Moonstone Business School of Excellence (MBSE) has completed the 2023 academic year with a record number of graduates.

With the last round of qualification exams recently concluded, MBSE announced that the past year saw the highest number of students completing their qualifications via the online learning platform.

Monique Brummer, operations manager at MBSE, says the academic team went to great lengths to support students through their learning journey.

“And our students have made us extremely proud with the great effort they put into their studies. Distance learning in itself is challenging, but our students proved that if you pursue your goals with enthusiasm, and you have an excellent support team cheering you on, nothing is impossible,” says Brummer.

MBSE was established in 2015 after the acquisition of PSG Academy by the Moonstone Group.

Since then, MBSE has gone from strength to strength, continually expanding the range of accredited qualifications, Class of Business training, CPD and short courses.

Among the accredited qualifications, the Postgraduate Diploma in Financial Planning (NQF 8) takes pride of place.

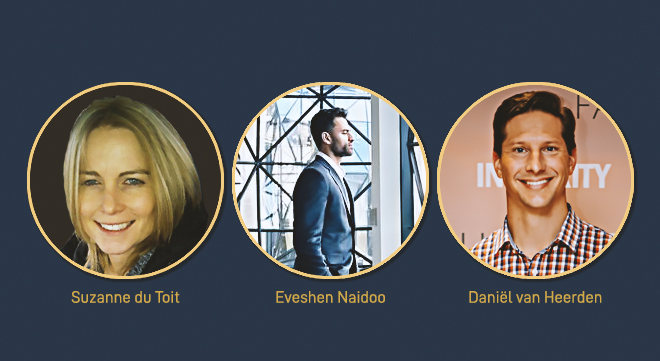

According to this year’s top three achievers in the Postgraduate Diploma in Financial Planning exams, MBSE was their first choice when it came to furthering their studies.

For Eveshen Naidoo, the fact that MBSE is recognised as a suitable education provider by the Financial Planning Institute of Southern Africa (FPI), with specific approval to offer the Postgraduate Diploma for the purposes of providing the educational component of the FPI’s Certified Financial Planner© designation, was the deciding factor.

Daniël van Heerden says he chose Moonstone because it is a respected brand in the industry.

Suzanne du Toit says that having completed her Regulatory Examinations through Moonstone in the past, she was familiar with the online learning business school.

“A few years back, I saw that they were going to offer the post-grad diploma at Moonstone as well, and I didn’t even think twice to enrol with them,” says Du Toit.

Staying the course

The Postgraduate Diploma in Financial Planning is approved by the FSCA as a recognised qualification for FAIS Fit and Proper purposes in all product sub-categories for all categories of FSP. The qualification provides a clear pathway for students who have completed a BCom in Financial Planning or similar NQF 7 qualification to further their studies in professional financial planning practice.

Naidoo, 34, who is a Chartered Accountant, says he enrolled for the Postgraduate Diploma because he wanted to enhance his understanding of retirement planning.

Van Heerden, 47, director and financial adviser with Global Asset Management and Financial Services, says advancing his studies in financial planning was the next logical step.

“As an independent brokerage, we have decades of experience in financial planning, but we felt it essential to link this with a post-grad qualification with a reputable business school,” says Van Heerden.

Du Toit, 45, started working in the industry about seven years ago. She works as a financial planner/adviser at Finmax Financial Services in Cape Town. She says after completing the RE exam and gaining experience as a financial adviser, she was looking for the next challenge.

“This was the perfect course. Not only have I expanded my knowledge, but it was also relevant and practical. I was also encouraged by our Key Individual, Neels Grobbelaar, to enrol for it and then to further qualify myself as a CFP©, and I am so thankful now that I did,” says Du Toit.

Time management and online learning

Edel Goldbach, academic manager at MBSE, says there are many benefits to online learning, but, at the end of the day, you get out of online learning what you put into it.

“Online learning is perfect for self-disciplined, independent, tech-savvy, motivated, and driven people. It also requires commitment,” Goldbach says.

Students who enrol for MBSE’s courses have the option to complete their studies either over one or two years.

The Postgraduate Diploma consists of four compulsory modules: financial planning environment, personal financial planning, corporate financial planning, and a case study module.

Naidoo, who completed the course over a year while working, says finding the best time to study while juggling his responsibilities at work and home was challenging at first.

