It is astounding but not surprising how Bitcoin and, for that matter, the cryptocurrency markets have evolved since my article on the subject in March last year (“Bitcoin’s price discovery justifies a core hold”).

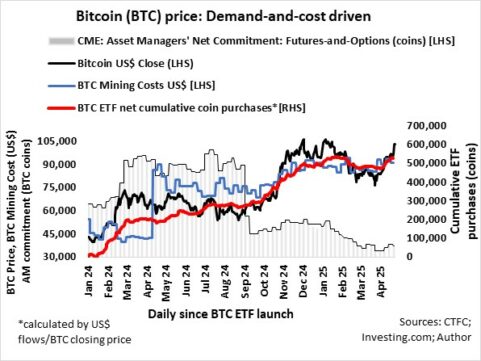

The net cumulative purchases of Bitcoin via exchange traded funds, calculated by ETF daily flows in US dollars divided by the closing price of Bitcoin (published by Investing.com), from mid-March increased 2.5-fold to 924 000 coins currently held by pure Bitcoin ETFs, which is equal to about 5% of the approximately 20 million Bitcoins in circulation.

The adoption of Bitcoin since the launch of the first Bitcoin ETF in mid-January last year can be classed in three distinct phases.

The first phase was from the launch to mid-March, when net inflows (excluding Grayscale Bitcoin Trust, “GBTC”) amounted to about 430 000 coins. Bitcoin’s price was initially kept in check by GBTC ETF, which is not registered under the Investment Company Act of 1940, and is therefore not subject to the same regulations and protections as ETFs and mutual funds registered under the 1940 Act. GBTC ETF sold about 215 000 coins, of which 141 000 coins were sold in the first three weeks after the first Bitcoin ETF was launched.

The net ETF inflows (excluding GBTC) in the second phase, from mid-March to early October last year, amounted to approximately 282 000 coins, which was partially satisfied by Grayscale selling about 150 000 coins. This second phase was also characterized by Bitcoin’s fourth halving on 19 April, which, according to MacroMicro, saw the average cost to mine one Bitcoin doubling overnight, considering electricity consumption and the issuance of Bitcoin.

During this period, Bitcoin’s price traded below mining cost, probably because of downside pressure from miners having to sell their Bitcoin inventories to cover the massive increase in mining costs, and some miners ceased operations. Also, according to Commodity Futures Trading Commission (CFTC) statistics (CME: Asset Managers’ Net Commitment: Futures-and-Options), asset managers maintained net long positions of approximately 90 000 Bitcoins via derivatives throughout the period until mid-September, when the exposure was slashed by about 50 000 coins. I would not be surprised if call options were exercised, or futures were swopped for “physical” Bitcoins on other exchanges, or exposures were switched to Bitcoin ETFs.

The third phase, from October last year, heralded a new and unchartered period for Bitcoin and other digital assets.

Net inflows into Bitcoin ETFs equalled about 261 000 coins, or US$26 billion in today’s money, amounting to total net inflows of nearly US$100bn at current market prices since the launch of the first official Bitcoin ETF.

In the second week of November last year until February this year, Bitcoin’s price rose above the cost of mining, and it has roughly matched the cost since then.

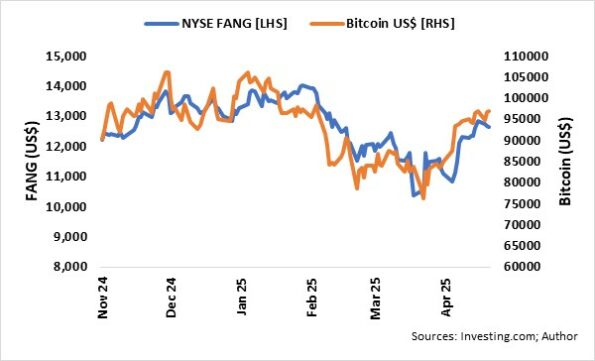

Since mid-November last year, after the re-rating of Bitcoin (when the price at least matched the cost of mining or break-even), Bitcoin’s price reflected the trend and moves of the NYSE FANG index. The relationship is linear, with r-squared of 0.51, Delta of 0.86, and Alpha of 0.13%. From CFTC statistics, it is evident that asset managers are increasingly interested in Bitcoin because CME: Asset Managers’ Net Commitment to Bitcoin: Futures-and-Options (in coins) is positively correlated with the NYSE FANG index. Yes, I may not be worse off by having some exposure to Bitcoin instead of a 100% holding in the Magnificent 5.

A fourth phase is in the making. According to Reuters, in July last year “Russian lawmakers passed a bill that will allow businesses to use cryptocurrencies in international trade”. According to reports, China and Russia are already settling energy transactions using Bitcoin and other cryptocurrencies. On 23 January, US President Donald Trump signed an executive order “to promote United States leadership in digital assets and financial technology”. Yes, institutional adoption is under way.

From the accompanying graphs, it is evident that short-term movements in Bitcoin’s price are mostly influenced by changes in asset managers’ net commitment, but the price-trend is driven by net inflows into Bitcoin ETFs. That excludes any re-rating because of adoption (Russia, China, US, or elsewhere).

I care about Bitcoin adoption because it is here to stay and will increasingly be part of my life and investment portfolio. How much should I be invested in Bitcoin (coins, positive derivatives, ETFs)? I am overweight the total market cap of Bitcoin ETFs of about 0.2% of the S&P 500, if it were included, because further adoption is likely to drive Bitcoin relative to other growth assets.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.