Investor behaviour showed signs of improvement in the year to September 2025, with fewer portfolio switches and a decline in the overall cost of emotionally driven decisions. However, Momentum Investments’ latest behavioural research suggests that this improvement conceals a familiar and persistent pattern: a subset of investors continues to destroy value by reacting to market volatility after it has already risen.

These findings are set out in the 2025 Sci-Fi Report by Momentum Investments, which analyses investor switching behaviour across discretionary investments and retirement income portfolios. Rather than focusing only on how often investors switch, the report examines whether those decisions ultimately add to or detract from long-term outcomes.

The 2025 analysis period (1 September 2024 to 1 September 2025) was characterised by a generally rising JSE All Share Index (ALSI) and relatively subdued market volatility, apart from a brief spike in April 2025. Momentum says this environment played an important role in shaping investor behaviour.

“Notably fewer investors ended up switching relative to prior years,” the report observes, adding this “could be a function of relatively low volatility with a general increasing trend in the ALSI”. Although switching activity did increase following the April volatility spike, it peaked in May and remained lower overall than in more turbulent years.

As in previous periods, investors tended to act after volatility had already risen, rather than ahead of it.

To assess the impact of these decisions, Momentum uses a measure it calls “behaviour tax”. This reflects the difference between the future performance of the funds out of which investors switched and the funds into which they switched, annualised over time. A positive behaviour tax indicates value destruction relative to a buy-and-hold approach.

In 2025, overall behaviour tax declined to just over 1% across both investment categories:

- Flexible Income Options (FIOs), which cover discretionary unit trust investments, recorded a cumulative behaviour tax of 1.27%.

- Retirement Income Options (RIOs), which include living annuities, recorded a similar figure of 1.28%.

Momentum notes that these are the most muted levels of behaviour tax recorded since the Covid-19 period of 2020. On the surface, the data suggests that investors, on average, made fewer costly timing errors. However, the report cautions that averages mask substantial differences in outcomes.

Discretionary investors: fewer switches, familiar patterns

Among FIO investors, Momentum recorded 13 924 switches during the year, at an average rate of 2.29 switches per investor, slightly below the previous period. The proportion of investors who switched back again after an earlier decision fell to 43.85%, a decline that Momentum attributes to the clearer and steadier market trend.

The average switch amount remained stable at about R154 000 per transaction.

Despite the moderation in switching activity, Momentum identifies a consistent behavioural pattern. “A general trend of de-risking prevailed over the period,” the report states, adding that “when the Anxious investor executes on this, they incur the greatest behaviour tax”.

Retirement investors: higher stakes, similar outcomes

The same tendencies were evident among RIO investors, although the decisions carry greater emotional weight given that these portfolios are typically used to draw income.

Momentum recorded 32 378 switches in RIOs, with an average switch rate of 2.28 per investor. Although overall switching activity remained relatively flat, the average switch amount increased, peaking at nearly R276 000 in April 2025. According to the report, this reflects “potentially significant switches in April 2025 due to the ALSI dip”.

Despite a greater emphasis on capital preservation, retirement investors did not avoid the cost of poorly timed decisions. Behaviour tax in RIOs was similar in magnitude to that of discretionary portfolios, reinforcing Momentum’s conclusion that emotional responses to volatility, rather than product structure, are the primary driver of value destruction.

Following the money

Momentum’s fund-level analysis notes that clear outflow patterns were less pronounced in 2025 than in prior years, consistent with the lower aggregate behaviour tax recorded for the period.

Even so, familiar timing challenges remain visible. Among FIOs, the Momentum Core Equity Fund recorded the largest net outflow – just over R109 million – following a 2024 return of 8.44%. In the year that followed, the fund delivered a return of 11.19%. Other funds on the outflow list, spanning both equity and income categories, showed mixed subsequent outcomes: in some cases, underperforming after investors exited, and in others recovering strongly.

