South Africa’s short-term insurance industry reported gross written premiums (GWP) of R131.6 billion last year, an increase of 7% from 2020, according to KPMG’s latest survey of the insurance sector.

“This is a worthy top-line performance, considering the state of the economy, competition in the market, and the ongoing Covid-19 impact,” said Benjamin Vosloo, KPMG associate director: insurance.

The growth in GWP for the non-life insurance industry exceeded the headline year-on-year consumer price index increase of 5.9%.

KPMG’s conclusions are based on an analysis of 34 non-life insurers, whose GWP comprise about 80% of the industry’s GWP.

Top five contributors to net profit

KPMG said the short-term industry has shown “incredible resilience” by getting back to pre-pandemic results, with profit after tax (PAT) increasing by 110% from R5.6bn in 2020 to R11.7bn last year, largely a result of a lower industry loss ratio of 57% (61% in 2020).

The following five non-life insurers made the biggest contribution to the improvement in the industry’s PAT last year:

- Escap, the captive insurance company of Eskom, was the largest contributor to the industry’s PAT in 2021.

Its net profit increased by 481%, from R491 425 to R2.85bn. The last time Escap reported PAT above R2bn was in its 2017 financial year.

The main contributors to Escap’s 2021 PAT were an increase in investment income of R0.9bn (attributable to an increase in unrealised gains on listed equity securities) and a 62% decrease (R1.57bn) in claims.

- Santam’s PAT increased by 853% to R2bn because of the recovery in its property book, which was negatively impacted by business interruption (BI) claims in the 2020 financial year.

Santam’s underwriting account was impacted by several large fire claims in the first half and last quarter of 2021 and excessive rains across large parts of South Africa.

Frost claims in certain regions contributed to the overall gross claims paid and reserved exceeding R1.1bn, resulting in a net underwriting loss of R92 million for the crop business in 2021.

- Old Mutual Insure’s PAT increased by 188%, to R0.43bn, in 2021, following a loss after tax of R0.48bn in 2020, when it was significantly affected by BI claims.

Old Mutual recorded a strong performance by its iWyze businesses last year.

- Bryte increased its PAT by R0.34bn and recorded a profit in 2021 of R0.28bn, after a loss after tax in the 2020 financial year. Bryte improved its underwriting result: a loss of R248m in 2021, compared to a loss of R404m in the previous financial year.

- OUTsurance’s GWP increased by 6% to R9.4bn in 2021, resulting in an increase in PAT of 16% to R1.94bn. A contributing factor was the performance of its equity portfolio.

Growth in OUTsurance Business recovered because of the expansion of OUTsurance Brokers.

Five companies whose GWP outperformed the industry

The top five non-life insurers that outperformed the industry GWP growth rate of 7% were:

- Escap’s GWP grew by R1.2bn (a growth rate of 38%).

KPMG said Escap has diversified its client base by providing insurance to other public entities. This helped Escap to generate additional income and reduce policyholder concentration risk.

- Lombard, which grew its GWP by R0.48 billion (22%).

- Discovery Insure, which grew its GWP by R0.68bn (18%). This was attributable to strong new business growth, with a large contribution from Discovery Business Insurance.

Discovery Insure reported that it experienced its lowest lapse rates since inception; 2% lower than in the previous year.

- Bryte, which grew its GWP by R0.66 billion (14%).

- Guardrisk, which grew its GWP by R0.98bn (9%). This growth appeared to be the result of healthy new business volumes in Guardrisk General Insurance.

Market share

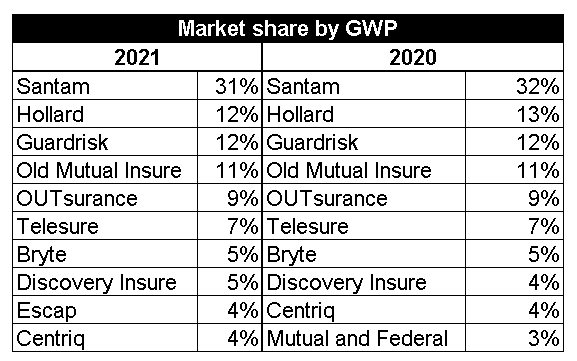

In 2021 the market share of the 10 largest insurers by GWP amounted to 76.5% of the total market share, which was relatively consistent with 76.8% in 2020.

Comparing the market share positions of 2021 to those of 2020, the top eight insurers remained consistent, with marginal shifts in market share.

Escap moved back into the top 10 from eleventh in 2020 to ninth in 2021. This resulted in Centriq moving down to tenth position, pushing Mutual and Federal out of the top 10 into eleventh position.