South Africans aspire to own investment products, but these products are not well understood, according to research by the FSCA.

The Authority released its inaugural “South African Financial and Customer Behaviour and Sentiment Study” this month. The study sought to establish how customers engage with and view the financial sector, and whether their use of financial products and services indicates that financial institutions are upholding the Treating Customers Fairly (TCF) outcomes.

The research was conducted among 1 200 respondents and was supplemented by a desktop analysis of FinScope and Human Sciences Research Council data, social media sentiment analysis, and complaints data from the financial sector ombuds.

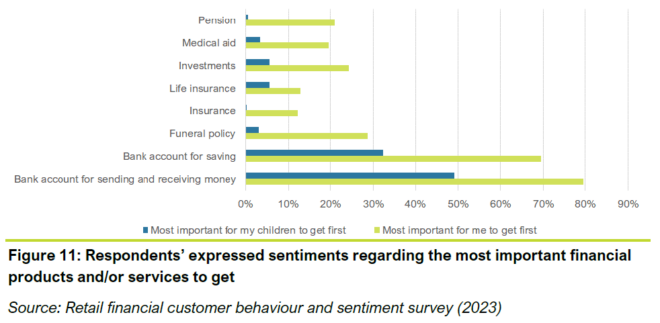

More than 50% of respondents consider a savings or transactional bank account to be the most important financial product or service to have. When advising others, particularly children, savings accounts, followed by investment accounts are primarily recommended.

Respondents expressed an aspirational desire to own investment products, equating owning these products with wealth and financial stability. But such products are not very well understood.

Consumers find it easier to save for the short term, for a clearly defined goal. But when the investment time horizon is pushed out, customers experience anxiety about making a long-term commitment.

Only about 20% of respondents indicated that retirement products are important, with a tiny percentage considering it important for their children to have such products. This suggests there is not an appreciation of the need to start to save for retirement early on.

Products are not well understood

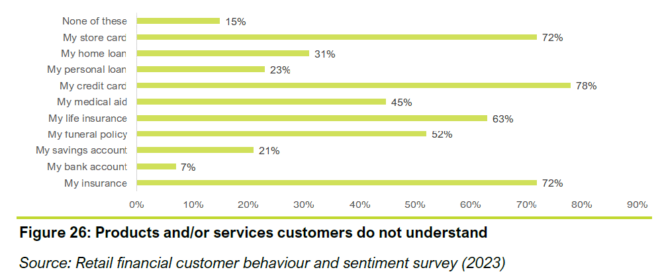

Customers reported that the information disclosed by financial institutions is generally adequate. However, they have gaps in their understanding of the products or services they purchase and use. When customers were asked whether there are products or services that they do not understand, many respond in the affirmative.

Customers do not always read documents before signing them, despite reporting that they do. Even if customers do read the terms and conditions, understanding is often lacking.

When asked whether they received easy-to-understand information from their financial institutions, the survey responses were overwhelmingly positive for bank accounts, strongly positive for funeral policies and investments, but tapered off for other insurance products.

A closer examination of the qualitative answers and the unsolicited responses shows that, in most cases, people feel they understood how the product was explained to them when they signed up, but they subsequently found they did not understand the details of the products or could not understand the terms and conditions document.

Several of the participants reported that they felt the financial institutions stopped communicating with them once they bought the product or service, resulting in customers feeling they are not kept up to date with their products and services.

In this sense, customers felt that the information is there, but it is not disclosed willingly, and many felt they had to ask detailed questions to ensure the information they were getting is accurate and complete.

Unmarried women are the only group that stand out as reporting poor treatment by financial institutions, with 12% of unmarried women reporting that financial institutions sometimes treat them badly. When probed further, they reported that their financial institutions were dismissive of the complaints or were unwilling to answer their questions.

In contrast, married women report struggling to resolve complaints themselves, but note that their husbands were able to resolve them.

Satisfaction with advice

Overall, respondents feel they receive good advice from their financial institutions. It was noteworthy that advice (TCF outcome 4) and disclosure (TCF 3) have the smallest number of mentions in the social media sentiment analysis, indicating that neither are a front-of-mind factor for many financial customers.

In the survey, financial advisers received a particularly good score, although white South Africans are most likely to report negative sentiments towards financial advisers.

Credit providers, retail shops, and retirement received the most negative responses in terms of advice.

