Bitcoin’s drop of more than 30% from a record high in October has most investors and market players questioning the future of Bitcoin and other cryptocurrencies. But what is really behind the crash?

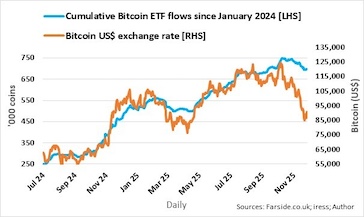

The peak-to-bottom drawdown of 32% in Bitcoin’s exchange rate or price in the current cycle is reminiscent of the 28% drawdown from January to April this year. Furthermore, the net outflow of 51 000 coins since ETF accumulation peaked in October is approaching the outflow of about 60 000 coins during the previous cycle (January to April).

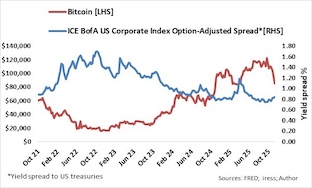

Bitcoin’s price is negatively correlated with the bond yield spread between the ICE BofA US Corporate index and US treasuries with similar durations, also known as investment grade credit spreads.

Rising credit spreads on a macro level typically indicate concerns about the outlook for the overall economy, while on a micro level, rising credit spreads could be company or industry specific, with investors demanding higher yields because of a company’s financial position and ability to service its financial obligations, specifically debt.

Bitcoin’s negative correlation with the ICE BofA US Corporate Index Option-Adjusted Spread means that historically Bitcoin’s exchange rate declined when corporate credit spreads increased and increased when credit spreads decreased. From the accompanying graph, it appears that Bitcoin’s drawdown since October is an overreaction to a slight increase (10 basis points) in corporate credit spreads.

However, my analysis indicates that the drawdown is justified.

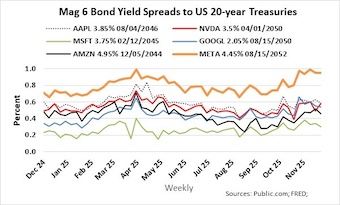

Although not technically perfect, because durations may differ, I calculated the yield spreads to 20-year US treasuries of listed bonds, with the closest duration to 20 years for the Magnificent Six (Apple, Nvidia, Microsoft, Alphabet (Google), Amazon, and Meta). Tesla, with energy operations bonds only, was excluded.

It is apparent that among the Magnificent Six, Microsoft has the lowest financial risk and Meta the highest.

The average yield spread of the Magnificent Six is currently 57 basis points, up from a low of 39 in August this year. Over the same period, Meta and Alphabet experienced the highest increases of 29 and 26 points, respectively, while Microsoft had the lowest increase of 12 basis points.

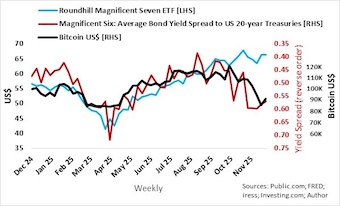

It is evident that a direct relationship between the average yield spread of the Magnificent Six and Bitcoin exists. Furthermore, the quantum and timing of the Bitcoin sell-off can directly be attributed to the increase in the yield spread. Yes, Bitcoin is a pure risk-on play in the corporate debt market.

It also appears that investors are hedging total exposures (equity and debt) to the Magnificent Seven stocks (with Roundhill Magnificent Seven ETF offering equal weight exposure to the Magnificent Seven as a proxy) by demanding higher credit spreads, Bitcoin sales, and equity rotation among the AI players.

The big question is how high the average yield spread of the Magnificent Six will go. The massive spending and the financing thereof by the hyperscalers (companies that provide massive, on-demand cloud computing resources through large-scale data centre that can rapidly scale up or down to meet fluctuating demands) have been telegraphed to investors for months and are probably priced into hyperscalers’ debt instruments and therefore in the yield spreads. Furthermore, the average yield spread of the Magnificent Six is currently within reach of the April 2025 highs.

The stock price and bonds of a geared hyperscaler such as Oracle, whose bond yield spread to US 20-year treasuries increased to 170 basis points from 100 in mid-September, are under immense pressure as they negotiate financing with banks and other financial institutions. Bitcoin, on the other hand, has tested the April 2025 lows.

Despite further downside risks, I am risk-on Bitcoin and bombed-out AI hyperscalers.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.