The government is upbeat about tax collections for the current fiscal year, but things are not as rosy over the medium term.

Several risks continue to loom on the horizon for South Africa’s fiscal outlook, including volatility in gross tax revenue, weaker-than-expected global and domestic economic growth, and the financial health of state-owned enterprises.

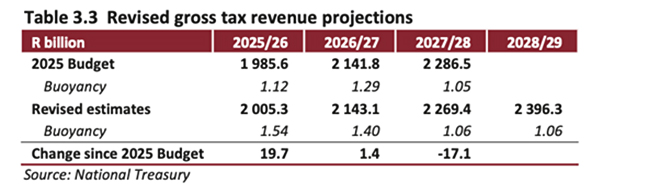

Finance Minister Enoch Godongwana revised the gross tax revenue estimate for 2025/26 by R19.7 billion. However, gross revenue is expected to fall short of the 2025 Budget estimates by R15.7bn for 2026 and 2027.

“Improved tax revenues will require more sustainable economic growth and further gains in tax compliance and administration,” National Treasury noted in the Medium-Term Budget Policy Statement (MTBPS).

The South African Revenue Service collected net revenue of R924.7bn by the end of September, and paid refunds of more than R230bn. This marks year-on-year growth of R78.6bn.

Promising trajectory

SARS Commissioner Edward Kieswetter said in a statement following the tabling of the MTBPS that the overrun of R18bn against the printed estimates indicated a “promising trajectory” for the second half of the fiscal year.

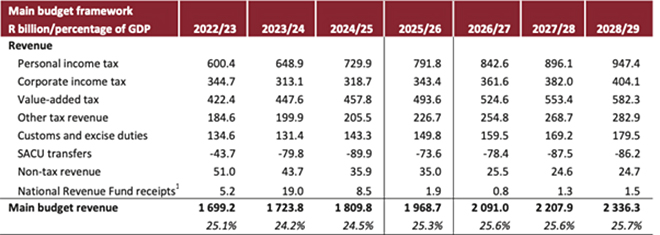

Revenue collection to the end of September has demonstrated resilience across the major tax categories. Value-added tax collections grew by 7.8% in response to resilient household consumption. Weaker economic activity and stronger enforcement to stop fraudulent claims resulted in a slowdown in VAT refunds.

Corporate and dividend tax collections benefited from strong collections in the trade, electricity, and finance sectors, boosted by large once-off dividends tax collections in mining and retail.

Fuel levy collections are estimated to improve in 2025/26 following the sharp contraction in demand in 2024/25, alongside large diesel refund claims settlements.

Government debt

Treasury notes that gross loan debt is expected to increase from R6.07 trillion in 2025/26 to R6.99 trillion in 2028/29, driven by the budget deficit and fluctuations in interest, inflation, and exchange rates. It seems that gross loan debt as a share of GDP may stabilise at just below 80% next year.

Debt-service costs in the current year will be R4.8bn lower than estimated in the 2025 Budget, supported by lower interest rates, lower inflation, and a stronger currency.

Ratings agency S&P Global on Friday raised its foreign currency long-term sovereign credit rating on South Africa to BB from BB- and its local currency long-term sovereign credit rating to BB+ from BB. The outlook is positive.

The upgrade reflects South Africa’s improving growth and fiscal trajectory, alongside the reduction in contingent liabilities largely tied to performance improvements at Eskom, the agency said. This is South Africa’s first upgrade in 20 years.

Taxpayer debt

The additional R4bn allocated to SARS in the 2025 Budget was intended in part to increase debt collection by R20bn to R50bn a year. SARS data for the first six months of the current tax year shows that debt collections remain below estimates.

SARS has obtained additional skills to address complex cases, which should improve collections for the rest of this year. Kieswetter says SARS has collected about R57bn of outstanding debt until October.

“The universe of debt is more complex, and the initial collections that simply required a phone call now require tougher engagements, such as civil judgments, letters of demand, and threats to attach assets to secure debt,” Kieswetter remarked.

SARS has seen an increase of 35% in civil judgments. It has more than 80 “higher skilled” debt collectors, which will soon be increased to 250. This will include litigation attorneys who can deal with letters of execution and more complex cases.

Illicit economy

Another battle facing South Africa is the massive increase in the illicit economy.

Kieswetter noted that the illicit economy was estimated to account for about 4% of the country’s GDP in 1994.

“This figure is now reported by various studies, to have grown to a staggering figure of between 10% and 15% of GDP in 2024. This is an unacceptably high level in our national economy and must be met with swift and determined efforts to reverse its impact,” he says. The illicit activities in tobacco and cigarettes, alcohol, fuel and fuel adulteration, counterfeiting, illegal mining, and the smuggling of gold and other minerals are a stark expression of this phenomenon.

According to Godongwana, illicit trade threatens the economy, endangers consumers, and robs the fiscus of billions in revenue. “Each year, billions of rands in taxes go uncollected, funds that could have closed our revenue gap and avoided tax increases entirely.”

The clamp-down on cigarette and alcohol sales during the Covid-19 pandemic led to a loss of about R40bn in excise revenue to the cigarette black market.

“The same is true for illicit alcohol and fuel,” Godongwana noted.

In the past six months, SARS suspended three licences for non-compliant tobacco production.

The Financial Intelligence Centre has provided intelligence reports to SARS to assist in investigations of criminal syndicates. Together, they have identified illicit markets in tobacco, precious metals, and fuel, as well as procurement fraud.

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law, and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.