Taxpayers and tax practitioners seem reluctant to report tax fraud to the police once they discover they have fallen prey to eFiling profile hijackers.

A recent survey by the Office of the Tax Ombud (OTO) found that only 25% of respondents reported the incident to the police, whereas most (52%) did not. The balance of 23% did not know whether the matter had been reported.

Read: Ombud urges taxpayers to share eFiling hijacking experiences in survey

When the respondents were asked why they did not report the matter, the survey found a distinction between the reasons offered by low- and high-income earners and large businesses.

The common issue is trust in and the perception of the police. Tax Ombud Yanga Mputa said during a feedback session on the results of the survey that high-income earners and large businesses found the police to be inefficient. They also felt the loss was not worth the effort of reporting it and rather dealt with the matter through lawyers.

Although low-income earners do have trust in the police, they feared they would be ignored not be taken seriously. In many instances, the police are not trained to deal with the issues, Mputa noted.

During the virtual feedback session, some tax practitioners commented on the lack of assistance they received at police stations when reporting the matter.

The OTO is finalising its systemic investigation into the high incidence of profile hijackings that started in 2021 and escalated last year. The OTO has met with the Australian Tax Ombud, which conducted a similar investigation into tax identification fraud.

Mputa said her office intends to finalise the draft report by the end of this month for public comment and the final report by August.

Lack of cyber security

The survey highlighted a lack of sufficient technical knowledge and cyber security measures, resulting in taxpayer vulnerability. However, there have also been concerns about internal fraud and insider involvement at the South African Revenue Service (SARS) and specific banks.

Theo Burrows, the secretary-general of South African Tax Practitioners United, raised concerns about the apparent ease with which hijackers are able to open bank accounts in the name of taxpayers or change their banking details.

In many instances, the taxpayers were due a refund from SARS. Yanga said they were going to raise the fact that taxpayers are required to verify their bank accounts before a refund is paid out, even if there was no change to the banking details.

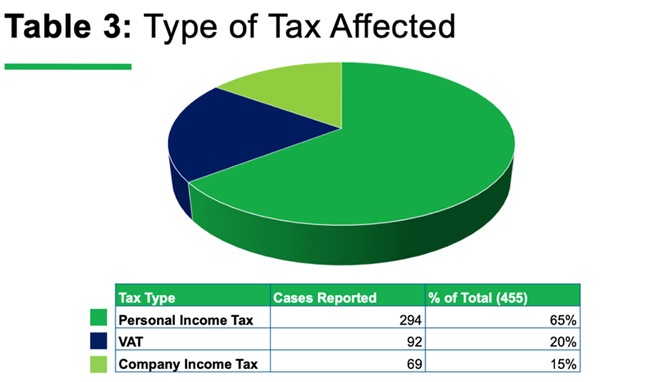

Taxpayers and practitioners are particularly vulnerable during tax filing season, mainly because of the lure of refunds. Hijackers seem to target personal income tax accounts rather than value-added tax or corporate income tax accounts to intercept refunds.

Source: OTO

It is “easier” to redirect a refund to a personal bank account. Transactions for VAT and companies are often cross-verified with other data, which reduces the opportunity for manipulation through a hacked profile.

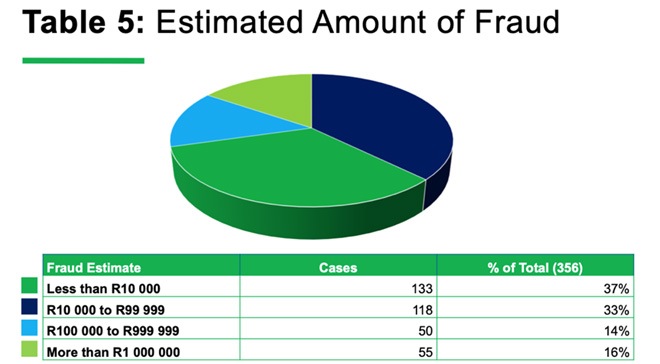

Fraudsters are also trying to operate under SARS’s risk radar. The claims are generally smaller than the risk thresholds.

However, some hackers are more brazen, and there were instances where the SARS risk engines did not pick up higher-than-usual claims from taxpayers, which turned out to be false claims from hackers.

Source: OTO

Tax filing season

SARS announced last week that this year’s tax filing season will officially start on 7 July and close on 20 October for non-provisional taxpayers. One of the enhanced support services this year is increased security measures to protect sensitive information.

“SARS requires taxpayers to ensure that their banking details are correct and updated. This ensures efficient processing of any refund that may be due,” SARS said in a statement.

“If you need to change your bank details, you must first check that your security contact details (email and cell-phone number) on the SARS eFiling are up to date.”

SARS specifically noted there is no need to do anything if the taxpayer’s banking details and security contact details have not changed.

A large segment of non-provisional and provisional taxpayers who receives income from one or more sources from formal and other forms of employment and whose tax affairs are not complicated have been selected to be automatically assessed.

They will be notified from 7 to 20 July. If they have not received a notification, they are required to submit their returns before the end of filing season for non-provisional taxpayers.

Provisional taxpayers and those with more complex tax matters will be able to file their returns from 21 July 2025 to 19 January 2026. Taxpayers are discouraged to visit SARS branches. They are encouraged to use the digital channels, such as eFiling and the SARS MobiApp.

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law, and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article is a general guide and should not be used as a substitute for professional tax advice.