Broker service fees totalled R2.97 billion in 2024, up 4.61% from the prior year, accounting for 17.65% of medical schemes’ directly attributable insurance service expenditure (DAE), according to the Council for Medical Schemes’ 2024 Industry Report.

DAE is the portion of a scheme’s operational spend that is directly tied to delivering the insurance service, including administration, managed care, and broker costs. Within this framework, broker fees represent the distribution and advice component of schemes’ core operating costs.

According to the report, 92.79% of open-scheme beneficiaries were covered by broker arrangements in 2024, whereas only 10.18% of restricted-scheme beneficiaries were broker-served.

For schemes that made use of brokers, fees made up 22.34% of DAE, underscoring the extent to which open schemes rely on intermediaries for acquisition, guidance, and retention.

Average broker fees reached R106.95 per average member per month (PAMPM) in 2024. Open schemes paid R106.57, while restricted schemes paid R111.42, although the latter apply broker remuneration to a small slice of their membership.

On average, schemes paid R106.95, or 79.66%, of the statutory maximum of R134.25 PAMPM published in December 2023.

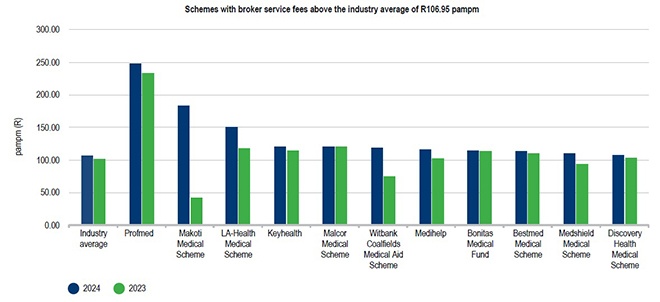

However, the averages conceal some outliers. The CMS identified 11 schemes whose broker fees exceeded the industry average and, in some cases, approached or surpassed the statutory cap. Collectively, these schemes accounted for 86% of total broker-covered membership and nearly 90% of all broker fees paid.

The most prominent example is Profmed, with broker-related payments of R247.90 PAMPM. Although this exceeds the fee cap, the CMS notes that Profmed’s figure includes remuneration for internal new-business consultants, which is recorded in the same category.

Other schemes with above-average fees include Makoti, LA-Health, Keyhealth, Bonitas, Bestmed, Medshield, and Discovery Health. Their higher PAMPM figures often reflect strategy, membership profiles, or changes in adviser coverage rather than pure fee escalation.

The restricted scheme environment saw the most dramatic movement. Their broker fees increased by 22.78% PAMPM, not because brokers were paid materially more, but because broker-covered membership fell in several schemes.

LA-Health (-9 473 covered members), Consumer Goods Medical Scheme (-4 152), and SAMWUMed (-1 251) reported significant drops in the number of members paying broker fees. When membership decreases faster than broker expenditure, PAMPM values rise disproportionately.

This table provides the broker fees paid by open and restricted schemes in 2024.