A similar picture emerged among retirement income portfolios. Switching activity reflected a blend of growth-oriented and income-focused funds, again without a single dominant trend. As with discretionary investments, some switches shielded investors from weaker performance, while others resulted in missed recoveries. The Allan Gray Balanced Fund recorded the largest outflow – just over R127m – following a 2024 return of 16.39%. The fund delivered a return of 11.29% in the following year.

Momentum does not present this data as evidence of flawed strategies or “wrong” funds. Rather, it reinforces the report’s central behavioural insight: value is most often destroyed not by what investors hold, but by when they decide to change course.

Who pays the price – and how

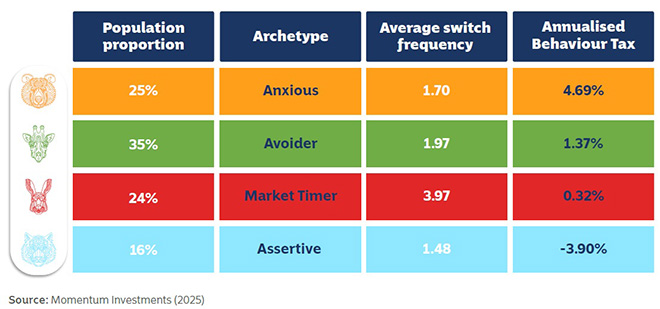

To explain why behaviour tax remains uneven despite lower overall switching, Momentum groups investors into four behavioural archetypes based on how they respond to market movements. These archetypes are not demographic profiles or risk ratings but empirically observed decision-making patterns that are consistent across both discretionary investments and retirement income portfolios.

The archetype data shows that how often investors switch is not, on its own, what determines outcomes.

Market Timers are the most active group by a wide margin, averaging 3.97 switches per investor over the period – nearly double the overall average. Their switching occurs in both directions: increasing risk exposure in rising markets and reducing it when volatility increases. As a result, Market Timers often capture gains early in a market cycle, but those gains are typically given back through subsequent de-risking, resulting in moderate behaviour tax (0.32%) rather than the highest losses.

By contrast, the Anxious archetype switches less frequently than Market Timers, but in a more concentrated and reactive manner. Their activity is heavily clustered around periods of elevated volatility, with a strong bias toward de-risking rather than re-risking. This pattern proves particularly costly. Anxious investors incurred behaviour tax of 4.69% – by far the highest across all the archetypes.

Assertive investors also switch actively, but their behaviour differs sharply in both timing and direction. Their switching is concentrated in rising markets and skewed towards increasing risk exposure rather than reducing it. In 2025, this pattern aligned with favourable market conditions, resulting in negative behaviour tax of –3.9%, meaning that switching decisions added value rather than destroyed it. Momentum notes this outcome is unusual, but consistent with the market momentum observed early in the period.

The Avoider is usually a tamer version of the Anxious investor because they de-risk far less aggressively. However, even modest defensive switching can be costly if it occurs during volatility spikes. In 2025, Avoiders incurred the second-highest behaviour tax of 1.97%, slightly above the average of 1.28% across all the archetypes.

Taken together, the archetype data reinforces a central behavioural insight: value destruction is driven less by how often investors act, and more by when they act and in which direction.

Behaviour remains the decisive factor

Momentum’s archetype analysis shows that calmer market conditions can reduce the overall incidence of harmful investor decisions, but they do not eliminate behavioural risk. Even in a year marked by rising markets and lower volatility, the data reveals persistent differences in how investors respond to uncertainty – and in the outcomes those responses produce.

The evidence suggests that behaviour tax is explained less by switching frequency than by emotional context. Investors who act proactively in rising markets, even if they switch frequently, may add value in certain conditions. By contrast, investors who respond defensively to volatility – particularly through anxiety-driven de-risking – consistently undermine long-term outcomes, even if they switch less often.

Crucially, these patterns appear across discretionary investments and retirement income portfolios, indicating that the behavioural drivers of poor timing are not mitigated simply by product structure or investment purpose.