Tax compliance, but more importantly, voluntary tax compliance, remains a challenge for many tax authorities, particularly in countries where taxpayers have little trust in their governments.

PwC recently highlighted a report from the African Tax Administration Forum (AFAF) that emphasises the importance of trust and facilitation as the key drivers of voluntary tax compliance, rather than the traditional big stick approach.

The ATAF report, which was published in October last year, showed progress with taxpayer education, the simplification of systems and processes, and the prepopulating of tax returns (facilitation).

“While the role of improving public trust in tax administration and government is well acknowledged as an important driver of voluntary tax compliance, little has been done, and there is still a lot of scope for improvement,” the ATAF analysis of nine tax African authorities, including the South African Revenue Service, found.

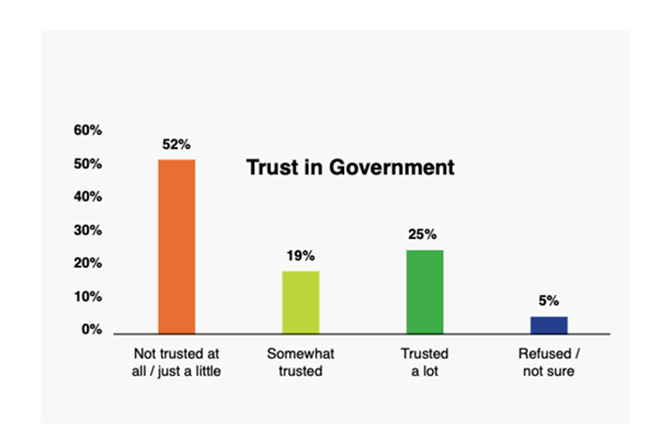

“Many Africans do not trust their governments to deliver public goods and services. Concerns of high levels of corruption and poor usage of public funds are widespread in many African countries.”

Voluntary tax compliance is ultimately achieved when there is a rapport between government and its taxpayers, and each party fulfils its obligations regarding the social contract.

According to PwC’s 2024 Taxing Times survey, 54% of the respondents felt that it had become easier to comply with their tax obligations. However, almost half still found it challenging to be compliant.

Kyle Mandy, director, and Adelheid Reyneke, senior manager at PwC, suggested that SARS considers establishing an open line of communication with specialists to enable taxpayers to seek assistance with the interpretation and execution of tax legislation.

“The call centre does not appear to be helpful to taxpayers,” they wrote in the May PwC Tax Synopsis.

Less than half the respondents in the Taxing Times survey indicated that their trust in SARS has remained the same since the previous survey period. Improvement in trust levels will translate into “increased tax morality and, ultimately, the voluntary payment of tax”.

Legislative interpretation

Joon Chong, tax partner at Webber Wentzel, says SARS’s “narrow and aggressive interpretation” of legislation in many instances gives rise to uncertainty in tax law.

She refers to the well-publicised Coronation case that dealt with the foreign business establishment exemption (FBE). The courts were asked to interpret the terms “the business of that controlled foreign company” and “the primary operations of that business” in the FBE definition.

The matter went all the way to the Constitutional Court, which effectively found that SARS’s approach was anti-business and hindered the expansion of South African companies into global markets.

Read: Important lessons from the Constitutional Court in the Coronation case

Chong says when a taxpayer does achieve success before the lower courts, the chances are good that SARS will appeal the matter.

This happened in another interpretation case where the Aggregate and Sand Producers Association of Southern Africa (ASPASA), the representative body for small businesses and individuals holding an interest in surface mining, asked for a declarator on the meaning of “bulk” in the Mineral and Petroleum Resources Royalty Act.

It wanted clarity on what constitutes the first point of sale for the calculation of royalty payments to the state for the extraction of aggregates. The court found in ASPASA’s favour.

SARS’s request for leave to appeal was dismissed. The court found that the grounds on which SARS based its request was “unpersuasive”, describing its interpretation of “bulk” as “unbusinesslike and insensible”.

Chong notes that more often than not, SARS does not properly consider the responses of taxpayers when there is a dispute. Taxpayers are put through the wringer by having to object to a decision or an assessment, having the objection disallowed, appealing, and ending up in the alternative dispute resolution process.

“They can only make headway with their case when they are faced with a SARS official during the alternative dispute resolution engagement. This is unfortunate because in many instances the answers were already supplied during the initial responses to the assessment.”

‘Open communication, justice and accountability’

ATAF notes in its report that trust is fostered by “open communication, justice, and accountability”. Individuals are more inclined to comply voluntarily with their responsibilities when they have faith in government.

“Accordingly, our main recommendation is that improving voluntary compliance specifically and revenue mobilisation generally requires a whole-of-government approach.”

ATAF believes the tax authority and all other government agencies need to work together, particularly regarding fulfilling the social contract.

“Tax education programmes should not only focus on maximising tax compliance but also focus on dissemination of information about public services, budget transparency, and government accountability,” ATAF recommends in its report.

PwC believes good progress has been made with the key drivers of voluntary tax compliance in South Africa. Mandy adds that SARS should continue to engage with taxpayers and tax professionals on ways to improve trust and facilitation.

“Hopefully, the modernisation of SARS’s systems over the medium term will also aid with voluntary tax compliance.”

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law, and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article is a general guide and should not be used as a substitute for professional tax advice.