There has been a 50% increase in the number of employers that are in arrears with their retirement contributions since the Financial Sector Conduct Authority published its list of employers that were non-compliant at the end of December 2023.

The Authority said the increase was mainly because two large retirement funds, the Auto Workers Provident Fund (AWPF) and the Motor Industry Provident Fund (MIPF), have reported non-compliance by employers. Together, these funds account for 57.5% (3 353) of the 5 821 employers named in the latest list.

On Thursday, the FSCA issued its fourth communication providing the names of employers that were in contravention of section 13A of the Pension Funds Act at the end of March this year. These are employers that despite deducting contributions from their employees’ salaries, failed to pay those contributions over to the relevant retirement funds. Section 13A prescribes how the payment of contributions and other benefits should be made to a fund.

Retirement funds reported 15 521 delinquent employers to the FSCA at the end of March this year, compared with 7 770 at the end of December 2023.

Of those 15 521, the Authority has published the names of 5 821 entities because of “the severity and duration of their arrears”. In November last year, the FSCA published the names of 2 330 entities that were in arrears at the end of December 2023.

The Authority once again cautioned that at the time of publication, there might be instances where named employers have, in fact, paid over the outstanding contributions, because there is a delay between the reporting date (March 2025) and the date of publication (September 2025).

Read: Arrear contributions: FSCA publishes third list of defaulting employers

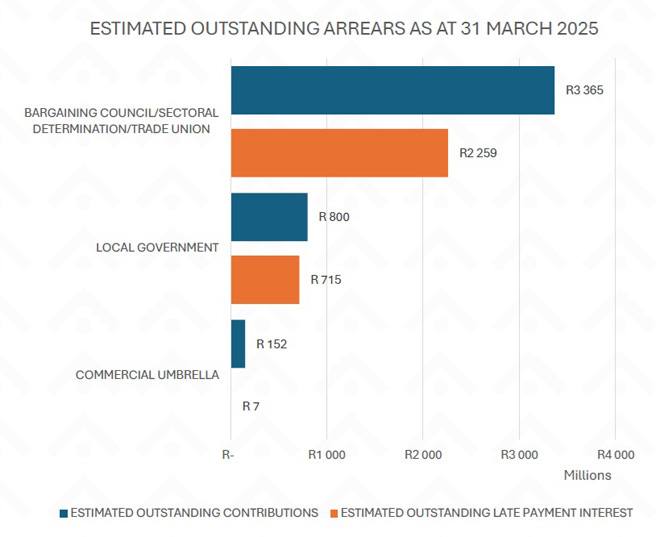

At the end of March, arrear contributions stood at R7.29 billion, compared with R5.2bn at the end of 2023. The R7.29bn comprises outstanding capital contributions of R4.31bn and R2.98bn in late payment interest (LPI).

The number of funds reporting non-compliance increased from 51 at the end of December to 67 at the end of March.

The arrear contributions affect 592 000 fund members, compared with 310 000 in December 2023.

According to the latest list:

- 5 671 employers have outstanding contributions exceeding R50 000, which have been overdue for five months or more.

- 80 employers have outstanding contributions exceeding R50 000, but the last contribution date has not been provided.

- 79 employers owe less than R50 000 in contributions, but outstanding LPI exceeds R50 000 and has been overdue for five months or more.

- 17 employers owe only outstanding LPI.

Sending a clear message

Commissioner Unathi Kamlana told a media briefing that although the FSCA does not have jurisdiction over employers – something it hopes will change once the Conduct of Financial Institutions Bill is enacted – the Authority publishes the lists as a tool to name and shame non-compliant entities, with the aim of protecting employees’ retirement savings, and by so doing, encourage accountability.

Deducting contributions from salaries but not remitting them to the relevant funds is a serious breach of fiduciary and ethical responsibility. Such conduct not only undermines employee trust, but may also amount to financial misconduct, which should attract severe consequences, Kamlana said.

“Our intention is therefore to send a very clear message: the practice of withholding employees’ pension contributions without remitting them to the respective funds will not be tolerated. By continuing to shine a spotlight on these practices, we aim to deter misconduct, safeguard workers’ futures, and reinforce confidence in the retirement system.

“While we acknowledge that some employers may be facing genuine financial hardship, this cannot and must not be used to justify the systemic failure to meet legal obligations,” he said.

Kamlana said there has been an improvement in compliance since the publication of the first list in 2023. A number of employers have reached out to their respective funds to make payment arrangements and, in some cases, to settle their standing contributions.

Deputy Commissioner Astrid Ludin said the FSCA has noticed an increase in funds adhering to their obligation to report non-compliant employers since the Authority published the first list of delinquent employers in August 2023, when 23 funds reported 5 430 employers that were in arrears at the end of April 2023.

