Over the past 10 years, there have been predictions that the combined effect of intrusive regulation (and the associated costs), robo-advisers and the increasing fee pressure from investors will result in independently owned financial adviser firms morphing into large tied networks owned by large product providers. By now, we know that the threat of technology and robo-advice was vastly overstated. But how healthy are financial advice practices from a resourcing and financial perspective, particularly given the unique pressures of the past three years? Jaco van Tonder, the head of adviser services in South Africa at Ninety One, examines the state of the industry.

Every five years, Ninety One obtains data from a third-party consultant that keeps a database of all licensed financial advisers in South Africa, using the FSCA adviser database as the key data source.

Plotting data from this database over time gives some interesting insights into the growth of various segments of the South African advice industry. This article focuses on financial advisers who hold Category 1 licences for:

- Long-term insurance B2, B1 and C (investment and life cover policies);

- Collective investment schemes; and

- Retail pension benefits.

These licences are typically held by advisers who have a focus on the lump-sum investment business.

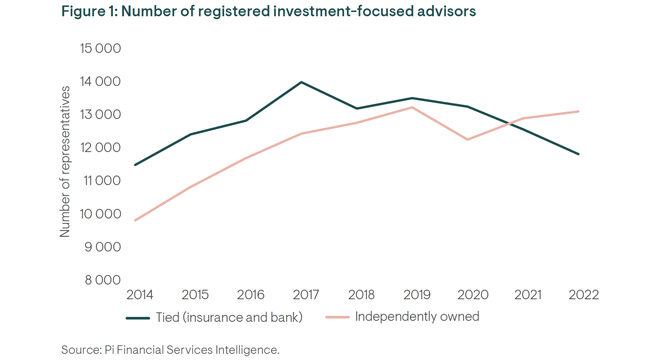

Figure 1 plots the number of advisers holding these licence categories, split between independent firms, on the one hand, and bank- and insurance-owned tied channels on the other.

The adviser numbers represent mid-year data (June of each year). There are some interesting takeaways from this graph:

- The number of investment advisers, both tied and independent, grew strongly from 2014 to 2016, but flattened out post-

- The first year of Covid (2020) triggered a reduction in the number of registered investment advisers for tied and independently owned firms.

- However, after Covid, the recovery among independently owned firms was immediate, with 2022 adviser numbers for independents back to the previous high of 2019.

- Tied channels, after surviving 2020 a little better than independents, saw their investment adviser numbers drop quite significantly over 2021 and 2022.

On face value, the data seems to suggest that independent advice firms respond to and recover from market shocks much quicker than their tied peers. This is arguably the result of a few differences between tied and independent advice channels:

- Independent firms, being mostly privately owned, have more of an owner culture and are more focused on retaining clients and good staff during market downturns.

- Independent firms, being smaller, are leaner and have lower overhead costs.

- Not having the financial backing of a large insurance or banking group arguably forces independent firms to respond faster to market shocks.

Demographics of advice firms in South Africa

Financial advice has often been depicted as an old profession, literally. The average age of advisers contracted to various large tied agency forces is often reported as being in the late 50s. This has raised concerns about the lack of younger, new advisers joining advice firms, who could take over the reins from their senior partners at the opportune time.

The advice industry has also faced criticism for the lack of female financial advisers.

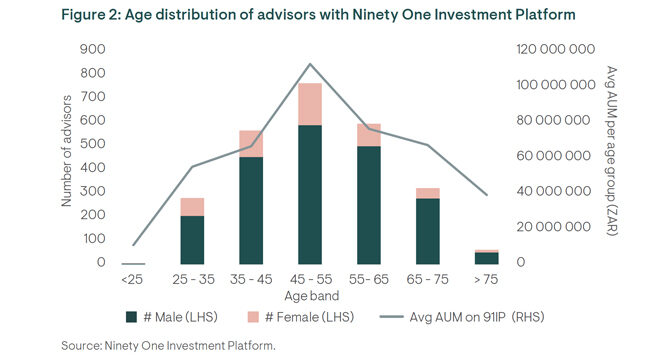

Figure 2 shows the current age breakdown of the largest 2 500 financial advisers registered with the Ninety One Investment Platform.

The age distribution graph highlights several important takeaways:

- The distribution looks quite normal, with the age band 45 to 55 dominating in terms of assets and the number of advise This is in line with what one would expect.

- Both the 35-to-45 and the 55-to-65 age bands look healthy, and they are similarly sized.

- There appears to be a strong pipeline of younger advisers coming through as potential successors to older advisers, which is a positive development.

- A substantial proportion of advisers stay licensed and operate in the industry after the age of 65. From the data, it appears that well over 50% of advisers reaching age 65 continue practis

- Women make up only 20% of the total number of advisers from this sample of 2 500.

- Not unexpectedly, the younger age cohorts have larger female representation.

