When it comes to meeting the transformation goals outlined in the Amended Financial Sector Code (FSC), life offices and asset managers have made steady progress overall, “but there’s definitely still work to do”.

Adriaan Burke, the recently appointed acting chief executive of the Association for Savings and Investment South Africa (ASISA), made this statement during a media conference on Tuesday.

The conference unpacked the findings of a research report titled “Association for Savings and Investment: a five-year transformation journey (2018 to 2022)”.

ASISA recently released an updated overview of the transformation progress made by members over the five years to the end of December 2022. The report builds on the previous edition by adding data collected for 2021 and 2022.

Burke said another key learning garnered from this period was that the economic environment has a direct impact on the delivery of some of the elements of the score.

“So Covid, for example, had an impact on the economy, and it made the deliverable of some of those elements of the scorecard that much more difficult and a challenge,” he said.

The report was commissioned by the ASISA board and researched and collated by independent consultants. It represents 97% of assets under management (AUM) for life offices and more than 85% of AUM for asset managers. In total, that represents the views of about 80 000 employees in the savings and investment industry.

At the media conference, Anton Pillay, the chairperson of ASISA, thanked members for their willingness and transparency “in what is a meaningful benchmark exercise”.

“Now that we’ve established our benchmark report, amidst a myriad of similar reports used to measure transformation, it assists us in not only understanding where we are succeeding, but more importantly, where we need to improve. And we can now track this more effectively,” Pillay said.

Read: FSCA, B-BBEE Commission to work together to advance transformation

B-BBEE scorecard – how it works

The amended FSC came into effect on 1 December 2017 and measures financial sector transformation using a balanced Broad-based Black Economic Empowerment (B-BBEE) scorecard.

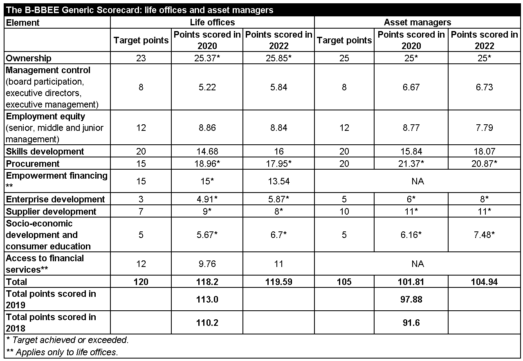

Life offices are measured against the following scorecard elements:

- ownership;

- management control (board participation, executive directors, executive management);

- employment equity (senior, middle, and junior management);

- skills development;

- procurement;

- enterprise development;

- supplier development;

- socio-economic development and consumer education;

- empowerment financing; and

- access to financial services.

Life offices attained or exceeded the target points set by the FSC in five of the elements for 2022: ownership, procurement, enterprise development, supplier development, and socio-economic development and consumer education.

While not having reached the target points in management control, skills development, and access to financial services, there was a slight improvement in the points achieved by life offices compared to 2020.

In the elements employment equity and empowerment financing, life offices scored slightly lower in 2022 than in 2020.

Asset managers are measured against these same elements, excluding the last two listed – empowerment financing and access to financial services.

They too attained or exceeded the target points set by the FSC in five of the elements for 2022: ownership, procurement, enterprise development, supplier development, and socio-economic development and consumer education.

While not having reached the target points in management control and skills development, there was a slight improvement in the points achieved by asset managers compared to 2020. However, asset managers scored lower for employment equity in 2022 than in 2020.

Making headway, step by step

Lister Saungweme, ASISA’s senior policy adviser for transformation, skills development, and education, said, overall, life offices and asset managers exceeded most B-BBEE ownership targets in 2022.

The ownership element of the FSC scorecard measures the extent to which black people own equity in a company.

Another notable improvement was that contributions by ASISA members towards enterprise and supplier development (ESD) exceeded the targets in 2021 and 2022.

Saungweme said the aim of ESD was to create sustainable small and medium enterprises, resulting in job creation and economic growth.

In 2022, the total ESD contributions by life offices and asset managers amounted to R617 million.

Socio-economic development and consumer education targets were also surpassed in 2022, with a total spend by life offices and asset managers of R483m, of which R88m a year was used for consumer education.

Falling short of expectations

Saungweme said the report showed that reaching management control and employment equity targets remained a challenge for an industry dependent on scarce specialised skills such as actuarial and asset management expertise.

“While we are not where we want to be, we are seeing progress, albeit slow progress, towards meeting management control, employment equity and skills development targets,” she said.

Of concern, according to Saungweme, was that there had been no significant improvement in the number of female portfolio managers, which stayed static at 17%. She added that similarly, the report highlighted slow progress in the advancement of black women across junior, middle, and senior management, both for life offices and asset managers.

However, she said, a more encouraging picture was emerging in the management control scorecard element, where the percentage of black women in life office executive management increased from 8.23% in 2018 to 21.91% in 2022.

In the asset management space, the representation of black women in executive management increased from 14.93% in 2018 to 20.83% in 2022.

Need for skills development

In the report’s executive summary, a drop-off in compliance at some of the junior levels from 2021 and 2022, accompanied by lower skills spend on non-management staff and the unemployed for life offices, was noted as a concern.

“This implies that the industry’s skills pipeline may come under pressure, which will stunt further progress at the senior levels in future years,” the executive summary read.

Saungweme said skills development was critical to the savings and investment industry because it determined the growth of the pipeline of black employees with specialised skills.

“Unfortunately, our industry’s skills development efforts were negatively impacted by the Covid-19 pandemic, which is reflected in the progress made towards achieving targets for 2021 and 2022.”

She explained that the financial impact of Covid on companies resulted in reduced spending on skills development. In addition, the sudden shift to remote working environments slowed the skills development of junior black employees and the onboarding of black interns.

Saungweme said employment equity, especially at the senior level, could not be achieved without a strong pipeline of black graduates with the scarce skills that employers in the savings and investment industry require.

Scorecard target rethink

During the media conference, the question was raised whether the targets set by the FSC in 2017 remained relevant or if they warranted a review.

Saungweme said that the discussion was currently tabled at the Financial Sector Transformation Council (FSTC).

“Our members respond to the targets that have been negotiated by different stakeholders, but it’s a discussion that can only be responded to by the FSTC channels,” she said.

Pillay added that the discussion around the scorecard had been ongoing for the past four years.

“There have been some good conversations taking place in the FSTC in the last few months, and we believe we should be in a position to actually release a new scorecard sometime this year,” he said.

Scorecard snapshot

The table below provides a snapshot of how ASISA members collectively performed against the targets of the various elements that make up the Amended FSC Scorecard.

Excellent

Ex

Good day, can you give me info on the RE5 program please.

Good day

Thank you for your interest in Moonstone’s RE service.

Information about how to register to write the RE exams can be found here: https://www.moonstone.co.za/services/regulatory-exam-body/

Note: Moonstone does not provide RE study material or workshops. In terms of our mandate from the FSCA, we cannot recommend training providers.

We do publish guides and other resources to help you prepare for the exams: https://www.moonstone.co.za/library/regulatory-examination-library/#RE1

We also have four exam preparation videos: https://vimeo.com/showcase/regulatory-exam-preparation

The exam fees are set by the Financial Sector Conduct Authority. The current fee to write the exam is R1 300 (VAT inclusive) per examination per candidate.

Moonstone has venues around South Africa where students write the exams. To find a venue, go to https://www.faisexam.co.za/nav/public and click on the Venues tab. To check the exam schedule, click on the Exam Schedule tab.

I would like to be part of this organization