Towards the end of last year, research published by Ninety One concluded that the investment advice market in South Africa appears to be vibrant and healthy.

Read: Is the independent financial advice market ‘an endangered species’?

Following the publication of the research, Ninety One said it received a number of questions from advisers about consolidating with another independent financial adviser (IFA) firm, to manage the challenges around succession and retirement. Ninety One therefore undertook further analysis of FSCA licensing data to investigate the structure of IFA firms in South Africa.

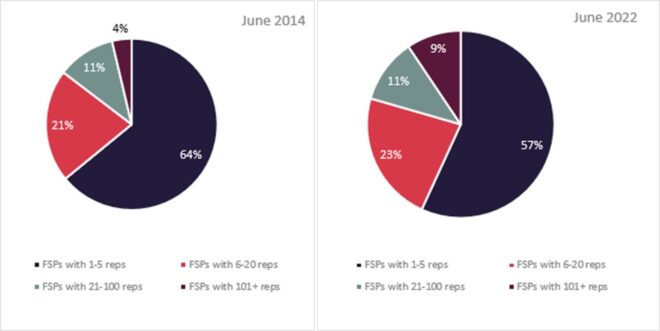

Jaco van Tonder, the head of adviser services in South Africa at Ninety One, said the analysis of about 13 000 IFAs with investment product categories on their FAIS licences produced the following results:

He said the main takeaways from these pie charts are:

- The vast majority (57%) of individual advisers work for IFA firms that have five or fewer advisers. The South African IFA market remains strongly entrepreneurial, dominated by small firms.

- However, from 2014 to 2022 the number of advisers working for firms with five or fewer advisers declined from 64% to 57%.

- About 70% of the advisers who exited smaller IFA firms between 2014 and 2022 appear to have joined large corporate advice networks (firms with more than 100 advisers on their licences).

- The other 30% of advisers leaving small firms joined slightly larger firms employing 6 to 20 advisers.

The data indicates there has been some level of consolidation of smaller South African IFA firms since 2014, Van Tonder said. “This resonates with the increase in succession and acquisition conversations we’ve had with advisers. The data also reflects the increased number of adviser practice acquisition transactions we have observed over the past five years.”

The UK experience

Consolidations and acquisitions are a hot topic of discussion in the British financial adviser industry, particularly because it has seen private equity investors funding large-scale consolidations in the financial advice industry over the past five years, Van Tonder said.

He said the following observations stand out when comparing the advice markets in the United Kingdom and South Africa:

-

- The UK advice market also has a large number of smaller practices, although not as many as South Africa:

- The Financial Conduct Authority (FCA) 2021 report lists about 36 000 individual investment-focused financial advisers in the UK working for about 5 000 firms across tied, restricted and independent categories (an average of 7.2 advisers per firm).

- In June 2022, the South African market had about 25 000 investment-focused advisers (both tied and IFA) working for 4 700 firms (an average of 5.3 advisers per firm).

- The UK market has had a higher rate of IFA consolidation than South Africa. International law firm Mayer Brown recently reported there have been about 400 financial adviser firm consolidation transactions in the UK annually for the past three years – representing almost 9% of registered advice firms every year.

- Because of this growing interest, the valuations of UK investment advice firms have been attractive, resulting in investment advice firms being valued between three and five times their annual revenue.

- Besides attractive valuations, market commentators in the UK list a range of factors that are driving the UK consolidation trend:

- Implementing succession plans: one article quoted 2022 data from the FCA stating that a third of authorised advisers were older than 50 years.

- Regulatory compliance burden: this is a major driver because overhead costs and regulatory requirements imposed on advisers are higher than in South Africa.

- Significant investment in technology is required to build an advice firm that can serve the client of the future: costs with which smaller firms struggle.

- Lower market returns are shaking out firms with flimsy advice propositions.

- The UK advice market also has a large number of smaller practices, although not as many as South Africa:

Van Tonder said the final chapter in the UK consolidator network story still needs to be written. Specifically, how the exit of private equity investors will be funded and what this means for advisers in a network remain open questions.

Will SA follow a similar path?

Given the huge amount of publicity of the UK experience, Van Tonder said it is easy to assume that consolidation should follow a similar path in South Africa.

“Although some consolidation is to be expected in South Africa, we believe that smaller, well-organised South African advice practices are in a better position than their UK counterparts. This is predominantly because of the less intrusive regulatory framework in South Africa compared to the UK, and the strong support local IFAs receive from outsourced local compliance providers, discretionary fund managers and investment platforms.”

He said there are also some structural differences between the two markets:

- The private equity market has been the driving force of the UK consolidation trend. In South Africa, private equity plays a much smaller role.

- Low interest rates in the UK since 2008 and the availability of significant capital have resulted in generous valuations for practices, supporting adviser consolidations.

- South Africa is an emerging market with higher interest rates and less private equity and international investor interest, so it’s not surprising that local investment advice firms are generally valued at lower revenue multiples – typically between 2- and 2.75-times annual revenue.

Similarities and differences

Reflecting on the learnings from the UK adviser market and understanding the drivers behind the adviser consolidation trend there will help South African advisers to navigate the trade-offs inherent in different succession options, which should lead to better succession decisions, Van Tonder said.

“There are significant parallels between the UK and the South African adviser markets. Both markets are experiencing increasing regulatory scrutiny of their advice industries and higher compliance costs, leading to some consolidation in advice channels. These factors are unlikely to change soon.”

But Van Tonder noted there are also significant differences, which affect the way these markets respond to their operating environments.

Most importantly, South Africa does not have the same large asset pools available to fund adviser consolidation. It is therefore likely that the structure of consolidation deals in South African advice firms will be different from those in the UK, and the amalgamations of like-minded, smaller IFA firms might be more popular here.

“We frequently speak to advisers keen on either buying or selling practices as part of succession plans. Based on anecdotal feedback from these conversations, it seems that the South African market currently has more buyers than sellers. After the spike in IFA buying activity in South Africa between 2017 and 2021, potential sellers are now more circumspect and are evaluating offers and succession options more carefully,” Van Tonder said.