The Financial Sector Conduct Authority has invited stakeholders to comment on its proposed budget and levies for the 2026/27 financial year, which it published on 9 October.

The Authority is budgeting for gross revenue of about R1.23 billion, 12% more than the R1.099bn budgeted for in 2025/26, while operating expenditure will also be about R1.23bn, 9% higher than the R1.125bn in 2025/26. The difference between revenue of R1 230 718 251 and expenditure of R1 230 638 369 will result in a slight surplus of R79 882, compared with a deficit of R25.297 million in 2025/26.

Operating expenditure comprises staff expenditure of R876m (R800m) and general expenditure of R355m (R325m). Staff expenses represent 65% of the total expenditure budget.

Click here to download the FSCA’s proposed budget for 2026/27.

To cover the budgeted operational expenditure (which includes capital expenditure of R99m), the FSCA is proposing to increase by 4% the levies payable by the entities it supervises, which include financial services providers.

Entities supervised by the FSCA will see their levies increase by 5% in the 2025/26 financial year if the proposed amendments to the levy Schedules are adopted. Minister of Finance Enoch Godongwana published the proposed amendments last month, and the deadline to comment on them was 9 October.

Read: Levies payable to the FSCA set to rise in 2025/26

The FSCA is not proposing to increase the fees it charges in 2026/27 to perform functions mandated under the Financial Sector Regulation Act and other financial sector laws.

Table B in Schedule 2 to of the Financial Sector and Deposit Insurance Levies Act sets out the formulae for calculating the FSCA’s levies. The formulae comprise a base amount and a variable amount or amounts.

The 4% increase will translate into the following levy increases for FSPs in 2026/27 (if the 2025/26 levy increase is also implemented):

Base amount

Category I or IV FSPs and Category I or IV FSPs that provide only Long-term Insurance Subcategory A products and/or Friendly Society Benefits: the base amount will increase from R4 006.80 to R4 167.07.

Category II, IIA, or III FSPs: the base amount will rise from R8 347.50 to R8 681.40.

Variable amount/s

There is one variable amount for Category I or IV FSPs and Category I or IV FSPs that provide only Long-term Insurance Subcategory A products and/or Friendly Society Benefits. This variable amount is based on the average total number of key individuals plus the average total number of representatives, calculated from 1 September of the preceding levy year to 31 August of the current levy year.

The amount for each rep and KI will increase from R578.76 to R601.91.

As has been the case over previous financial years, there is an exception for Category I or IV FSPs that provide only Long-term Insurance Subcategory A products and/or Friendly Society Benefits: the amount for each rep and KI remains at R250.

There are two variable amounts for Category II, IIA, or III FSPs: the total rep and KI amount and the total value of investments under management or administration on 31 August of the levy year.

The percentage used to calculate the levy on investments under management or administration will increase from 0.0020697% to 0.0021524%.

Maximum levy

The cap on the maximum levy payable by any category of FSP will increase from R2 782 500 to R2 893 800.

Click here to download the proposed levy increases for 2026/27 for all entities supervised by the FSCA.

Proposed increase is below CPI

In its explanatory document, the FSCA said it could have proposed a levy increase of 4.4%.

Section 10(4)(b) of the Financial Sector and Deposit Insurance Levies Act provides that the levies in the Schedules to the Act must be increased by the arithmetic mean of the Consumer Price Index (CPI) as published by Statistics South Africa in the preceding calendar year, unless the Minister of Finance determines that there must be no increase or an increase lower than CPI. StatsSA published an average CPI of 4.4% for the 2024 calendar year. Therefore, the levy variables for 2026/2027 must automatically increase by 4.4%. However, the Authority proposes to apply a 4% increase in line with its projected operating expenditure.

The Minister of Finance does not have to submit the proposed levy increase for 2026/27 to Parliament for approval, because it does not exceed CPI.

The proposed 4% increase will translate into an overall increase of 14% in levy revenue compared with the 2025/26 budget. The FSCA is budgeting for levy income of R1.153bn compared with R1.015bn in 2025/26.

Levies will account for 94% of the budgeted gross revenue in 2026/27 (budget 2025/26: 92%). Fees (R32.823m) and interest (R44.539m) will each account for 3% of gross revenue.

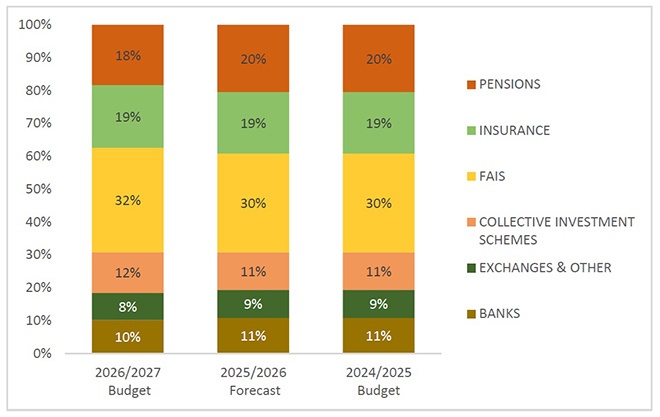

FSPs – the single-biggest source of the Authority’s levy revenue – will see their contribution to levy revenue increase from 30% to 32%.

Comments on the FSCA’s proposed budget must be submitted on the template and emailed to FSCA.RFDStandards@fsca.co.za by 20 November 2025.

Other proposed levy increases

The Prudential Authority (PA), the FAIS Ombud, and the Office of the Pension Funds Adjudicator (OPFA) have also released their proposed budgets and levies for 2026/27.

The PA is proposing to increase its levies and fees by 3.3%, while the FAIS Ombud is not asking for an increase.

The OPFA has proposed increasing the amount payable by retirement funds per eligible fund member by 15%, or R1.59, to R12.46.