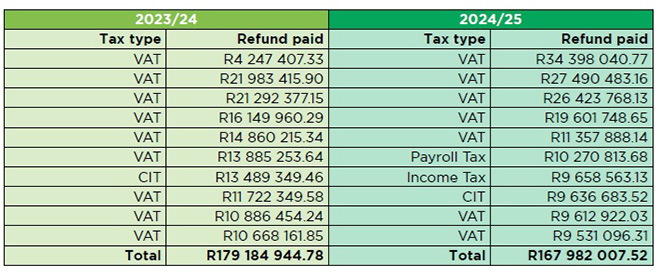

The top 10 refunds facilitated by the Office of the Tax Ombud (OTO) came to more than R167 million in 2024/25, a decrease of 6.27% compared with the previous year.

The top 10 refunds amounted to R167 982 007.52, compared with R179 184 944.78, according to the OTO’s annual report for 2024/25, released this week. “These refunds are often life-changing for taxpayers, particularly for small and medium businesses.”

The report attributed the decline to improved understanding by taxpayers of the documentation required by the South African Revenue Service for claiming refunds, as well as SARS’s efforts to expedite refund payments.

Most of the top 10 refunds involved value-added tax, followed by corporate income tax, and payroll tax. The annual report said this was consistent with past trends, where refunds are delayed because of pending verifications, disputes, or systemic backlogs.

The OTO’s mandate in terms of the Tax Administration Act (TAA) is to:

- Review and address any complaint by a taxpayer regarding a service matter or a procedural or administrative matter arising from the application of the provisions of a tax Act by SARS.

- Review, at the request of the Minister of Finance or at the initiative of the Tax Ombud, with the approval of the minister, any systemic and emerging issue related to a service matter or the application of the provisions of the TAA, or procedural or administrative provisions of a tax Act.

In August last year, the Minister of Finance gave the OTO approval to conduct a systemic investigation into alleged SARS eFiling profile hijacking. This decision followed a request by the OTO to the Minister, based on numerous complaints and queries received by the OTO, as well as insights gathered during a public workshop hosted by the OTO.

The OTO released its preliminary report on 1 October, which disclosed a pattern of systemic failures within SARS’s fraud prevention, detection, and resolution processes.

Read: Deep flaws in SARS’s systems, OTO investigation finds

Preliminary investigations

During the year under review, the OTO initiated preliminary investigations into two possible systemic issues based on taxpayer submissions.

Suspension of payment functionality

Taxpayers raised concerns about not being able to request a suspension of payment before submitting a dispute. They also reported receiving system-generated final demand letters even after a suspension had been approved and flagged the non-availability of the suspension function for trusts on SARS eFiling.

“After a thorough assessment, the OTO concluded that SARS’s systems and processes were operating as intended. Therefore, the matter was not deemed systemic,” the annual report stated.

VAT refund delays

A complaint submitted by a tax practitioner cited excessive delays, often beyond six months, in the payment of VAT refunds. However, the OTO’s analysis found that the delays were mostly linked to SARS’s verification processes and, in some instances, taxpayer non-compliance. “Since these delays were case-specific and not caused by a systemic breakdown, the OTO did not escalate the matter but continues to monitor it due to its association with an already open systemic issue,” the report said.

Systemic issues

At the beginning of the financial year, the OTO was monitoring 19 systemic issues. Following remedial actions by SARS and the absence of new complaints on those matters, the OTO closed two issues:

- Delays in deceased estate coding. Taxpayers complained about long delays in SARS updating tax profiles after a taxpayer’s death. SARS, in partnership with the Department of Home Affairs, introduced an automated process to update executor details and code deceased estates. This enhancement significantly reduced delays, and the issue was removed from the register.

- SARS’s inability to confirm that correspondence was sent. Concerns had been raised that taxpayers were receiving final demand letters without proof of dispatch. SARS resolved this issue by implementing delivery notifications with audit trails.

Details of the 17 systemic and emerging issues that remained opened at end of 2024/25 are provided in the table on pages 48 to 56 of the annual report.

SARS required to provide reasons

Yanga Mputa (pictured), the Tax Ombud, said a milestone during the reporting period was the implementation of section 20(2) of the TAA. This provision strengthens the OTO’s oversight function by requiring SARS to give reasons for not implementing the OTO’s recommendations.

In terms of the TAA, recommendations issued by the Tax Ombud are not binding on either SARS or the taxpayer. However, where SARS or the taxpayer elects not to accept a recommendation, they are legally required to provide written reasons to the Tax Ombud within 30 days of being notified of the recommendation.

The OTO also exercised its authority under section 20(2) to escalate unresolved matters to the Commissioner of SARS where recommendations were not implemented within a reasonable time.

In the 2024/25 financial year, 391 letters requesting reasons were sent to SARS. Of these, 299 matters were resolved following SARS’s response, while 92 matters remained outstanding at the year’s end.

“The noticeable increase in the successful implementation of OTO recommendations by SARS following the issuance of section 20(2) letters highlights the growing effectiveness of legislative oversight mechanisms in promoting accountability, strengthening the authority of the OTO and advancing the protection of taxpayer rights,” Mputa said.

Increase in complaints received

In the 2024/25 financial year, the OTO received 18 576 “contacts”. These included 13 729 queries, representing an 11.27% increase from the previous year, and 4 847 complaints, reflecting a 4.3% growth.

The OTO classifies queries into three main categories:

- Request for advice: Assisting taxpayers with understanding tax procedures and related matters.

