Procedural timelines in tax disputes are important for obtaining a speedy resolution, but taxpayers must ensure they fully understand the Tax Court’s rules when they approach it to compel the South African Revenue Service (SARS) to stick to the timelines.

Several tax specialists noted that although the rules are “useful” and even “powerful”, taxpayers must be aware that the courts will prioritise the broader interests of justice over strict adherence to deadlines.

In a recent case before the Supreme Court of Appeal (SCA), the court found in favour of SARS despite it ignoring a 45-day timeline for more than a year.

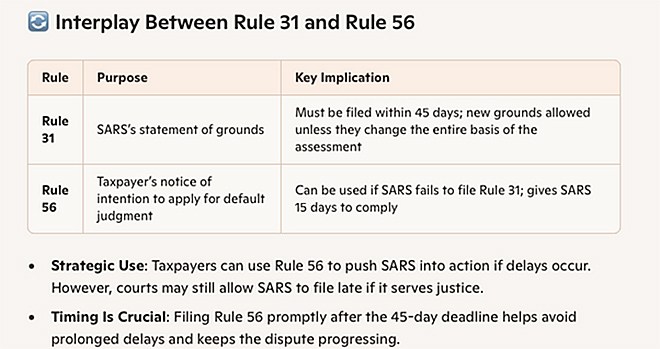

SARS issued an additional assessment against Virgin Mobile for three consecutive years. The company appealed the assessment in May 2019, and SARS then had 45 days in which to file its grounds for the assessment (Rule 31). It failed to do so.

Despite several reminders, the tax authority remained non-compliant. In October 2020, Virgin filed a notice giving SARS another 15 days to remedy its default, and failing a response, it would apply for a default judgment against SARS.

Five days before the deadline, SARS filed its grounds for the additional assessment. Despite SARS’s compliance, Virgin applied for a default judgment, claiming SARS never applied for condonation.

SARS asked Virgin to withdraw the default judgment application, basically arguing that it had remedied its default, and the notice for a default judgment (Rule 56) was an “irregular step”.

Virgin disagreed, and SARS approached the Tax Court asking it to set aside the default judgment. The application was dismissed with costs.

SARS took the matter to the High Court in Pretoria, which also dismissed its application with costs. The SCA granted the tax authority leave to appeal and ruled in favour of SARS.

It’s better not to delay filing

Joon Chong, a tax partner at Webber Wentzel, says the SCA found it was not necessary for SARS to have applied for condonation for the late filing, because it had filed the Rule 31 statement within 15 days of the notice for a default judgment (Rule 56).

Chong says, in practice, SARS has more than 45 business days to file the Rule 31 statement. “SARS can file the Rule 31 statement even after being given the Rule 56 notice and expiry of the 15 days, provided default judgment has not been granted to the taxpayer,” she adds.

It is thus important for taxpayers to keep a close track of the 45 days and file the request for a default judgment soon after the expiry of the 45 days. This is to progress the matter and avoid unnecessary delays.

“In the Virgin Mobile case, SARS had not filed its Rule 31 statement for more than a year and still did not need to file a condonation application after filing the Rule 31 statement within the 15 days of the Rule 56 notice,” Chong points out.

Sufficient notice should be given before it is sought, because a final order can be drastic. “The aim of Rule 56 is to facilitate finality of the dispute by coercing compliance. Once compliance has been achieved, the rule will have served its purpose,” the court found.

Nico Theron, the founder of Unicus Tax Specialists, says although the notice for default judgment is a “useful and very powerful tool”, it does extend an olive branch to SARS.

SARS can effectively “play possum” for years, and if a taxpayer then files a default judgment notice, SARS will have another 15 days from the date of that notice to deliver an outcome without having to explain its breach.

He says, in practice, taxpayers (or their advisers) tend to delay the delivery of Rule 56 notices, often to try to “amicably resolve the dispute” or because delivery of the notice might be construed as being “too aggressive”.

“This judgment by the SCA points out that this is a terrible idea and rather suggests an immediate delivery of a default notice as soon as SARS is in breach of the rules […] To be fair, the rule cuts both ways: the same principle should apply to taxpayers,” Theron adds.

A prompt – not a hammer

Cliffe Dekker Hofmeyr associate Mariska Delport writes that Rule 56 should be used as a prompt and not a hammer.

“The SCA clearly sets out that the purpose of Rule 56 is to drive compliance. If the defaulting party responds within 15 days, a default judgment is no longer available, even if the original non-compliance was clear.”

She also has an important warning for taxpayers. “Be careful of overreach.” Although SARS complied with the Rule 56 notice in the Virgin Mobile case, the company’s continued pursuit of a default judgment was found to be an “irregular step”.

“Attempting to extract procedural advantage where the default has been cured may result in adverse cost orders,” she says. The appeal in favour of SARS was upheld with costs, including the costs of two counsel.

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law, and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article is a general guide and should not be used as a substitute for professional tax advice.