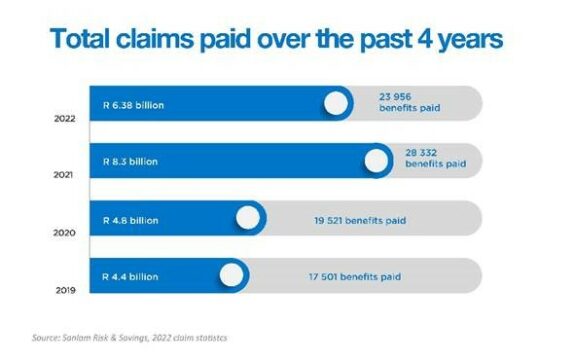

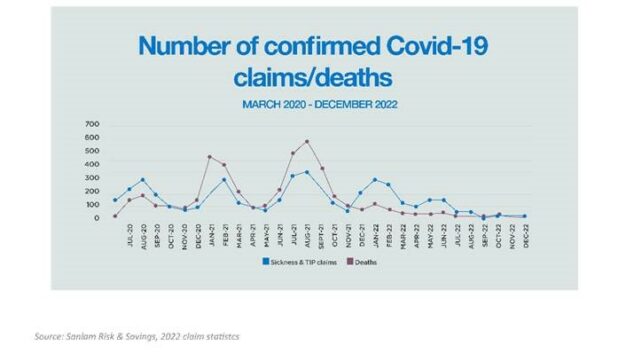

Sanlam Risk and Savings paid out R6.38 billion in claims in 2022, which was 23% down from R8.3bn in 2021. A marked decrease in Covid-19-related claims is partially behind this, with the business paying out R2.64bn in confirmed death and funeral claims in 2021 because of the virus, versus R108.84 million last year.

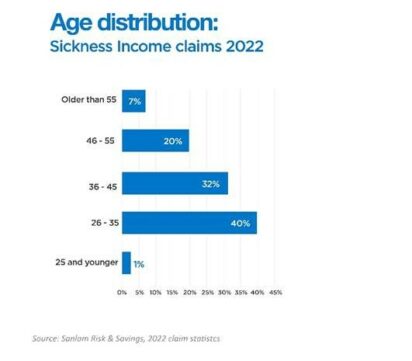

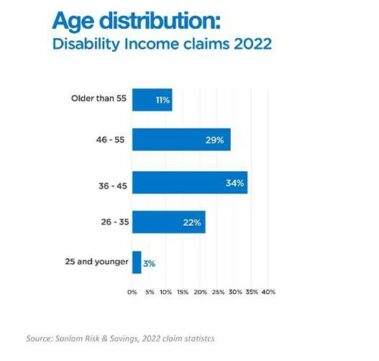

Product actuary Petrie Marx said Sanlam Risk and Savings’ 2022 claim statistics reveal interesting patterns that highlight the importance of cover for younger South Africans. For example, more than 70% of sickness income claims were from people younger than 45 years, and there was a 6% increase in disability income claims for those aged 26 to 35. With many working years ahead of them, the greatest financial risk facing younger South Africans is the possibility of losing their ability to earn an income.

Of the total R6.38bn in benefits paid, R5.44bn went to death and funeral claims, R444.9m to disability, loss of income and impairment claims, and R496.9m to severe illness and injury claims. Confirmed Covid-19 claims accounted for only R133.7m of total pay-outs.

“Our results are consistent with the global trend of Covid-19 cases becoming less frequent and severe as vaccination efforts and past infection result in some ‘herd immunity’ worldwide,” Marx said.

“Our data reveals interesting pandemic patterns. Between March 2020 and March 2022, most Covid-19 death claims came from men, but sickness and disability income claims for clients booked off from work for Covid-19 were more or less the same for men and women.

“In terms of sickness and disability income claims, the age group hardest hit was individuals aged 30 to 39 years (39%). Most death claims came from people aged 50 to 59 years (30%). The majority (74%) of our sickness and disability income claims came from clients in the medical field.”

Death and funeral claims

In 2021, diseases of the respiratory system were the leading cause of death claims because of Covid-19. This year, cardiovascular disease (21%) was responsible for most claims, followed by respiratory diseases (17%), accidents, poisoning and violence (12%), and cancer (12%). Most death claims were from men (67%) and from individuals older than 55 (74%).

In terms of accidental death claims, motor vehicle accidents were behind 33% of claims, followed by assault (24%) and suicide (21%). Although the number of claims for accidental deaths has increased slightly from 2021, it is still significantly lower than pre-Covid levels as percentage of all other causes.

“Prior to the pandemic, cardiovascular disease was the main cause of death claims, and we expected to see it return to this position. Non-communicable diseases, such as cardiovascular disease, did not disappear during the Covid-19 pandemic, and it is a reminder of the importance of annual health checks and screenings to these at an early stage,” Marx said.

“In 2022, we paid 16% fewer death and funeral claims than in 2021. Our biggest death claim was R57.8m, and the oldest deceased was 104 years old. For both men and women, most claims for death were the result of heart disease.”

Disability claims

Cardiovascular disease was also the primary cause (23%) of disability claims, followed by bones, back, joints and connective tissue (19%), mental disorders (11%), diseases of the nervous system and sensory organs (11%), cancer (9%), and accidents and injury at 7%.

Most claims came from individuals older than 55 (44%), and 40% were from women. For both sexes, most claims were for cardiovascular disease (25% for women and 21% for men).

“The increase in disability claims for cardiovascular disease is something that we will watch closely in the coming years,” Marx said. “The leading causes of heart disease are high blood pressure, diabetes, smoking, obesity, an unhealthy diet, and a sedentary lifestyle. We urge people to have regular check-ups and make positive lifestyle choices.”

Severe illness claims

In terms of severe illness claims, 58% of claims were by people under the age of 55, also emphasising the need for severe illness cover for younger South Africans.

Cancers and tumours remain the leading cause of claims by some margin, at 52%. Heart attacks followed at only 8%. Interestingly, last year saw an increase in claims for angioplasty, which may point to earlier diagnosis of heart conditions.

Of the 47% of severe illness claims from women, 63% were for cancer, 48% of which were for breast cancer.

Of the 53% of claims from men, 42% were for cancer, with 36% of these for prostate cancer. This is a marked increase, up 11% from 2021.

“Prostate cancer is the most frequently diagnosed cancer for males in 112 countries, and the continued increasing incidence has been reflected in clinical research globally. Certainly, our significant increase in prostate cancer claims highlights the ongoing need for regular screening for all men,” said Dr Marion Morkel, the chief medical officer at Sanlam.

Disability income claims

Bones, back, joints and connective tissue made up 29% of all disability income claims, followed by accidents and injury at 21%. Once again, men made the most claims (53%), 33% of which were for accidents. Interestingly, most claims came from individuals aged 36 to 45 years, and the 26-to-35-year age group saw a 6% increase in claims.

Sickness income claims

Covid-19 still accounted for most sickness income claims (41%) in 2022. However, Sanlam paid out R31m for people being booked off work, which was 46% less than in 2021.

More than 70% of sickness income claims were from those under 45. Women accounted for 55% of claims, 12% of which were linked to pregnancy, childbirth, and puerperium-related conditions.