She said the FSCA’s shining a spotlight on non-compliance has also put retirement funds under pressure to improve the quality of their data. For example, in the previous publication, the Private Security Sector Provident Fund (PSSPF) reported 531 employers as non-compliant, but 421 of those have been removed from the latest list.

The FSCA receives information from funds about arrear contributions every month, but it publishes the information only at certain intervals, to afford funds and employers an opportunity to implement measures to remedy the arrears, Ludin said.

A closer look at the numbers

The following information is based on the 15 521 employers reported to the Authority, not the 5 821 whose names were published.

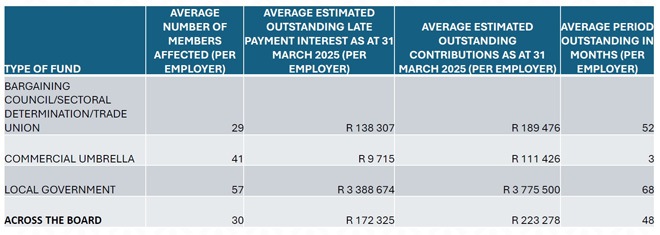

Most of the arrear contributions – R5.6bn – is owed to funds that fall under bargaining councils, sectoral determinations, or trade unions.

A bargaining council, a statutory body established under the Labour Relations Act, is formed by registered employers’ organisations and trade unions in a specific sector or industry. A sectoral determination is a legal instrument issued by the Minister of Employment and Labour under the Basic Conditions of Employment Act. A determination applies automatically to all employers and employees in a specific sector.

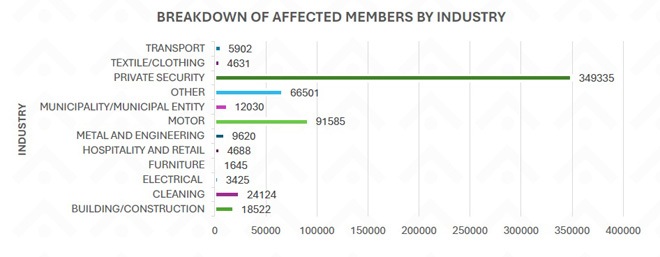

Arrears by industry

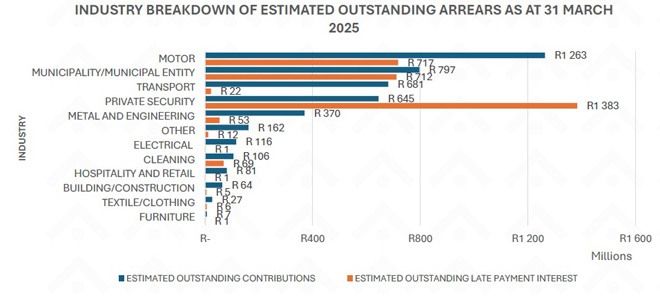

Of the total arrears of R7.29bn, 27% (R1.98bn) is owed to the AWPF and the MIPF, which are two of the five funds that comprise the Motor Industry Retirement Funds (MIRF), which is administered by the Motor Industry Fund Administrators.

The AWPF has 182 000 active contributing members in job grades 1 to 6 as at June 2025, and the MIPF has 53 000 in job grades 7 to 8, according to fact sheets published by MIRF.

Members of the Motor Industry Bargaining Council (MIBCO) are required to contribute to the MIRF, unless exemptions are granted. MIBCO represents employers and employees across sectors such as vehicle manufacturing, sales, aftermarket services, and related trades.

Keabetswe Tsuene, a specialist analyst in the FSCA’s Retirement Fund Conduct Supervision department, said the Authority has noted that where employers in the private security sector settle arrears, they often pay the capital portion only but not the LPI.

She said LPI should be treated as investment income, because it replaces, at least in part, the returns members have forfeited during the period the fund did not receive contributions.

Tsuene said the Authority has found that paying LPI creates something of “a stressful situation” for municipalities. This is because municipalities’ financial statements must categorise LPI as irregular or wasteful expenditure – they should not have incurred LPI in the first place.

