Advice is evolving from transactions to trusted relationships

The industry is moving beyond sales models towards relationship-led, purpose-driven engagement built on trust, transparency, and technology.

The industry is moving beyond sales models towards relationship-led, purpose-driven engagement built on trust, transparency, and technology.

The transition from commission-based remuneration succeeds only when advisers clearly communicate what clients are paying for.

This edition of Cover to Cover explains medical scheme dependant rules, required documentation, and how advisers can help clients keep their families covered.

For single parents, a ‘one-family, one-premium’ gap policy turns unpredictable medical shortfalls into a fixed monthly cost, protecting household cashflow.

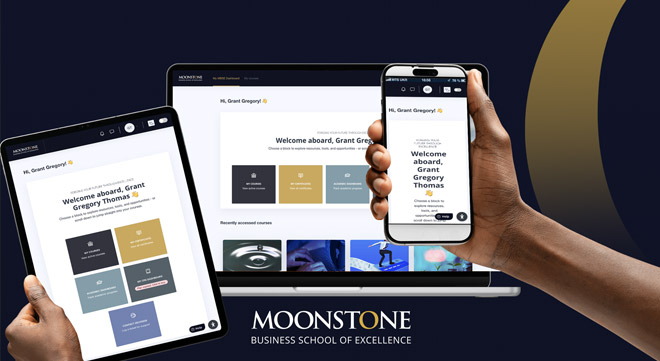

MBSE’s free Virtual Open Days from 11 to 13 November offer aspiring and established finance professionals a chance to explore accredited qualifications, engage with lecturers, and map out their next academic step.

Incorrect source codes trigger unnecessary tax for hundreds of expatriates. The result is lost refunds or large tax bills.

Across three days in November, aspiring and current financial services professionals can explore MBSE’s suite of accredited qualifications.

MBSE combines conduct and regulatory modules with customer-service training – and offers discounts up to 30% for bundled purchases.

In a landscape defined by rising costs and digital disruption, brokers who embrace technology and tailor gap cover to individual life stages will lead the way.

MBSE’s first CPD course in isiXhosa makes compliance training more accessible with translated material, subtitles, and assessments.

Advisers can highlight their human edge by spotting common gaps in AI-generated DIY plans, from overconfidence in returns to blind spots in risk protection.

Moonstone’s enhanced Self-Comply Service gives small FSPs and sole proprietors even stronger compliance support, including dedicated consultants, customised plans, and proactive monitoring.

Kickstart your career with MBSE’s accredited online qualifications – from certificates to its new future-ready BCom degree.

Marriage, divorce, children, or business changes – life doesn’t stand still, and neither should your will. Wills Week is a reminder to act now.

Students can now access MBSE’s courses and materials with a single click from desktop or mobile, enjoying seamless, on-the-go learning without opening a browser.

The first edition of our new series unpacks the types of medical plan, who they suit, and why the cheapest option isn’t always the smartest choice.

As South Africa prepares for a tougher FATF evaluation, FSPs must master risk-based compliance – balancing security, cost, and strong partnerships to target real threats and protect legitimate customers.