A Crypto Assets Market Study has identified 10 common risks in the crypto asset environment that pose a significant threat to customers.

Published by the FSCA last week, the study used a “mixed methods” approach, obtaining information on crypto asset activities in South Africa directly from crypto asset financial service providers through an Information Request issued in December 2022.

The scope of the Information Request covered crypto asset activities and business practices of crypto asset FSPs in South Africa as of December 2022.

A total of 47 crypto asset FSPs responded “substantially”.

According to the Authority, the goal of the Information Request is to enhance the FSCA’s understanding of current crypto asset activities by crypto asset FSPs, helping to identify conduct risks. These include regulatory, volatility, market, operational, liquidity, cybersecurity, adoption, anti-money laundering (AML) and Know Your Customer (KYC), and terrorist financing and fraud risks.

“To regulate effectively, the Authority needs to develop a deeper understanding of these risks and market dynamics, to refine its approach to licensing and supervising crypto asset activities with a view to appropriately mitigate investor protection risks and ensure better financial customer outcomes,” the FSCA states.

The size of the crypto economy in Africa

In sub-Saharan Africa, the crypto economy comprises 2.3% of global transactions (July 2022 to June 2023), with $117.1 billion in on-chain value. Despite its small size, key populations in countries such as Nigeria (second on Chainalysis’s Global Crypto Adoption Index), Kenya (21), Ghana (29), and South Africa (31) show significant crypto adoption.

A 2022 study by Triple A indicates that 9.44% of South Africa’s population owns crypto assets, with an expected 43% usage by 2030.

Looking at total annual revenue among crypto asset FSPs, 38% earn less than R1 million, 46% earn between R1m and R50m, and 10% derive income from both regulated and unregulated financial services. Over half of crypto asset FSPs focus entirely on retail customers.

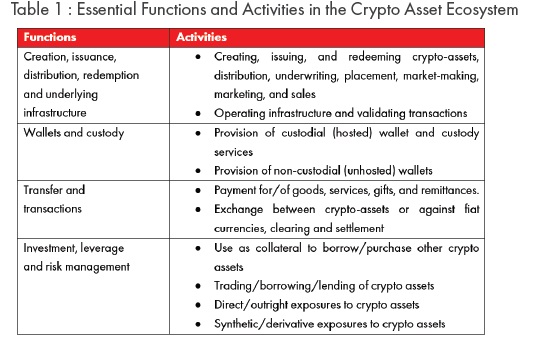

According to the study, the activities in the crypto asset ecosystem identified span both financial markets and financial services. The researchers state that this will be instructive for the development of the Conduct of Financial Institutions (COFI) Bill and revisions to the Financial Markets Act.

“Understanding the extent of retail participation over time will be critical in assessing the consumer protection risk and impact of this market.

Under the COFI Bill, provision is expected to be made for a targeted regulatory framework for retail customers.

Understanding marketing and distribution strategies will be a particular focal point.

“Consistent with international developments, consideration may be given to prohibiting more risky products and services from being marketed to higher-risk and more vulnerable customer groups,” the research authors say.

Grappling with governance

Globally, governments face challenges regulating the decentralised crypto asset ecosystem. Issues include jurisdictional complexities, fitting crypto asset service providers (CASPs) into existing financial laws, and addressing concerns such as money laundering, fraud, and financial system stability.

In South Africa, the Crypto Assets Regulatory Working Group (CAR WG) of the Intergovernmental Fintech Working Group published the final Position Paper (CAR Paper) in June 2021, signalling a regulatory response to crypto assets. The CAR Paper outlines 25 recommendations for a regulatory framework, proposing the FSCA as the regulatory body for licensing, supervising, and investigating crypto asset FSPs.

In November 2020, the Authority drafted a Declaration of crypto assets as a financial product under the FAIS Act, expressing keen interest in CASPs.

Read: Crypto Assets – Draft declaration to define it as financial product

In October 2022, the FSCA officially declared crypto assets as financial products, mandating registration for those providing financial services related to crypto assets. This establishes a regulatory regime with oversight and supervision by the FSCA.

Together with the declaration, the FSCA also provided a general exemption of persons rendering financial services in relation to crypto assets from certain requirements (FSCA FAIS Notice 90 of 2022).

One of the conditions of the general exemption was the submission of an application between 1 June and 30 November 2023 to render financial services in respect of crypto assets as defined in the declaration.

Read: FSCA discloses how many crypto licence applications it is processing

As to what’s next, according to the study’s researchers, broader developments surrounding crypto assets will likely be given effect through the COFI Bill.

“Financial services related to crypto assets will likely be included in the licensing activities under the COFI Bill, potentially expanding the scope of crypto asset activities that are currently regulated under the FAIS Act,” the study says.

Key findings

The study finds that most crypto asset FSPs in South Africa provide financial services by making use of unbacked crypto assets (60%), followed by stablecoins (26%) such as USD Coin and Binance Coin. This is followed by security tokens (7%) and Non-Fungible Tokens (NFT) (4%).

