Gold was my defensive strategy, but gold’s parabolic surge over the past few weeks has made me revisit this strategy.

From 2010 to the first quarter of 2022, the gold price was highly correlated with US 10-year Treasury Inflation-Indexed Security Yield, also known as TIPS. The supply and demand equation of gold changed from 2022 because central banks and other official institutions doubled their purchases of gold to an average of more than 30% of new mine production, from an average of about 15% in the 10 years from 2012. This effectively meant that the mine supply available to other gold-market players was reduced by more than 400 tons a year, and the price therefore had to react to attract secondary supply and restrict other demand (industrial and investment).

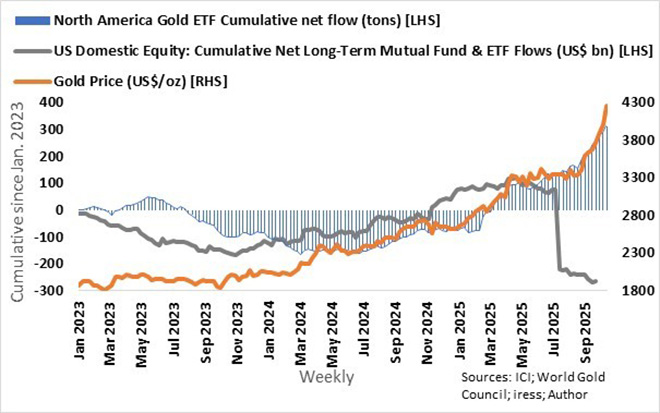

It is evident that asset managers and retail investors were late in recognising the change in the supply and demand dynamics. North American gold ETFs experienced cumulative net outflows of more than 164 tons from January 2023 to March 2024 as investors sold into the gold price rally.

Investor adoption of gold as a core asset was on the cards because gold displayed the characteristics of a defensive stock and proved to be a great asset to mitigate overall downside risk in a well-diversified investment portfolio, because it outperforms stocks in weak stock markets.

Since March last year, North American gold ETFs had net inflows of nearly 500 tons of gold, or about 14% of annual mine supply. More importantly, the cumulative inflows are highly correlated to the gold price and are therefore a major determinant of changes in the gold price. Net flows in and out of gold ETFs are driven by safe-haven demand caused by economic uncertainty, geopolitical risk, and factors such as tariffs and exuberant stock market valuations.

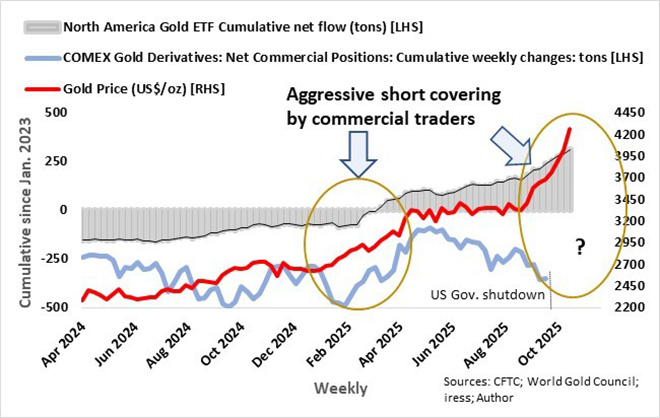

Commercial entities such as miners, refiners, jewellers, and other end-users use gold derivative instruments such as futures and options contracts “to lock in a price for future transactions and mitigate their exposure to price fluctuations” (AI). Their positions are referred to as commercial (Commitments of Traders Reports) positions on the Commodity Exchange (COMEX) and are normally net short (short positions exceed long positions). The cumulative net weekly changes since January 2023 ranged between minus 100 and minus 500 tons of gold.

Surging net gold ETF inflows tend to result in parabolic-like increases in the gold price, as untenable margin calls force commercial entities to cut their short positions. This was specifically evident from the end of January to mid-April this year when the commercials cut their short positions by about 400 tons of gold. North American gold ETFs had inflows of 190 tons over the same period. Yes, in total a mammoth 17% of annual mine production in three months!

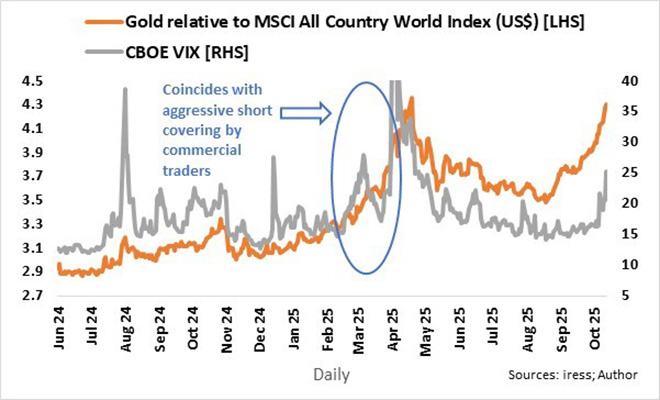

The main catalyst in the surge in demand was undoubtedly the tariff announcements that saw the Chicago Board Options Exchange’s CBOE Volatility Index (VIX) jumping from 15 to more than 40, indicating severe anxiety among investors. Gold outperformed the MSCI All Country World Index (USD) by more than 33% over the same period.

The gold price stabilised at the higher levels but underperformed global equities until August as the VIX eased. North American gold ETF inflows continued as investor sentiment regarding US equities soured, resulting in net long-term mutual fund and ETF outflows. The impact of gold ETF inflows was balanced by increased shorting by commercial entities on COMEX, though.

Gold’s new parabolic-like increase started in September. First, a spike in volatility was anticipated as volatility in all six years since 2019 moved higher after triple witching dates in September. Second, the possibility of regime change at the Federal Reserve, because the White House is challenging the Fed’s independence, is adding fuel to the gold price.

By the end of September, the commercial entities’ cumulative net short position on gold had increased by more than 250 tons since April this year. Due to the shutdown of the federal government, the Commodity Futures Trading Commission does not publish the Commitments of Traders Reports. However, the parabolic-like increase in the gold price points to aggressive short covering by commercial traders since end-September – like what happened earlier this year.

With the VIX at an anxiety level of 25, it seems a lot of future uncertainty is already priced into the gold price, specifically relative to the MSCI All Country World Index (USD). Yes, the risk/reward of the current gold price is above my threshold.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.