In the case of credit providers, participants also reported they were given credit that was more than they could realistically afford, and the cost of the credit had not been adequately explained to them. In addition, some report there were challenges if they tried to pay off the full credit amount in one go.

Retirement providers were criticised for not adequately explaining pay-out rules and regulations and for giving poor advice about the funds in which to participate.

What influences product uptake?

Customers have generally positive sentiment towards the available product mix and the value derived from it: 88% of respondents report that their financial products or services meet their needs “extremely well” (20%) or “well” (68%).

Half of respondents see value in the financial products and/or services for which they are paying.

But most feel that the cost of financial products or services is too high, with 47% of respondents saying the costs are “much too high”, while 19% report they are “too high”.

Those with a loan product (store card, credit card, home loan, car finance, or personal loan) are 63% more likely to report that costs are too high relative to those with no loan product.

Respondents believe that charges should be for the “core” financial product or service only, with additional features perceived as free add-ons. Individuals who feel that they are paying unnecessarily for additional features, predominantly flag things such as SMS updates, insurance add-ons, and rewards programmes for things that they will never use, such as discounts on flights, as being problematic.

Loyalty and rewards programmes (specifically, cash rewards) are rated by close to 80% of respondents as the most important features among respondents of all demographics – as long as customers do not feel they are paying for added benefits that they will never use.

Flexibility is also highlighted as important, particularly for black Africans (32%), women (16%), and those living in rural areas (26%). Furthermore, being able to use an app is very important to all survey participants, except for individuals aged 51 to 60.

Word-of-mouth plays a significant role in shaping customer perceptions of certain financial products or services. Nearly half of survey respondents report that they had been warned against using a particular financial product or service, or against a financial institution, at some stage in their lives. Most of these respondents tend to either be young (under the age of 30) or much older (over the age of 60). Respondents would either be warned that the financial product and/or service opened them up to the risk of being scammed, or that the product and/or service was expensive or charged high interest rates.

Behavioural drivers

The findings show that customers explore options for financial products or services because they must do so to meet specific and clear underlying needs.

People tend to postpone decisions on when and which product or service to take up until it can no longer be avoided. Their selection is then based on which product or service they come across, know about or have been told about and not necessarily whether the product or service precisely matches what they need.

Customers often feel overwhelmed by the range of choices available, meaning that salience and “decision fatigue” are important behavioural triggers. Salience bias is a cognitive bias that predisposes individuals to focus on or attend to items, information, or stimuli that are more prominent, visible, or emotionally striking.

Crucially, customers’ perception of the extent to which financial institutions uphold the TCF principles matters for uptake. For example, South Africans who believe that their bank has a culture of treating customers fairly are significantly more likely to take up a formal savings product than South Africans who do not hold the same belief about their bank. The same effect can be seen where take-up of credit at a bank is concerned; those who affirm that their bank has a culture of treating customers fairly are significantly more likely to take up credit at a bank than those who do not hold the same belief about their bank.

Positive experiences build engagement

For some, engagement with the product or service leads to increased knowledge about the product or service. For others, the financial product and or service moves “to the background”: they do not actively engage or think about their financial products or services, unless something about their underlying needs changes. This is because engagement with financial products or services beyond the basic features can be cognitively taxing for customers, while usage of the basic features becomes automatic and viewed with neutral sentiments.

FinScope analysis shows that positive experiences, along the TCF principles, have a statistically significant impact on both how extensively people use their bank account and the range of financial services that they hold.

The engagement process can also make an important difference to whether customers build trust and continue to use the financial products or services they take up. Where customers have had positive experiences, they may expand their horizons of use and further explore what their financial products or services can do for them.

However, behavioural science shows that positive sentiments are less long-lasting than negative sentiments, and the threshold for positive sentiments becomes higher over time. While a customer may initially be pleasantly surprised by a provider’s service, the same experience becomes standard/neutral over time, after which any deviation from the “positive standard” becomes disappointing or annoying. As such, it is necessary that financial institutions improve their service on a continuous basis to maintain positive sentiments.

Switching products or services or providers, or exiting a relationship with a provider, generates a cognitive load. This means that even if customers are not fully satisfied with a product or service, the effort required to find and engage in an alternative may outweigh their discomfort or dissatisfaction. As a result, some customers open a new account or buy a new policy without cancelling a previous one. Instances of extreme annoyance may, however, lead to cancellation, which the qualitative research suggests is then usually a spur-of-the-moment decision.