On balance, the numbers suggest that the age demographic of the independent advice firms contracted to Ninety One is healthy.

Financial performance of independent wealth advisers

Now that we have looked at the numbers and demographics of registered investment advisers in South Africa over time, we turn our attention to understanding how well these advisers are performing financially.

Every year, Ninety One tracks the financial affairs of about 35 independent investment-focused wealth advisory firms, ranging from single adviser lifestyle firms to large national corporates. We obtain basic financial ratios from the participants of the study reflecting the revenue and cost growth in their firms. This information helps us to keep track of how these firms perform over time.

The results for 2021 have just been processed and give us a glimpse of how well adviser firms have weathered the impact of the Covid lockdowns and the recent difficult market conditions. For the purposes of this article, we will just look at the results for fees as a percentage of assets and revenue growth as indicators of how well investment advice firms are performing financially.

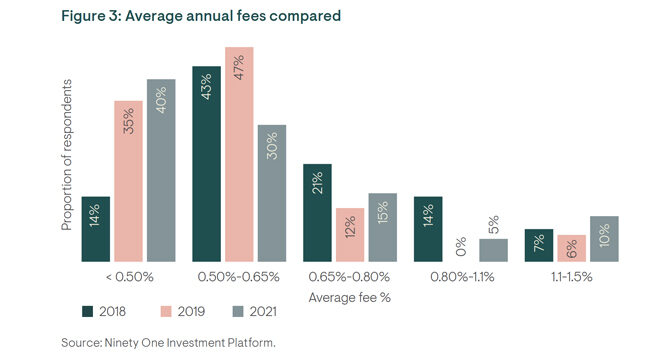

The chart below shows total practice fee revenue as a percentage of assets (in other words, fee rate as a percentage).

The graph shows three years’ data and highlights the proportion of respondents in different fee bands. Here are some high-level conclusions:

- The average fee revenues for 2018/2019/2021 are 0.65%/0.62%/0.65% respectively – fairly stable even through Covid lockdowns.

- However, there are some shifts in the fees charged:

- 40% of respondents now report fee revenues of less than 0.50% – in 2018 only 14% of respondents reported fees in this band.

- 70% of respondents charge less than 0.65%.

- Higher fee wealth managers (typically family office firms with Category 2 investment manager revenues) appear to be able to sustain revenues in excess of 1% a year – this is remarkably robust given market conditions.

There appear to be at least two fee and value propositions in the survey group.

- The more conventional advice firms focusing on classic investment planning have a revenue margin that generally falls below 0.6% – some of the lower-margin operators are experiencing fee pressure.

- Advice firms offering a wider array of services, including a family office proposition, capture a larger slice of the investment management margin. They earn a revenue margin of 1% a year or higher and appear more able to defend their revenue margin.

In general, the fee levels for these two propositions appear to be fairly stable, except for the fee pressure on the lower-margin firms.

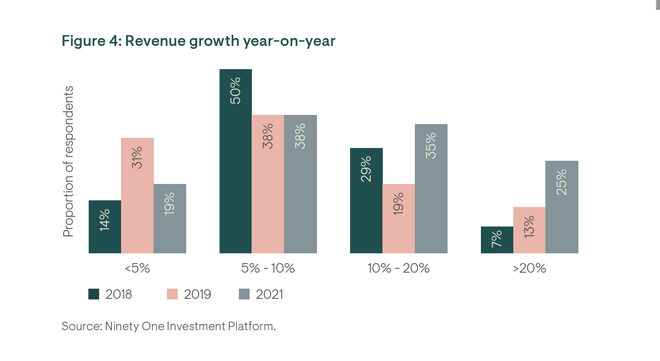

Let’s turn our attention to revenue growth.

The revenue picture also looks stable and remarkably strong – the average revenue growth from participating firms grew by 17% in 2021.

A closer look at the detail reveals that 60% of respondents cited revenue growth of more than 10% a year in 2021. Strong markets during the year, combined with healthy flows during the Covid-lockdown phase, supported revenue growth.

However, discussions with advisers indicate that we should expect lower growth for 2022, as markets and flows have been challenging this year. The final numbers for 2022 will be revealed in next year’s review.

But generally, the results seem to indicate that high-quality independent advice firms grow their revenue under most market conditions.

Conclusion

The data presented contradicts the often-expressed view that independently owned financial advisor firms are under pressure and that tied channels are well positioned to absorb these independent businesses.

The independent wealth adviser market looks vibrant, with strong growth numbers in demographics, as well as solid financial performance in difficult market conditions.

And with about R1 trillion of excess retail bank deposits in the local market waiting for investment opportunities, the story about the demise of the independent adviser has surely been greatly exaggerated.

This article was first published by Ninety One and is republished with permission. It has been edited slightly to reduce the length.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.

[…] Read: Is the independent financial advice market ‘an endangered species’? […]