Life insurers continued to deliver on their promise in 2024, paying out R39.5 billion in death benefits and settling more than 95% of valid claims – a track record that has remained steady for four years.

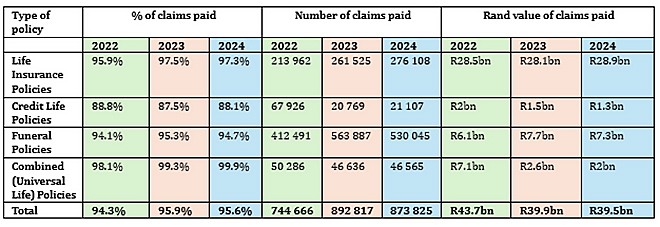

Figures from the Association for Savings and Investment South Africa’s annual death claims payout statistics show that members paid 873 825 death claims last year – 95.6% of all claims received. The total number of death claims processed was 914 258, with 40 433 declined because of fraud and dishonesty, or contractual exclusions, including suicide within the first two years of the policy’s inception.

Gareth Friedlander, a member of ASISA’s Life and Risk Board Committee, said claims are declined only if there is clear evidence of a crime, the benefit definition is not met, an exclusion applies, or fraud or intentional dishonesty is detected. This could include withholding material information about a medical condition or lifestyle when applying for cover.

“This highlights the importance of being honest with the life insurer when taking out a life or funeral policy,” says Friedlander.

“Life companies exist primarily to provide consumers with the option of insuring themselves and their loved ones against the financial impact of an event like death, disability, or critical illness. Policyholders and their beneficiaries should be able to trust that their policies will pay when a life-changing event occurs.”

ASISA began publishing claims payout statistics for fully underwritten life policies in 2013. In 2021, the data was expanded to include partially underwritten and funeral policies, offering a more complete picture of the sector’s reliability.

ASISA claims payout statistics

Life insurance policies – including older universal life products – recorded the highest payout rates in 2024: 97.3% for life policies and a near-perfect 99.9% for universal life policies. Friedlander said these policies typically involve risk screening, such as health checks and lifestyle assessments, which significantly reduce fraud and non-disclosure. The underwriting process is rigorous because they can provide cover worth millions of rand.

Funeral insurance, which provides faster, simpler payouts without medical exams, had a still-impressive 94.7% payout rate in 2024.

Because there are no underwriting requirements for funeral insurance, some people try to take funeral cover only once they have developed a serious illness and are expecting to die as a result. To counter this, policies usually impose a six-month waiting period for natural deaths.

Credit life insurance, which settles debt such mortgages or car loans if the policyholder dies, recorded an 88.1% payout rate in 2024.

The payout by a credit life insurance policy decreases as the outstanding loan amount decreases, and once the debt has been repaid, the cover ends. Since premiums are worked into the monthly loan repayment, a default on the repayment also means that no premiums are paid to the life insurer, and the cover therefore lapses.

Declines were mostly because of lapsed cover from unpaid premiums or because the debt had already been repaid.

With life insurance payout rates holding steady at 94% to 96% since 2021, ASISA says policyholders who are truthful during the application process and keep their policies active can expect their claims to be honoured.

ASISA notes that because applicants know more about their own health and lifestyle risks than insurers, the law requires them to disclose all relevant information that could influence policy terms or premiums. This ensures fair pricing and prevents healthier policyholders from subsidising higher-risk applicants.

Failing to disclose material information, or being dishonest during underwriting, allows insurers to reject claims and void policies – a move that could leave beneficiaries without the expected financial support.

Murder-for-insurance and estate fraud flagged as growing threats

South Africa’s life insurance industry is grappling with a rise in high-stakes crimes, including murder-for-payout schemes and deceased estate fraud, according to the latest ASISA Forensic Standing Committee statistics.

Read: Increase in cases of fraud and dishonesty detected by ASISA members

Of the 5 505 fraudulent and dishonest life insurance claims recorded in 2024, 38 involved policyholders being murdered for financial gain. ASISA has set up two working groups to reduce the risk of criminals taking out funeral policies with the intent to kill, while keeping the product accessible to genuine policyholders.

“While we can confidently say that criminals are highly unlikely to get away with this type of crime, the ultimate goal is to prevent someone from losing their life in the first place,” said committee convenor Jean van Niekerk. “Life companies pick up on this type of crime very quickly through their data-sharing initiatives, but the process of gathering evidence and building a case that will stand up in court is often slow.”

Deceased estate fraud is also on the rise, with reported cases tripling from 54 in 2023 to 161 in 2024. Syndicates have targeted grieving families by impersonating executors, forging documents, and opening fraudulent bank accounts in the names of estates. Van Niekerk said R220 million in potential losses was prevented last year thanks to early detection.