If it feels like the rules of retirement savings keep changing under your feet, you’re spot on. Over the past 10 years, South Africa’s retirement sector has seen a whirlwind of new regulations – with more still to come. What do these shifts mean for the industry, and for the consultants tasked with steering members through the maze?

At the recent Employee Benefits and Health Masterclass, hosted by the Financial Planning Institute of Southern Africa, Chris Basson, manager in the group savings and investments team at Allan Gray, unpacked the latest industry-wide changes and their ripple effects on advisers and consultants.

He also shed light on the steady shift from standalone retirement funds to umbrella funds, outlining what employers consider when weighing their options and the key factors that guide decisions when selecting a new fund.

The milestones tell the story. In 2016, tax harmonisation aligned pension, provident, and retirement annuity funds under the same framework, simplifying the system and encouraging preservation. A year later, the default regulations introduced default investment portfolios, preservation strategies, and annuity options at retirement. By 2021, T-Day brought provident funds in line with pension funds, introducing annuitisation rules that required members to secure an income in retirement. Most recently, in 2024, the two-pot system split contributions into a savings component for limited withdrawals and a retirement component preserved for long-term income.

These headline reforms have been accompanied by sweeping structural changes. Oversight has shifted to the FSCA and Prudential Authority under Twin Peaks regulation, while governance, treating customers fairly, and trustee training have moved centre stage. Auditor reporting standards have been updated, and Regulation 28 was broadened to encourage infrastructure investment and permit hedge funds. At the same time, the FSCA has pushed for better member communication, greater digital engagement, and umbrella fund consolidation.

And the reform train isn’t slowing down. The FSCA’s 2025–2028 Regulation Plan promises new standards for fund liquidations, administrators, financial reporting, unclaimed assets, and the transition to the upcoming Conduct of Financial Institutions (COFI) Act.

For members, this creates a more structured – but also more complex – retirement landscape. Basson summed it up simply: “At the point of retirement, after the two-pot system and harmonisation, there is a lot more complexity, and that creates an opportunity. The need for advice is just so much higher now than it was 10 years ago.”

Advisers under pressure – but also in demand

This rising complexity has major implications for advisers and consultants. Basson explained that advisers are facing a mix of new responsibilities, fresh risks, and real opportunities.

Clients now expect far more rigorous due diligence. It’s no longer enough to tick boxes on broad fund terms – advisers must dig deeper into governance frameworks, ESG policies, and fee structures.

“It’s not just about the broad terms anymore,” Basson emphasised. “Advisers need to understand the different fee elements and what this means for members’ long-term returns.”

But he warned that cost alone can be misleading. A fund that seems attractively priced upfront may turn into a costly mistake if its economic model is not sustainable. Advisers, he argued, must take a longer-term view.

Greater responsibility also comes with risk. Advisers may face exposure if the funds they recommend run into governance failures, or if they push clients towards umbrella funds without properly considering fit. Not every employer belongs in an umbrella fund, and adopting a one-size-fits-all approach could backfire.

Still, Basson adds that the opportunities are just as strong as the risks. Advisers who develop specialist expertise – benchmarking governance frameworks, sharpening client segmentation, and matching solutions to employer size, complexity, and even culture – will stand out.

Shift away from standalone funds

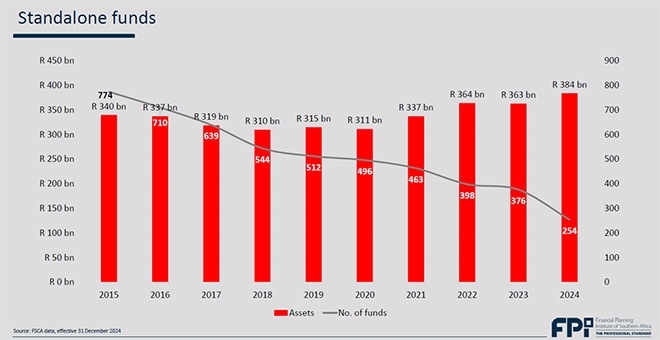

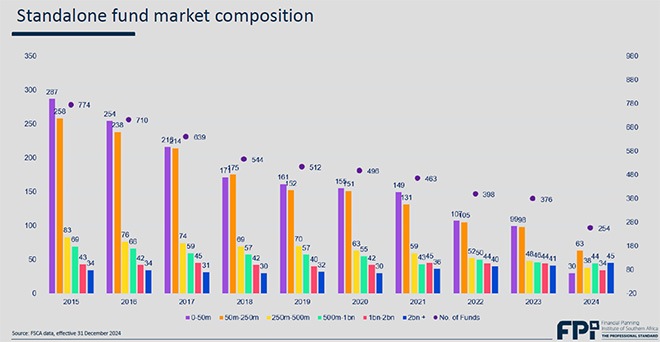

The retirement fund market has been reshaped by consolidation. Data from the FSCA shows the number of standalone funds – where employers run their own schemes with their own board of trustees – has collapsed from 774 in 2015 to just 254 by the end of 2024. Although assets in these funds have largely stabilised, the overall trend shows that employers are moving into umbrella funds.