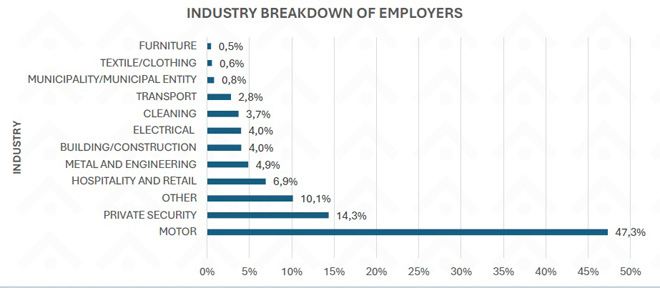

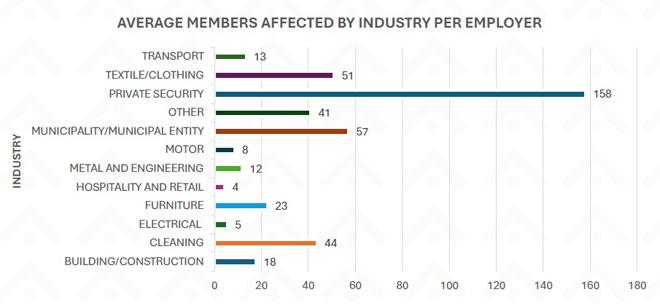

Sixty-two percent of the delinquent employers are in the motor industry (47.3%) and the private security sector (14.3%).

Tsuene said one of the reasons for the prevalence of arrears in the private security sector is that these entities often rely on contract work, and if they are not paid on time, it affects their cash flow.

She said a possible reason for the large-scale arrears in the motor industry is that employers that fall under a bargaining council (or a sectoral determination) are required to participate in a fund but might not be able to afford to pay the contribution rates.

However, there are some employers that are not going to pay, even if they can afford to do so.

Delinquent employers participating in corporate umbrella funds (10.1%) are classified as “other” because the FSCA does not currently have data on the industries in which they operate. As the quality of the data improves, the Authority will allocate employers to the relevant categories, Tsuene said. The “other” category also includes public sector employers – mainly provincial entities – that are not municipalities or local government entities.

Regarding the private security sector, the Tsuene said the FSCA has observed that the industry’s non-compliance is not limited to failing to pay retirement contributions. It is non-compliant with registering employees with the PSSPF and in not paying other employee benefits, such as medical scheme contributions.

Period outstanding

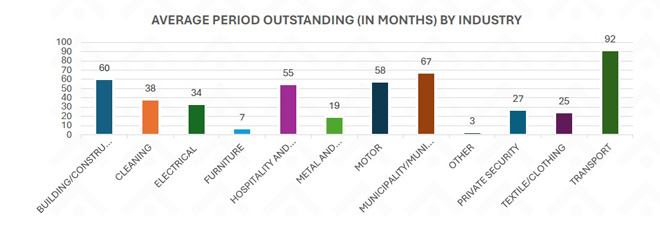

In terms of the periods over which contributions are in arrears, 43% are outstanding for up to 24 months (two years) – virtually unchanged from the end of 2023. In the local government sector, it is 67 months (almost six years), and the average across all sectors is 48 months (four years).

Tsuene said the FSCA does not, at this stage, have an explanation of why certain sectors are in arrears for longer than others.

Tsuene said one of the reasons for the longer average in the municipal sector is an issue that arose when one fund changed its contribution rate in 2006, but some employers did not adjust their contribution rates to the new rate. The fund has reported these municipalities as non-compliant because they are paying contributions at the incorrect rates.

In bargaining council funds, long-term arrears often arise because an employer registers with a fund – as it is required to do – but does not receive any business or trades for a short period. The employer fails to inform the fund that it does not have any employees, and the fund assumes the employer is simply not paying contributions.

Tsuene said this highlights that funds rely on receiving accurate employee information from employers when assessing whether they are owed contributions. If an employer does not provide a fund with an up-to-date schedule of the employees for whom it is paying contributions each month, the fund will conclude there is non-compliance. The fund will try to figure out how to calculate how much is outstanding, and for how long the contributions have been outstanding, based on the last schedule it received. She said it is very rare for an employer to provide an up-to-date schedule and not pay contributions. In most cases, funds that do not pay contributions do not provide a schedule.

Affected members

Of the 592 000 members affected by arrear contributions, 59% (349 335) are in the private security sector – mainly security officers.

Tsuene highlighted that the average period outstanding per employer in the commercial umbrella space is only three months. This is because, typically, if a participating employer is non-compliant for three months, the fund’s board of trustees will decide to terminate or liquidate that employer in the fund.

Downloads: funds and employers with arrear contributions

Click here to download the FSCA’s Communication 18 of 2025 (RF) and the accompanying annexures:

- Annexure A names the delinquent employers, as reported to the FSCA.

- Annexure B names employers that have settled in their arrears fully or partially (418), and those in voluntary termination/suspension/liquidation (34).

- Annexure C names 531 entities that were previously incorrectly listed as non-complaint. These entities were erroneously reported as owing contributions to the PSSPF, the Contract Cleaning National Provident Fund, and, in one instance, the Corporate Selection Umbrella Retirement Fund No. 2.