Although there is no internationally agreed taxonomy for crypto assets, the study provides the following descriptions for the types mentioned:

- Unbacked crypto assets are transferable, primarily designed to be used as a medium of exchange and are often decentralised. These crypto assets are the oldest and most prominent type of crypto asset. They do not rely on any backing asset for value but instead on supply and demand. Most unbacked crypto assets are currently used for speculation and not for payment purposes. Prominent examples are Bitcoin and Ether (although in some jurisdictions with broad definitions of securities, these might be considered security tokens).

- Stablecoins aims to have a stable price value. This objective is normally pursued by the crypto asset being linked to a single asset or a basket of assets – for example, fiat funds, commodities such as gold, or other crypto assets. Prominent examples are Tether, Binance USD, and USD Coin.

- Although the definition of a security token varies across jurisdictions, these are tokens that provide the holder with rights like that of traditional security – for example, the right to a share in the profits of the issuer. Securities tokens are often subject to securities laws and regulations.

- NFT – a unique digital asset that represents ownership of a specific item or asset – for example, art, music, in-game items, and videos. They are bought and sold online, frequently with crypto assets, and they are generally encoded with the same underlying software as many crypto assets.

Most unbacked crypto assets are used for speculative purposes rather than as a medium of exchange – for example, the buying and selling of goods and services, the study finds.

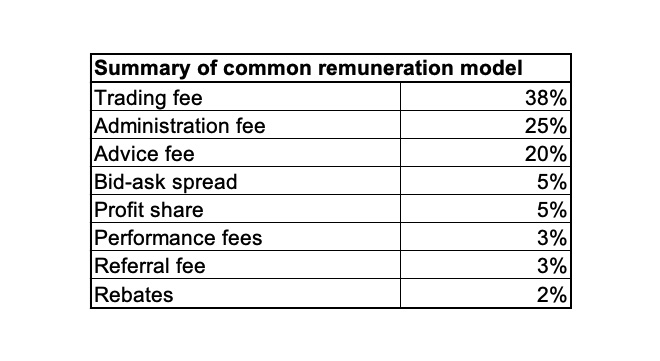

When it comes to the remuneration model used, most crypto asset FSPs charge trading fees (38%) followed by 25% who earn their revenue from administration fees, while 20% earn revenue from advice fees.

Another key finding in the study is the fact that some of the financial services in respect of crypto assets and technical activities inherent to the provision of crypto assets financial services are outsourced.

These financial services include AML/KYC, exchange platform, custody, cyber security, information technology services, and blockchain monitoring services.

“The outsourcing of the activities does not relieve crypto asset FSPs from their responsibilities to ensure fair treatment of customers,” the research authors state.

In the study, almost all crypto asset FSPs claim to disclose the risks relating to crypto asset activities to their customers and the public. This includes:

- Risks are disclosed when clients are signing up.

- Risk disclosures are made on the website, exchange platform, and in all communication with the clients.

- Risk disclosures are made on social media platforms and in webinars, events, and media interviews.

- Clients sign a crypto assets declaration describing the risks and that they understand the implications of trading with crypto assets.

The researchers comment that the accuracy of this claim and the quality of disclosure will have to be monitored over time.

Cross-border monitoring

Monitoring across borders is crucial to prevent money laundering and funding terrorism. It helps safeguard market integrity and the global financial system. But because of its digital nature, crypto assets are easily “traded across borders”, government authorities do not currently have the information they need to monitor crypto-asset revenues efficiently.

Read: South Africa undertakes to implement Crypto-asset Reporting Framework

Among the respondents, 56% indicate that cross-border monitoring is not applicable in their current operations, while 42% consider cross-border monitoring as part of their business to promote good governance, fair treatment of customers, and regulatory compliance.

Something that bodes well for regulatory and supervisory protection, the study states, is the strong local presence of crypto asset FSPs.

The study finds that the largest percentage of crypto asset FSPs have established their head offices in Cape Town. It is followed by Johannesburg (33%) and Pretoria (7%). A small proportion of crypto asset FSPs operating in South Africa have their head offices in foreign countries.

“This is important because it, amongst other things, creates a physical presence that would allow the FSCA to have appropriate oversight over and ensure accountability of the institution conducting activities in South Africa,” the research states.

For the 10% of entities that have an offshore head office, the authors state consideration will have to be given to the requirements relating to having a local branch.

BURST A BROWN PAPER BAG FULL OF AIR.

CAPTURE THE ESCAPED AIR AND PUT IT INTO THE BROKEN PAPER BAG.

THE AIR IN THIS ANALOGY IS CRYPTO. BITCOIN AND THE REST.

AIR HOT COLD IS MORE VALUABLE THAN CRYPTO.

THANK YOU CHARLIE MUNGER.