Much of the consolidation has come from smaller standalone funds. As Basson noted: “I think it’s harder for smaller funds with the changes in legislation, the increased cost for these funds to actually sustainably run at a smaller size.”

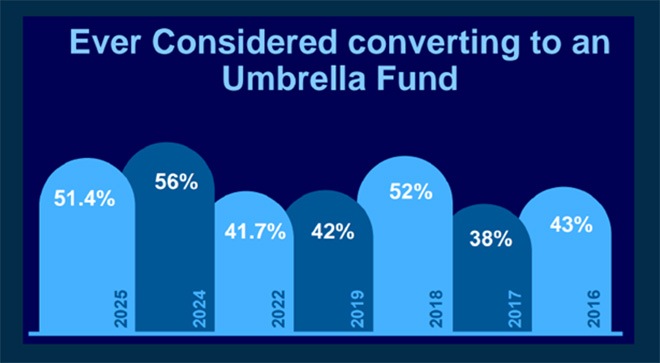

The most recent Sanlam Benchmark Survey confirms this shift in sentiment. In 2016, 43% of standalone funds said they had considered moving to an umbrella arrangement. By 2024, that figure had climbed to 51.4%.

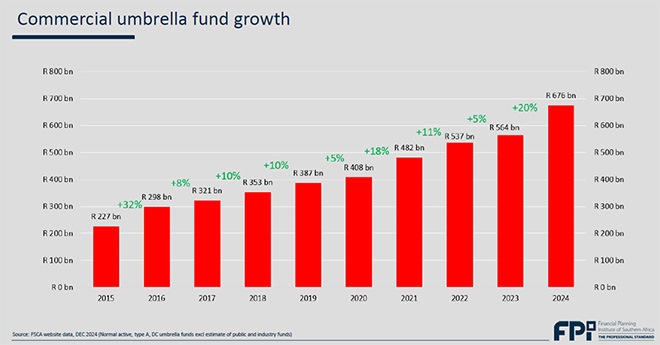

The result? A booming umbrella fund market. Commercial umbrella fund assets alone have nearly tripled, from R227 billion in 2015 to R676bn in 2024.

Umbrella vs standalone: what employers really look at

What is driving employers’ decisions to switch? Basson explained that the comparison between standalone and umbrella funds usually centres on structure, governance, control, cost, compliance, risk, and portability.

Standalone funds give employers full control: they choose their investment strategies, service providers, and fund rules. But they also carry heavy governance responsibilities. Employers must appoint trustees – often employees who take on personal legal liability – and meet growing regulatory demands. For many, the attraction of umbrella funds is the ability to outsource that governance burden to a professional board of trustees.

Cost is another major consideration. Standalone funds are expensive to run, thanks to bespoke administration and compliance requirements. Umbrella funds benefit from economies of scale, which makes them significantly more cost-efficient. They also lift the weight of compliance and regulatory reporting off the employer’s shoulders.

Risk exposure is markedly different too. Employers in standalone funds face greater fiduciary and governance risk, while umbrella funds centralise oversight and spread that responsibility.

Historically, umbrella funds were seen as inflexible. But Basson said this perception is changing fast: “With increased competition in the umbrella fund market, a lot more providers are actually offering that flexibility, and there’s a lot of customisation that employers can do when moving into the umbrella fund environment.”

In short, large employers with governance capacity and a need for customisation may still favour standalone funds. But for SMEs, or for those seeking simplicity, cost savings, and reduced governance risk, umbrella funds are increasingly the logical choice.

What drives the choice of a new fund?

Even once employers have decided to move, the choice of a new fund involves tough evaluation. Basson said the three issues that dominate discussions are investment performance, costs, and service levels.

Poor investment performance – or limited choice of investments – can quickly prompt employers to look elsewhere. So too can costs, whether in the form of administration fees, investment management charges, or group risk premiums.

“We think we’re paying too much for our overall fund solution,” is a common refrain Basson hears.

Service, while harder to quantify, is equally critical. Employers want confidence that turnaround times, administration systems, and member support will at least match, if not exceed, current standards.

Beyond these, employers are asking tougher questions than ever. Are providers keeping pace with regulatory changes? Do they have strong governance frameworks and skilled teams in place? Are they investing in digital tools, member education, and management committee engagement? How comprehensive is their reporting? How reliable are their systems?

As Basson summed it up: “A lot of different things that employers and consultants use to assess in which direction they want to take their company’s retirement solution.”