“My daily schedule involved a 3am start with two hours of studying, followed by an hour of exercise, and then work. Evenings were dedicated to my family. I aimed to maintain consistency throughout the year,” he says.

Naidoo says maintaining discipline in online learning is crucial.

“Initially, I faced challenges in underestimating the reading workload, especially in the financial planning environment module. To overcome this, I adjusted my approach, breaking down the material into smaller, manageable portions,” he says.

Van Heerden says with study/work/life balance in mind, he chose to complete the post-grad over two years.

“Even then, I still had to schedule my time very deliberately to complete the required tasks and studies. The key is simply to schedule the time and then to get stuck into it.”

Van Heerden adds that although MBSE provides a timetable for the completion of tasks well in advance, he almost got tripped up on his first assignment.

“I had to put in some serious effort and late hours to make the deadline, simply because I didn’t schedule my time correctly. Rather start early and expect it to take longer than planned,” he says.

Du Toit says she too decided to complete the course over two years because it allowed her to focus properly on her studies and work while allowing for family time. Because of her inherent curiosity and interest in the subject matter, she found that she did not need to stick to a study schedule.

“I like to read and do research about a subject, especially and even more so when I am studying or providing feedback to my clients. I enjoy information, and studying was like that for me, as the material and handbooks kept me interested, and I was motivated from the beginning to finish this course,” says Du Toit.

Quality of study material and support

All three top achievers were full of praise when it came to the quality of the study material, as well as the support received by the MBSE team during their studies.

Naidoo described the study material as very user-friendly, accessible, and easy to understand.

“Edel’s responsiveness and support further enhanced the learning experience,” he says.

Van Heerden says the MBSE learning centre provides plenty of resources, but the South African Financial Planning Handbook is essential.

“It is such a valuable learning tool, and one that you will keep using well after you are done with your exams,” he says.

Du Toit shares she used the study guides that were provided as references but mainly used the prescribed textbooks.

“The prescribed textbooks are well written, and the new Case Study Handbook is a great addition. The videos and papers and examples that were shared were very helpful,” she says.

Calling the support received by the MBSE team “commendable”, Naidoo says when he faced challenges with a lecturer’s delayed script marking, MBSE promptly organised a call, “demonstrating their efficient handling of such issues”.

Van Heerden says he had a couple of queries related to assignments and projects during his studies to which he “received a quick and informative reply”.

“I always got the impression that whoever responded to me, wanted to help, was passionate about what they did and wanted to be there,” says Van Heerden.

Du Toit says when she needed to chat through things, Edel and Tyrone Ford, MBSE senior lecturer, would go out of their way to help.

“They called me, arranged online meetings, and so on. I really appreciate them, and they are the best and very skilled people,” says Du Toit.

2024 enrolments are open

Naidoo says his advice for prospective students is to have a clear understanding of their goals and objectives before enrolling in the course.

Van Heerden says the post-grad qualification carries weight in the financial industry, and for a good reason.

“It is a fair amount of work and rightly so. If you are working already and have a family, I would suggest spreading the qualification over two years. It can be done in one, but it does require your attention. That said, if you plan well (which you should be able to do as a planner) it is very manageable and rewarding,” he says.

Du Toit says those thinking of enrolling for the post-grad need to do it for the right reasons.

“You need to be passionate about this industry and wanting to add value and better yourself. Keep doing your bit every day, keep reading up, challenge yourself, and ask the relevant questions. Don’t think you will just pass it if you start studying a week before the exams. In the end, the effort that you put in, you will get out and see it in your results,” she says.

Applications for the first semester are now open and close on Monday 29 January 2024.

Brummer says MBSE is excited to welcome the Class of 2024 in February.

“We look forward to breaking more records in the next academic year!”

The Postgraduate Diploma in Financial Planning is one of five accredited qualifications offered by MBSE. The others are:

- Advanced Certificate in Financial Planning (NQF 6)

- Occupational Certificate: Compliance Officer (NQF 6)

- Higher Certificate in Wealth Management (NQF 5)

- Higher Certificate in Short-term Insurance (NQF 5)

Apply today at www.mbse.ac.za.

For more information, contact us at help@mbse.ac.za.

I really appreciate the opportunity I will highly use it 🙏