisers behind the scenes while building practical knowledge. Her path into finance was unconventional: she previously owned a health store, which closed during the Covid-19 pandemic.

“At the age of 40, I decided to change my career entirely and pursue studies in finance,” she recalls. “Starting over later in life became a powerful motivator. The combination of real-world business experience and returning to study gave me focus, resilience, and a renewed sense of purpose.”

Nicole’s decision to pursue the ACFP was driven by the need to build a strong, credible foundation in finance.

“The timing felt right because I was clear about my goals and fully committed to this new career direction. With prior business experience and a renewed focus on learning, I approached the ACFP with maturity, discipline, and purpose.”

While she expected the programme to be challenging, the reality exceeded her expectations.

“The modules were very well structured and offered a diverse range of information that was both relevant and practical. Studying online allowed me to balance work and learning effectively.”

Estate planning stood out as a pivotal module.

“It highlighted the importance of obtaining accurate, comprehensive information from clients and reinforced the need to prepare a fully holistic financial plan. It shifted the way I view my role – not just as someone working with numbers, but as someone responsible for helping clients protect their legacy and make informed long-term decisions.”

Nicole credits MBSE’s lecturers, mock assessments, and structured support with helping her overcome the toughest aspects, particularly mastering calculations and self-discipline in online learning.

While not yet applying content directly to client-facing decisions, she has already adjusted how she views the financial planning process.

“One key takeaway has been the importance of maintaining consistent communication with clients and understanding the legal requirements involved. The course reinforced how staying informed builds trust and supports a strong, long-term client–adviser partnership.”

The programme has given Nicole confidence, a clearer roadmap for her career, and the motivation to progress to postgraduate studies.

“Balancing work, family, and study can be challenging, but the effort is truly worth it. The programme offers practical skills you can apply in the real world and the confidence to grow in your career,” she advises.

Building technical depth from day one

Jordan Sluzki, 23, works at MoneyDoc (Pty) Ltd in the client advisory and cross-border FX division. His journey has always blended entrepreneurship, financial services, and a drive to understand how money moves in the real world.

“I chose the ACFP because I reached a point where I wanted to strengthen the technical foundation behind the work I was already doing. My career responsibilities were growing, and this qualification would give me the depth and credibility to match that growth,” he explains.

Jordan was struck by how practical and immediately applicable the programme was.

“The ACFP pushed me to think more critically about client outcomes, risk, ethics, and strategic planning. Instead of feeling theoretical, the content connected directly to the situations I encounter at MoneyDoc, which made the workload meaningful rather than overwhelming.”

Modules on advice processes, ethics, and client-centred planning were pivotal.

“Understanding how behavioural finance and structured decision-making shape real client outcomes changed how I approach every interaction. Financial planning is not only about numbers but also about clarity, trust, and guiding clients in moments where emotions often run high.”

The toughest challenge was balancing full-time work with online study.

“The volume of content can feel overwhelming if you fall behind even slightly. I overcame it by building a non-negotiable study routine, breaking the work into manageable chunks. Discipline became more important than motivation.”

MBSE’s lecturer guidance, mock assessments, and the ability to revisit recorded sessions made a tangible difference.

Jordan also applied learnings directly at MoneyDoc, improving risk management, compliance frameworks, and client processes.

“The qualification strengthened my practical understanding of regulatory requirements and helped me build more robust and compliant internal processes.”

Jordan describes his personal growth as significant.

“The ACFP gave me a new level of confidence, not just in what I know but in how I think. It sharpened my analytical ability, deepened my understanding of the financial planning landscape, and helped me communicate complex concepts more clearly to clients.”

He now plans to pursue a Category II Key Individual designation.

Shared lessons from three different paths

Across these diverse journeys, a few themes emerge. The ACFP is demanding, particularly when combined with professional and personal responsibilities, but MBSE’s structured support, clear guidance, and practical content help students succeed. Each achiever highlights the importance of discipline, consistent study, and leveraging both internal motivation and peer support.

Ryan, Nicole, and Jordan all emphasise that the qualification goes beyond technical mastery: it reshapes thinking, builds confidence, and provides a framework for professional decision-making that can be applied immediately or in future roles.

Their advice to future students is: start early, commit fully, break work into manageable chunks, and use the support available.

As Nicole summarises: “Believe in your ability! The road will have challenges, but each step will teach you something valuable. Embrace every lesson, stay curious, and let this journey show you that dedication, perseverance, and passion can truly transform your future – not just for you, but for those who look up to you.”

Expanding qualifications for a changing world

MBSE offers six accredited qualifications, ranging from entry-level certificates to advanced postgraduate studies:

Postgraduate Diploma in Financial Planning (NQF 8)

BCom Financial Management (NQF 7)

Advanced Certificate in Financial Planning (NQF 6)

Occupational Certificate: Compliance Officer (NQF 6)

Higher Certificate in Wealth Management (NQF 5)

Higher Certificate in Short-term Insurance (NQF 5)

Registrations for 2026 are open

Visit www.mbse.ac.za to learn more and secure your place for the 2026 academic year.

For more information, contact MBSE at help@mbse.ac.za.