A recent global survey conducted by the Financial Planning Standards Board (FPSB) has shed light on the attitudes of financial planners towards artificial intelligence (AI) and its impact on their profession.

The study found a predominantly optimistic outlook on AI’s potential to transform financial planning – albeit tempered by concerns about data security and the reliability of AI-generated outputs.

“We are witnessing a pivotal moment in the financial planning profession as financial planners embrace AI to work smarter, allowing more time to engage in deeper human connection with clients, such as navigating difficult conversations that impact financial decision-making and providing clarity and support to stay on track to achieve their life goals,” Dante de Gori, the chief executive of the FPSB, said in a statement accompanying the survey.

“This survey provides a valuable snapshot of how financial planning professionals worldwide are leveraging AI to stay competitive, improve work efficiency and better serve clients.”

The survey was conducted among 6 206 financial planners across 24 territories, including South Africa, between November and December 2024. The research was conducted by the FPSB and its network of organisations, which include the Financial Planning Institute of Southern Africa.

The FPSB is the standards-setting body for the global financial planning profession and owns the Certified Financial Planner (CFP) certification programme outside the United States.

Sixty percent of survey respondents have the CFP designation.

More than half (54%) of respondents said they work primarily in the banking sector, and 21% identified as independent financial advisers. Respondents work in firms ranging from solo practices (13% of respondents) to those with 150-plus planners (10%). Most (34%) work in a practice with between two and ten planners.

Most respondents (33%) personally serve between 51 and 100 clients, while 21% manage fewer than 50 clients, and 17% more than 500 clients.

Widespread adoption of AI

The report indicates that nearly two-thirds of financial planners (64%) are currently using AI (28%), piloting it (16%), or planning to adopt it within the next 12 months (10%). This high adoption rate underscores the growing recognition of AI’s potential to enhance financial planning services and operations.

AI adoption varies by firm size. The survey found that small firms (with two to ten planners) and very large firms (more than 150 planners) are more likely to adopt AI compared to medium-sized firms. This trend suggests that smaller firms, which may be more agile, and larger firms, which often have greater resources, are leading the charge in integrating AI technologies.

The primary driver for AI adoption, as reported by 61% of respondents, is internal business needs. This is followed by industry demand and client demand.

Despite the widespread adoption of AI, only 45% of respondents report that their firms have an AI policy or provide guidance on its use. However, 18% said a policy or guidance is being developed.

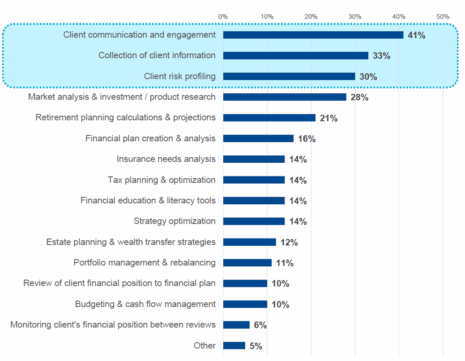

The survey found that AI is being integrated into several key client-facing functions. The top three uses are client communications (41%), collecting client information (33%), and client risk profiling (30%).

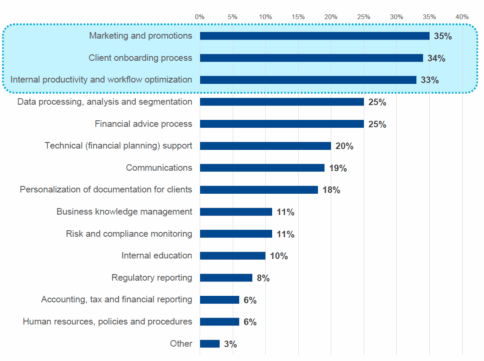

Beyond client services, AI is being leveraged to support business operations. The most common operational uses include marketing and promotions (35%), client onboarding (34%), and optimising productivity and workflow (33%).

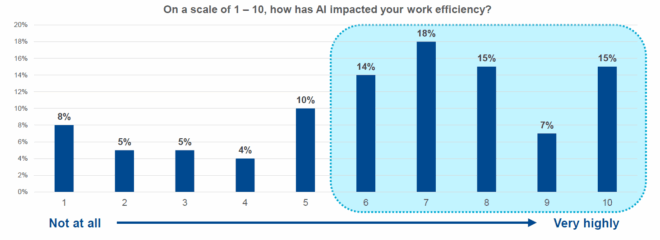

Overall, financial planners report that AI has improved their work efficiency.

When it comes to deploying AI, most financial planners (45%) rely on third-party vendor solutions. This is followed by firms that use in-house developed solutions or a combination of in-house and third-party tools.

The survey found that large language models and generative AI tools – such as ChatGPT, ClaudeAI, and Gemini – are the most commonly used AI models in financial planning, with 33% of respondents using them. These tools are valued for their ability to process and generate human-like text, making them useful for tasks such as client communications and data analysis.

Other popular AI tools are:

- AI built into financial advice software, which assists planners in providing tailored recommendations.

- Practice management tools, such as Microsoft Copilot and Salesforce, which help to streamline administrative tasks.

- Robo-advice platforms, used directly by clients for automated financial guidance.

Optimism about AI’s benefits

Half the respondents have a positive view on the impact of AI on financial planning, and only 8% view it negatively, while the rest are neutral.

Notably, 78% of respondents believe AI will enable them to serve their clients better, whereas 4% believe it will not and 18% are neutral.

The positive sentiment is underpinned by the expectation that AI can streamline some aspects of the financial planning process. Advisers believe the elements of the process that will benefit the most from AI are gathering client information, analysing data, and creating and presenting recommendations.

Furthermore, 60% of planners anticipate that AI will improve the quality of financial advice. Additionally, 59% of respondents expect AI to reduce the cost of financial planning services, potentially making them more accessible to a broader range of clients. In line with this, 60% believe AI will increase access to financial planning for underserved populations.

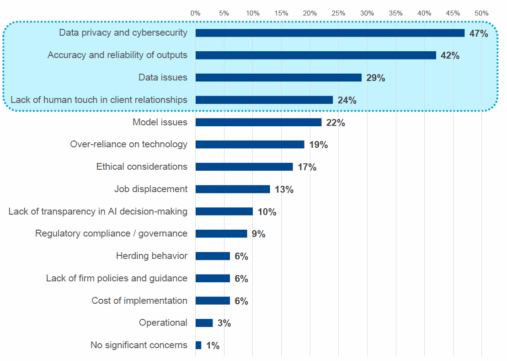

Despite the optimism about AI, financial planners are not without reservations.

The survey identifies data privacy and cybersecurity as the foremost concerns, with 47% of respondents citing these issues as significant challenges. Another major concern is the accuracy and reliability of AI outputs, noted by 42% of planners.

Adaptation and skill development

To integrate AI effectively into their practices, financial planners recognise the need for new skills and knowledge. The survey indicates that 49% of respondents prioritise professional development in data analysis and interpretation skills. This emphasis on data literacy reflects the growing role of data-driven decision-making in financial planning.

Moreover, 36% of planners believe that both the public and the financial planning profession would benefit from education and training on AI. This highlights the importance of fostering a broader understanding of AI’s capabilities and limitations to ensure its responsible and effective use.