- Request for complaint forms: Taxpayers expressing intent to lodge formal complaints.

- Follow-ups on existing complaints: Taxpayers checking on the status of previously submitted complaints.

There was a 9.42% increase in advice-related queries, and a 10.58% increase in requests for complaint forms.

More taxpayers lodging complaints directly

A total of 4 913 complaints were validated in 2024/25 – an increase of 6.4%.

Validation is the first stage in the OTO’s complaints-handling process. The OTO checks whether the complaint falls within its mandate. This means the issue must relate to a service, administrative, or procedural matter arising from the application of the provisions of a tax Act. Additionally, the taxpayer must have first tried to resolve the complaint through SARS’s internal complaints process (unless compelling reasons are provided for not doing so).

Most validated complaints, 97.6%, were lodged directly by taxpayers – an increase of 36.57% compared with the previous year. In contrast, complaints lodged by taxpayer representatives declined by 89.3%, constituting only 2.4% of all complaints.

“This trend indicates a growing confidence and awareness among ordinary taxpayers in the services provided by the OTO. More taxpayers are choosing to engage the OTO without relying on tax professionals, reflecting not only accessibility of the OTO but also its reputation as a trustworthy and effective recourse mechanism,” said the annual report.

The OTO categorises validated complaints as follows:

- Service matters: These complaints involve delays, failure to respond, incorrect information, or poor conduct by SARS staff. They represent service delivery breakdowns.

- Procedural matters: These relate to SARS failing to follow legally prescribed steps, such as not providing reasons for assessments or delays in objection or appeal processes.

- Administrative matters: These include issues such as failure to update taxpayer profiles, incorrect taxpayer records, or misallocation of payments.

- Other: These complaints either do not fall within any of the above categories or are not within the OTO’s mandate, such as policy issues or court disputes.

Of the 4 913 validated complaints in 2024/25, 76.82% (3 774) pertained to service matters, 10.36% (509) related to procedural matters, 8.53% (419) addressed administrative matters, and 4.29% (211) were classified as other matters.

“Compared to 2023/24, the number of service-related complaints increased by 7.25%. This indicates that while more taxpayers are engaging with SARS, a large proportion still experience unacceptable delays or non-responsiveness. Conversely, procedural complaints declined by 16.01%, suggesting some improvement in SARS’s adherence to processes,” the annual report said.

Of the 4 913 validated complaints, 2 265 (46.1%) complaints were accepted (5.35% lower than in 2023/24), 1 652 (33.63%) were rejected (increase of 24.21%), and 996 (20.27%) were terminated were (up 11.28%).

Accepted complaints are identified taxpayer grievances that SARS must address. “The drop in accepted complaints may reflect more stringent validation. The rise in rejected complaints is concerning and likely reflects a gap in public knowledge about when and how to use the OTO,” the annual report said.

Complaints are mainly rejected because taxpayers do not first use SARS’s internal complaints process. Section 18(4) of the TAA requires that taxpayers must exhaust internal channels unless there are compelling reasons.

SARS implements most OTO recommendations

At the start of 2024/25 financial year, there were 442 unresolved complaints and unimplemented recommendations. An additional 2 265 complaints with OTO recommendations were referred to SARS for resolution, bringing the total number of complaints requiring implementation in 2024/25 to 2 707. In comparison, the 2023/24 financial year had 2 674 complaints with recommendations available for resolution.

The most frequent categories of recommendations included:

- Compliance audit: 578 cases (25.52%) – typically related to delays in finalising verification or issuing tax residency certificates.

- Portfolio maintenance: 437 cases (19.29%) – including deregistration and reactivation of tax numbers.

- Dispute resolution and assessment: 513 cases (22.65%) – helping taxpayers who were stuck in the objection or appeal process.

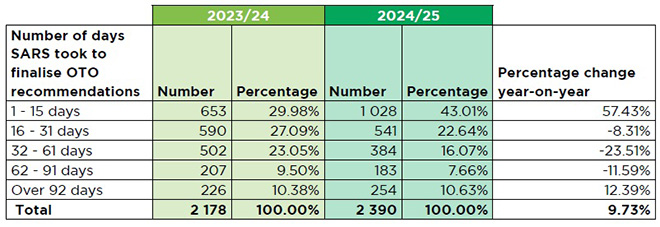

SARS resolved 2 390 complaints in 2024/25, an improvement on the 2 178 resolved in 2023/24. This translated into a resolution rate of 88.29%, a notable increase from the 81.45% achieved in the prior year.

The annual report also drew attention to the continued high level of acceptance and implementation of OTO recommendations. SARS accepted and implemented 2 374 recommendations in 2024/25, representing 99.33% of cases resolved. Only 16 recommendations were not implemented. By comparison, in 2023/24, SARS implemented 2 173 recommendations (99.77% of cases resolved), leaving only five recommendations not implemented.

At the close of the 2024/25 financial year, 263 complaints remained unresolved and recommendations unimplemented; these will be carried forward into 2025/26 financial year. The number of unresolved complaints decreased by 40.5%, from 442 in 2023/24 financial year.

The annual report provided a breakdown in how long SARS has taken to implement the OTO’s recommendations over the past two years.

There was a notable improvement in the proportion of recommendations resolved within 15 days, which rose from 29.98% to 43.01%. “However, the increase in matters taking longer than 91 days shows that further work is needed in handling complex or disputed complaints efficiently,” the OTO said.