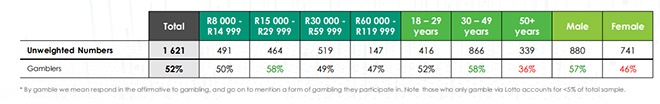

More than half of working South Africans – 52% – gamble, with 40% admitting they do so frequently in the hope of making money to cover expenses or debt, according to the 2025 Old Mutual Savings & Investment Monitor (OMSIM).

Now in its 16th year, OMSIM tracks the financial attitudes, behaviours, and priorities of South Africans earning at least R8 000 a month. The 2025 findings highlight a shift from crisis management towards more forward-looking financial behaviour, while also disclosing worrying trends related to gambling.

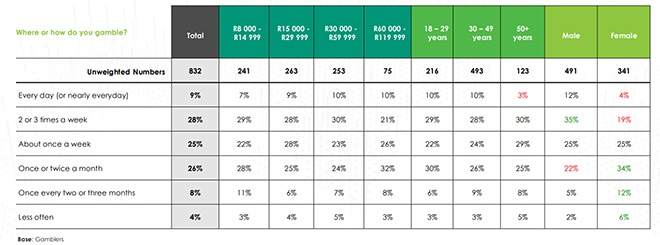

According to OMSIM’s findings, gambling is largely an online activity, either through apps or betting websites. Among gamblers, sports betting is the most popular form, with 61% participating, followed by Lotto at 53%, and slot machines at 52%. About 62% of gamblers play at least once a week, and nearly 40% gamble even more frequently.

Vuyokazi Mabude, the head of knowledge and insights at Old Mutual, said the primary driver for gambling – particularly among mid- and lower-income earners – is to find ways to make extra money or because it was recommended by someone they know.

“When we look at gambling, it is not looking at it in isolation but looking at it in the context of how and why people are gambling in the first place, and they are telling us that it’s to try to make more money and to make an income where maybe they didn’t have one previously.”

Debt-fuelled betting on the rise

And this trend continues to rise. About 52% of working South Africans gamble, with the highest participation among those aged 30 to 49 (58%) and men (57%).

About 40% of working South Africans say they gamble frequently in the hope of making money to cover expenses or debt, up from 36% in the previous survey and more common among lower-income earners.

Mabude said many working South Africans are also turning to gambling as a way to cover debt, a risky approach that raises concern.

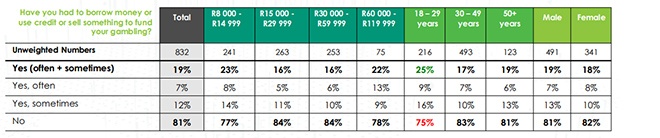

“One of the things we’ve done this year is to also look at the impact of gambling, and one of the things we’ve looked at is, where do you get your money from to gamble? So, we’ve asked people, did you have to borrow, sell something or use credit to fund your gambling. And 19% of people said, yes, I do quite often or sometimes.”

She said the financial consequences of gambling were becoming more evident, noting that people were starting to report financial difficulties linked to their gambling behaviour. She added that this was also driving some of their borrowing.

“Across the board, although the intent of the gambling is to make an income, the impact of that gambling has a negative impact on people’s financial well-being.”

Gambling boom poses growing financial risks

John Manyike, the head of financial education at Old Mutual, said it is important to view gambling through the lens of financial health and responsible behaviour.

“As part of that commitment, we recognise the fact that gambling can have a significant impact on individuals’ financial health and financial stability,” he said.

Manyike said 40% of working South Africans admit to gambling frequently in the hope of making money quickly, with 28% saying they gamble two to three times a week.

“A lot of people … gamble with the hope that they’ll make a big win someday … The minute gambling gets to a level where one has become addicted, it starts to present certain risks which could actually push people into debt, and it can affect their financial stability.”

He said that half of low-income earners gamble, but the risks are the same regardless of income level.

“There’s absolutely no relationship between what people earn and their ability to manage their finances. … It doesn’t matter whether you’re [a] high-income earner [or] low-income earner, the risks are quite similar.”

While gambling is legal and regulated in South Africa, Manyike believes the risks must be highlighted.

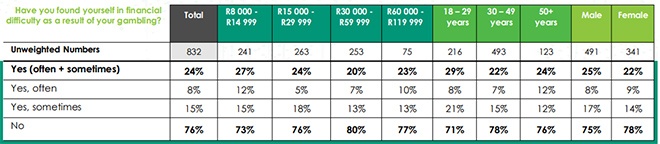

“One in four have landed in financial difficulty because of gambling … These financial difficulties … can affect their loved ones as well.” He warns of extreme outcomes, noting reported cases of suicide linked to gambling-related losses.

Manyike said responsible gambling must be encouraged. Financial education is key, because many people gamble believing they could become millionaires at any moment.

“The money they’re directing to gambling could be directed to settling debt or … investing towards something that’s more meaningful,” he said. “Because gambling … is a game of chance, not strategy.”