The rand has experienced mixed fortunes against major currencies over the past six months, declining by 2.7% against the euro, and improving against the US dollar and the Chinese yuan by 5.7% and 3.6%, respectively. But whereto from now?

When analysing the rand, I prefer to look at what I call the world rand instead of only one cross-currency rate, such as the US dollar, euro, or Chinese yuan, because the cross-currency movements between those currencies have an impact on the rand’s exchange rate against those currencies.

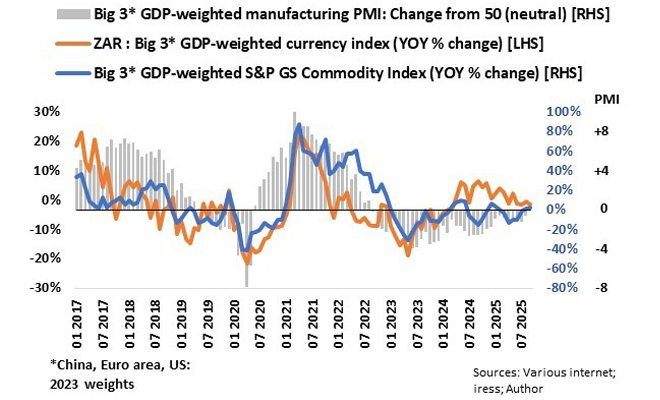

The world rand is calculated as the rand’s exchange rate against a GDP-weighted currency index consisting of the Big Three economies – namely the United States, the euro area, and China – using 2023 GDP data.

From the accompanying graph, it is evident that the 12-month momentum of the world rand is highly correlated to the momentum of the Big Three GDP-weighted S&P Goldman Sachs Commodity Index (S&P GSCI), which is also calculated by expressing the index in US dollars, euros, and Chinese yuan and applying 2023 GDP weights. The S&P GSCI covers physical commodities spanning five sectors: energy, industrial metals, precious metals, agriculture, and livestock, weighted in relation to their global production levels.

It also appears that the 12-month momentum of the Big Three GDP-weighted S&P GSCI is highly correlated to changes in the Big Three’s 2023 GDP-weighted manufacturing PMI, where a change above 50 indicates expansion in the Big Three’s manufacturing sector, while a drop below 50 indicates contraction.

Optimism about SA politics is waning.

Between May 2024 and January this year, the rand gained momentum, while commodities were under pressure. The divergence can be attributed to the positive reaction to the South African political situation after the 2024 election, specifically the establishment of the Government of National Unity.

The optimism has fizzled out since then as the gap between the 12-month momentum of the world rand index and the S&P GSCI has converged, and both coincide with the GDP-weighted manufacturing PMI registering zero.

The outlook for commodities, and therefore the world rand, is highly dependent on how the manufacturing sector PMI in the Big Three evolves over the next few quarters. The outlook is not great, though, as investment banks are forecasting slower economic growth over the next two to three quarters, implying that the global manufacturing sector may remain in contraction mode despite easing monetary policies.

Interest rate differentials will not save the rand.

The counterargument is that the real interest rate differential between South Africa and the rest of the world is likely to underscore the external value of the rand.

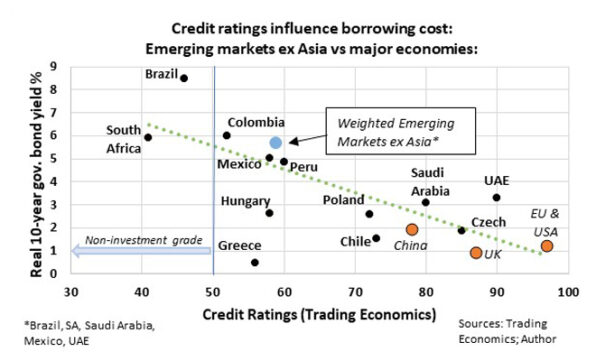

South Africa’s fiscal and, specifically, its debt position is such that the official credit rating agencies classified the country as non-investment grade. Low investment grade is synonymous with high borrowing cost, and vice versa.

From the accompanying graph, it is evident that South African 10-year government bonds are priced in line with the country’s credit rating. Although the austerity measures implemented by the government and the South African Reserve Bank’s fixation on inflation could improve the country’s credit rating over the next two or three quarters, the ratings will probably remain at non-investment grade, as economic hardship will worsen, hampering the country’s ability to borrow offshore.

Foreign capital inflows are therefore likely to be limited to investments with short durations, and we know how fickle they can be. It is especially relevant now that world stock markets are (again) at exuberance levels. Any risk-off avalanche is likely to tank the rand against the major world currencies.

Yes, we are at a major inflection point on the rand.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.

Ryk,

Thanks, enjoyed your reasoning.